I know I'm a bit late and others were quicker. Nevertheless, here is my classification and explanation of the numbers. As beginner-friendly as possible 😬

__________

Coca-Cola $KO (+2,3 %) published its figures for the fourth quarter and full year 2024 today.

Coca-Cola is one of those stocks that almost everyone knows and many people have it in their portfolio. At the beginning of this year, I considered liquidating the position and shifting into other high-growth stocks, but I couldn't bring myself to do so and am now holding my position for the time being. According to DeepDive, Coca Cola currently accounts for just under 2.5% of my portfolio.

The company is a real heavyweight in the consumer sector and has a certain stability and an impressive dividend history. The quarterly figures published today show solid growth, but also some challenges.

I took a look at the news release "Coca-Cola Reports Fourth Quarter and Full Year 2024 Results" [1] and also read the transcript of the earnings call [2].

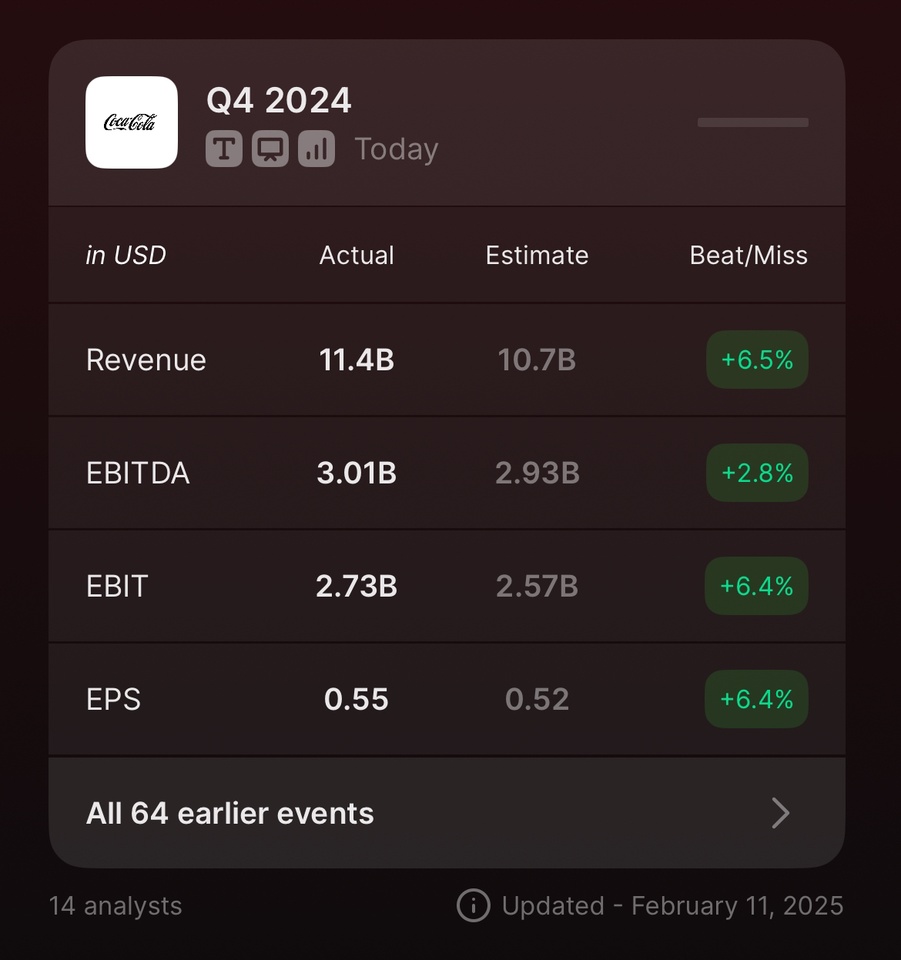

Q4 vs. Estimates [3]

Business figures at a glance

📊 Q4 2024 (October - December):

- Sales: $11.5 billion (+6% compared to the previous year)

- Organic sales (adjusted for currency effects and acquisitions): +14 %

- Operating profit: +19

Earnings per share (EPS):

- Reported EPS: $0.51 (+12%)

- Adjusted EPS (without special effects): $0.55 (+12 %)

- Unit case volume: +2 %

➡️ Coca-Cola sold 2 % more beverages than in the same quarter of the previous year.

➡️ Growth was particularly strong in China, Brazil and the USA.

📅 Full year 2024:

- Sales: $47.1 billion (+3%)

- Organic sales: +12%

- Operating profit: -12% (partly due to a one-off Fairlife write-down)

Earnings per share (EPS):

- Reported EPS: $2.46 (-0.4%)

- Adjusted EPS: $2.88 (+7%)

- Unit case volume: +1 %

➡️ Coca-Cola Zero Sugar (+9 %) and tea (+4 %) were particularly popular.

➡️ There were declines in water (-2%) and coffee (-3%).

While the fourth quarter was strong, the reported operating profit for the full year was depressed by the Fairlife write-down (-12 %). Without this one-off effect, adjusted and currency-adjusted operating profit would have risen by 16%.

Fairlife amortization - What's behind it?

I was wondering again what fairlife depreciation is all about, and here is the explanation:

Coca-Cola had to take a $3.1 billion write-down related to the Fairlife brand.

➡️ Fairlife is a dairy brand that Coca-Cola acquired in 2020.

➡️ The value of this acquisition has now been revalued (fair value measurement).

➡️ The Fairlife write-down of $3.1 billion results from a revaluation of goodwill. Coca Cola had originally paid a higher price for Fairlife, but due to changed market conditions part of this value was written off.

➡️ Such write-downs are accounting losses, but do not directly affect cash flow or ongoing business development.

Regional development - Where Coca-Cola is growing

🌍 North America: +11% sales growth in 2024, particularly due to price increases.

Latin America: Strongest growth (+25% organic sales in Q4), but strongly influenced by high inflation in Argentina.

🌍 Europe, Middle East & Africa: Growth due to price adjustments, but currency devaluations depressed earnings (more on this below).

🌍 Asia-Pacific: Solid growth, but sales per unit fell slightly as more sales were made in lower-priced categories (e.g. due to smaller packaging units or promotions)

What does currency devaluation mean and why is it problematic?

When Coca-Cola sells beverages in Europe or Latin America, for example, the company earns euros or local currencies there.

➡️ These revenues end up being converted into US dollars because Coca-Cola is a US company.

💡The problem:

If the US dollar gets stronger, then Coca-Cola gets less dollars per euro/peso when it converts.

This makes it look on paper as if sales are falling, even though Coca-Cola is selling the same amount or even growing in these regions.

Example of currency devaluation:

- Let's assume that Coca-Cola makes 100 million euros in sales in Europe.

- If the exchange rate is 1.20 USD/EUR, this means a turnover of 120 million dollars.

- If the exchange rate falls to 1.05 USD/EUR, Coca-Cola only receives 105 million dollars for the same 100 million euros - 15 million less!

➡️ This happened in many markets in 2024, especially in Latin America (Argentina) and parts of Africa.

➡️ The currency devaluation therefore had a negative impact on reported sales.

Expansion: more fridges for more sales

Coca-Cola has expanded its presence in stores worldwide:

- 250,000 new points of sale

- 600,000 new refrigerators installed

Investments were particularly strong in Latin America, Asia and Africa.

➡️ In these markets, 90% of drinks are sold cold - more fridges = more sales!

Dividends & share buybacks - Coca-Cola remains an investor favorite

✔️ Coca-Cola paid $8.4 billion in dividends in 2024 - dividends have increased every year for 62 years!

✔️ Share buybacks worth $1.8bn - reducing the number of shares and increasing earnings per share in the long term.

What is the tax payment to the IRS?

➡️ Coca-Cola has deposited $6.0 billion as collateral in a long-running tax dispute with the U.S. Internal Revenue Service (IRS). If the company loses the lawsuit, the money will be used to pay the taxes.

➡️ If Coca-Cola wins, some of the money could flow back.

➡️ Without this one-off effect, free cash flow would have increased by 11% to $10.8 billion!

Outlook for 2025 - What does Coca-Cola expect?

📈 Planned sales growth: 5-6 %

📉 Currency impact: -3 to -4% on sales, -6 to -7% on profit

💰 Expected earnings per share: $2.88 (+2 to 3%)

💵 Free cash flow forecast: approx. $9.5 billion

Conclusion - Coca-Cola remains stable, but currencies are a risk

- Stable sales growth and strong market position

- Expansion through refrigerators and retail outlets pays off

- Strong dividend history - a classic for dividend investors

- Currency risks and tax dispute weigh on figures

I continue to hold the share and am always happy when I drink an ice-cold Coke Zero!

Thanks for reading 🤝

__________

Sources:

[1]

https://investors.coca-colacompany.com/

[2]

https://web.quartr.com/companies/4595/events/248468/transcript?targetTime=0.0

[3]