Mid-May 2025 sees the dry bulk market navigating shifting currents. Capesize vessels soften amid limited enquiry, Panamax gains traction in the Atlantic, Ultramax/Supramax remains subdued, and Handysize stabilizes with steady South Atlantic demand. China’s bauxite and iron ore import surge, Brazilian soybean exports, and U.S.-China trade tensions shape the horizon, while Guinea’s Simandou mines and holiday slowdowns add complexity. This sector is a bulker charting global trade routes—let’s explore its journey.

⏬ Capesize Market: Softening Amid Thin Enquiry

Rate Declines

Capesize vessels, the titans of dry bulk, face a softening market after a holiday-dampened week. The Baltic Capesize Index (BCI) 5TC falls $3,072 week-on-week to $14,169 per day. The C8 trans-Atlantic route settles at $13,071 per day, dragged by a low time-charter equivalent (TCE) on a short-duration voyage. Brazil-to-China (C3) drops to $18.215 per metric tonne (pmt), down from high $19 levels for June dates. Pacific routes weaken, with West Australia-to-China (C5) fixing at mid $7s pmt (from $7.90). Clarksons reports Capesize spot rates at $15,200 per day, down 8% week-on-week, as miners fix at softer rates—Capesize navigates a cautious decline.

Cargo Dynamics

China’s bauxite imports (110.2 million tonnes in 2024, up 11.2%) drive Capesize demand, with Guinea supplying 69.41% of the market via Africa Atlantic Coast (AAC) routes. Iron ore imports rise, with Guinea’s Simandou mines (120 million tonnes per year at full capacity) set to supply 10% of China’s seaborne needs. East Australia maintains peripheral volume, but Brazil and West Africa see thin enquiry for end-May dates, shifting focus to June. Far East spot tonnage tightens slightly, though ballast tonnage remains heavy for mid-June. A 180,000-dwt vessel fixes at $18 pmt for Brazil-to-China, reflecting softer sentiment—Capesize relies on China’s import surge.

Global Forces

U.S.-China tariff tensions curb U.S. grain exports (down 54% to China), indirectly supporting Capesize via longer Brazilian routes. A potential Houthi ceasefire may normalize Red Sea routes, reducing tonne-miles. China’s aluminium demand (70% import-reliant) and Simandou’s ramp-up signal upside, but low fleet growth (2.5% in 2026) and holiday slowdowns temper gains. Clarksons forecasts 1.5% dry bulk demand growth in 2026, outpaced by 2.5% fleet growth, pressuring rates. Rising inventories could lift rates in a contango market—Capesize sails with guarded optimism.

For illustrative purposes only

⏳ Panamax Market: Atlantic Gains

Rate Improvements

Panamax vessels, key for grain and coal, gain momentum in the Atlantic despite a muted start. The Baltic Panamax Index averages $12,238 per day, down 35% year-on-year but up week-on-week. North Atlantic routes achieve $18,500-$19,000 per day for grain runs (NC South America to Far East, Gibraltar delivery). South Atlantic softens, with 82,000-dwt vessels fixing at $16,500 plus $650,000 ballast bonus for end-May. Pacific rates weaken, with Far East trips at low $12,000s for 82,000-dwt vessels (Philippines delivery, 10-12 months). Tight North Atlantic tonnage and Brazilian soybean exports (19.6 million tonnes in Q1) drive gains—Panamax thrives in premium routes.

Regional Trends

North Atlantic sees tight spot tonnage and consistent NC South America grain demand, supporting fronthaul and trans-Atlantic runs. East Coast South America (ECSA) remains quiet, with limited fresh enquiry. Pacific markets struggle, with growing Far East tonnage and weak NoPac/Aussie rounds pressuring rates. Brazilian soybean shipments (up 9% year-on-year) boost tonne-miles (1,270 nautical miles longer than U.S. routes), absorbing surplus tonnage. A 82,000-dwt vessel fixes at $12,500 per day for a Pacific round-trip, reflecting fragility. Atlantic premium routes counter Pacific weakness—Panamax leans on grain-driven strength.

External Pressures

U.S.-China tariffs reduce U.S. soybean exports (16% market share), boosting Brazilian cargoes and Panamax tonne-miles. A Houthi ceasefire could normalize Red Sea routes, impacting Pacific trades. Brazil’s 9% soybean harvest increase and China’s import momentum (through Q2) support rates, but Clarksons’ 2026 forecast (2.5% fleet growth, 1.5% demand) signals pressure. Potential U.S.-China trade talks could restore U.S. exports, per BRS, shifting tonne-miles. Low period market activity (e.g., one 82,000-dwt fixture) reflects caution—Panamax navigates with Atlantic optimism.

For illustrative purposes only

⏱️ Ultramax/Supramax Market: Subdued Sentiment

Rate Stability

Ultramax and Supramax vessels, versatile mid-sized bulkers, remain subdued amid holiday slowdowns. The Baltic Supramax Index holds steady at $11,500 per day. U.S. Gulf fixes a 63,000-dwt vessel at $16,000 per day for a trans-Atlantic run, while EC South America achieves mid $20,000s for an Ultramax on similar routes. Mediterranean rates weaken, with a 56,000-dwt vessel at $10,000 per day (Spain to NC South America). Indian Ocean sees demand, with a 64,000-dwt vessel fixing at $16,000 per day (Tema to China via South Africa). Asian rates soften, with a 63,000-dwt vessel at $13,000 per day (Thailand to Indonesia)—Supramax treads water.

Market Dynamics

South Atlantic and U.S. Gulf show sporadic strength, with Ultramax fixtures outperforming Supramax. Mediterranean markets remain patchy, with limited fixing. Indian Ocean demand rises for West Africa-to-Far East routes, supporting rates. Asian markets weaken, with growing prompt tonnage and scarce cargoes (e.g., a 63,000-dwt vessel fixes at $14,000 per day, China to Arabian Gulf). Holiday-dampened enquiry limits momentum, though South Atlantic stability absorbs tonnage. A two-year period fixture for a 63,000-dwt vessel (West Coast India) signals long-term confidence—Supramax seeks demand catalysts.

Broader Forces

U.S.-China tariffs indirectly support Supramax via Brazilian grain routes, but Red Sea normalization risks tonne-mile losses. China’s bauxite and iron ore imports (e.g., Guinea’s 110.2 million tonnes) boost West African demand, though Asian oversupply caps gains. Clarksons’ 2026 forecast (2.5% fleet growth, 1.5% demand) and 5% newbuild deliveries in 2025 pressure rates. Sporadic Indian Ocean and South Atlantic demand offers upside, but holiday slowdowns and weak Asian enquiry cloud prospects—Supramax navigates with cautious resilience.

For illustrative purposes only

⏸️ Handysize Market: Steady but Flat

Rate Trends

Handysize vessels, nimble bulk carriers, stabilize with mixed regional performance. The Baltic Handysize Index (BSHI) averages $9,800 per day, flat week-on-week. South Atlantic rates rise slightly, with a 37,000-dwt vessel fixing at $17,000 per day (Recalada to Mediterranean). U.S. Gulf weakens, with a 35,000-dwt vessel at $8,000 per day (SW Pass to UK-Continent). Asian rates hold, with a 40,000-dwt vessel at $12,000 per day (Hong Kong to Colombia). Mediterranean markets soften, with limited activity. A period fixture at 120.5% of BSHI for a 40,000-dwt vessel (June-July 2025) reflects stability—Handysize balances steady demand with oversupply.

Trade Patterns

South Atlantic maintains steady activity, with fresh demand supporting rates. U.S. Gulf faces pressure from growing tonnage lists, depressing rates. Asian markets stabilize, with gradual tonnage increases offset by demand (e.g., steel cargoes to Colombia). Mediterranean and Continent markets remain soft, with sparse fixtures. Brazilian grain exports (71% soybeans) and West African bauxite flows support Handysize, though cargo volumes remain flat. A 37,000-dwt vessel fixes at $17,000 per day for a South Atlantic run, reflecting localized strength—Handysize relies on regional pockets of demand.

Influencing Factors

U.S.-China tariffs boost Brazilian grain routes, supporting Handysize tonne-miles. Red Sea normalization could reduce Asian tonne-miles, but South Atlantic stability mitigates risks. Clarksons forecasts 6% Handysize fleet growth in 2026, outpacing 1.5% demand, pressuring rates. China’s bauxite imports and Brazil’s harvest (9% up) offer upside, but holiday slowdowns and U.S. Gulf oversupply limit gains. Period market caution (e.g., sporadic fixtures) reflects geopolitical risks—Handysize seeks momentum amid flat sentiment.

For illustrative purposes only

🌐 What’s Moving It: Trade Shifts and China’s Demand

Commodity Shifts

China’s bauxite imports (110.2 million tonnes, up 11.2%) and Guinea’s Simandou iron ore (120 million tonnes per year) drive Capesize demand. Brazilian soybean exports (19.6 million tonnes in Q1, up 9%) boost Panamax tonne-miles, replacing U.S. cargoes (down 54%). West African bauxite and Indian Ocean trades support Supramax, while South Atlantic grain and Asian steel cargoes stabilize Handysize. China’s aluminium demand (70% import-reliant) and infrastructure upgrades fuel bauxite flows, but coal and grain shipment reductions increase segment competition—commodity shifts shape bulker dynamics.

Trade and Policy Pressures

U.S.-China tariffs curb U.S. grain exports, boosting Brazilian routes and tonne-miles. Potential U.S.-China trade talks could restore U.S. soybeans, per BRS, shifting demand. A Houthi ceasefire may normalize Red Sea routes, reducing Pacific tonne-miles. Clarksons’ 2026 forecast (2.5% fleet growth, 1.5% demand) and 5% newbuild deliveries in 2025 pressure rates. Guinea’s bauxite exports (69.41% of China’s market) and Brazil’s harvest offer upside, but holiday slowdowns and oversupply cloud prospects—trade policies steer the bulker path.

🌐 Market and Stocks: Balancing Volatility

Stock Performance

Dry bulk stocks navigate trade shifts. Star Bulk Carriers $SBLK (-3,89 %) sees John Fredriksen’s Famatown increase its stake to 11.4% ($200 million) and Danaos Corp acquire 5.23% ($95 million), signaling confidence despite a 20% share price drop since March. 2020 Bulkers $2020 (+0,62 %) reports $200,000 net profit (Q1), down from $28.7 million, with TCEs at $19,000 per day, but April dividends rise to 10 cents per share ($27,100 per day). Clarksons notes dry bulk earnings at $12,500 per day (20% below 10-year average)—stocks reflect resilience amid softening rates.

Investor Insights

Capesize may rebound with Simandou and bauxite demand, but oversupply risks persist. Panamax benefits from Brazilian soybeans, though Pacific weakness caps gains. Supramax and Handysize rely on South Atlantic and Indian Ocean trades, but 2026 fleet growth (2.5%-6%) pressures rates. Star Bulk’s shareholder backing (Fredriksen, Danaos) and 2020 Bulkers’ dividend hike signal long-term optimism. Potential U.S.-China trade easing could shift tonne-miles, per BRS. Investors weigh tariff risks against China’s import surge—strategies balance volatility with fundamentals.

Sector Outlook

Tariffs, Red Sea dynamics, and holiday slowdowns pressure rates, but China’s bauxite/iron ore imports and Brazilian soybeans drive demand. Clarksons’ 2026 forecast (earnings softening) highlights oversupply risks, particularly for Supramax/Handysize. Panamax and Capesize benefit from long-haul trades, while stocks like Star Bulk (undervalued) and 2020 Bulkers (dividend-focused) offer value if demand holds—investors navigate short-term challenges with long-term supply constraints.

🌐 Outlook: Charting Future Currents

Market Projections

Capesize ranges $13,000-$15,200 per day—Simandou offers upside—cautious. Panamax at $12,000-$19,000—Atlantic strength persists—buoyant. Ultramax/Supramax at $10,000-$16,000—subdued sentiment lingers—flat. Handysize at $8,000-$17,000—South Atlantic stabilizes—steady. Red Sea normalization and newbuilds signal volatility—2026 could soften with fleet growth.

Strategic Horizons

Capesize leverages China’s bauxite and iron ore imports, but Panamax thrives on Brazilian grain. Supramax needs Indian Ocean demand, while Handysize relies on South Atlantic stability. Tariffs, 2026 fleet growth (2.5%-6%), and trade talks challenge margins, but Guinea’s Simandou and Brazil’s harvest offer upside. Investors must navigate trade shifts while betting on supply constraints—strategic moves will define bulker fortunes.

Your Call

Will Capesize lead with Simandou’s iron ore, or can Panamax’s grain surge steal the spotlight? Share your take—let’s master the markets! 🚢

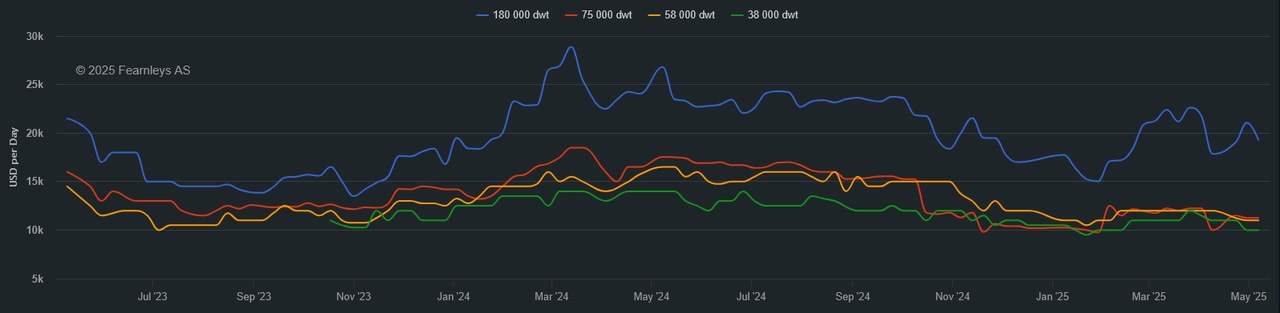

1 Year T/C Dry Bulk - May 7th