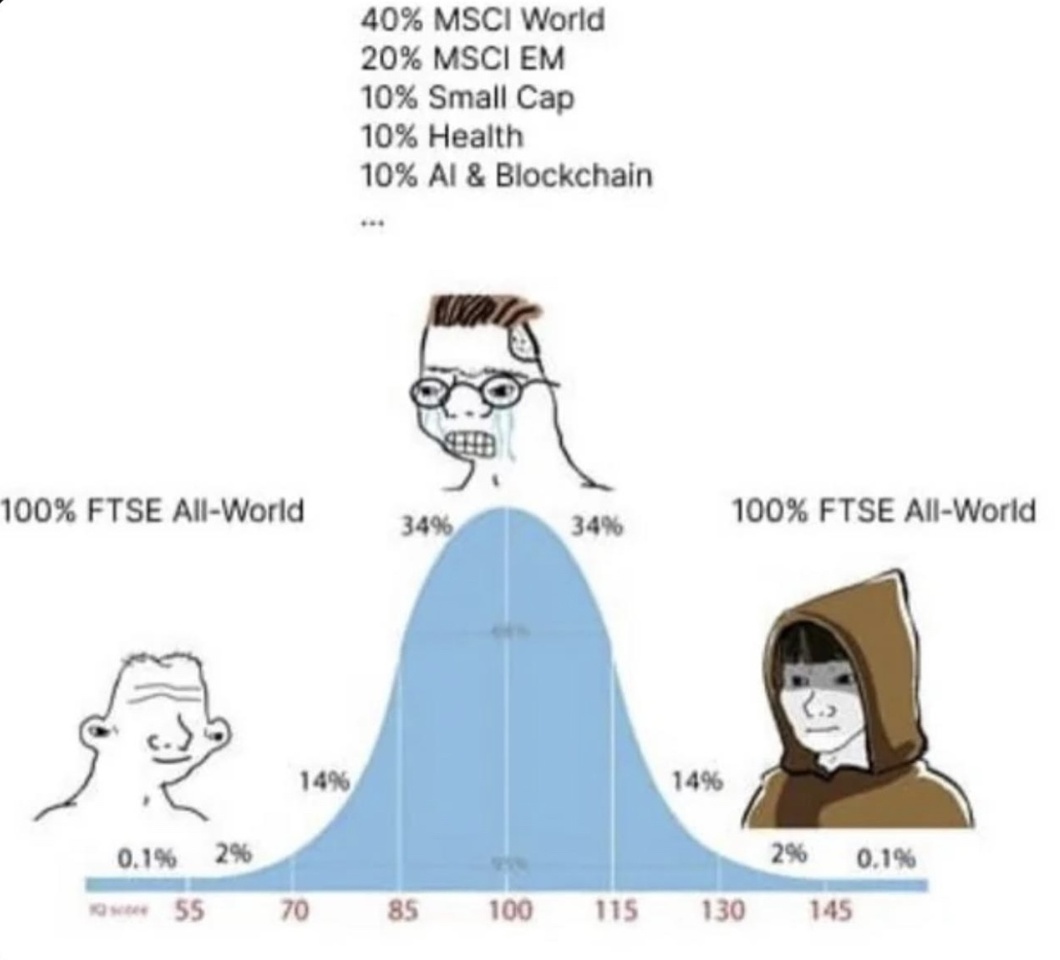

After observing the markets for around 24 months now, I am beginning to understand why a portfolio consisting of just one world ETF could be the holy grail in the long term.

But I still have some doubts, my father has also moved from the simple world concept further and further into the multi-factor concept camp and has a more extensive portfolio than just one ETF, recently he even built his own ETF.

Perhaps the one ETF solution was ideal 10 years ago but has not arrived at 2025.

I would therefore like to ask you specifically whether, in addition to the $VWCE (+1,27 %) it might make sense to mix in some of the following:

Some covered call things from Global X

and these secret dividend etfs from JP Morgan