Shopify's business model is based on a subscription-based SaaS structure. Merchants pay monthly fees that vary depending on the scope of services and company size. This model ensures stable and predictable revenue. In addition, Shopify benefits from transaction fees and commissions that accrue from the use of in-house services such as "Shopify Payments".

Why many merchants swear by Shopify - and rarely switch again

This integrated payment processing works both online and in stationary retail. Shopify thus builds a bridge between digital and physical sales and enables merchants to seamlessly connect both sales channels.

A key competitive advantage lies in the high level of customer loyalty. Once a retailer has set up their online store on Shopify, switching to another platform involves considerable effort. This technical and organizational commitment leads to constant, recurring revenue and creates a strong revenue base for Shopify.

The business model is characterized by high profitability and scalability. As additional customers only incur low variable costs, the potential profit margins are considerable.

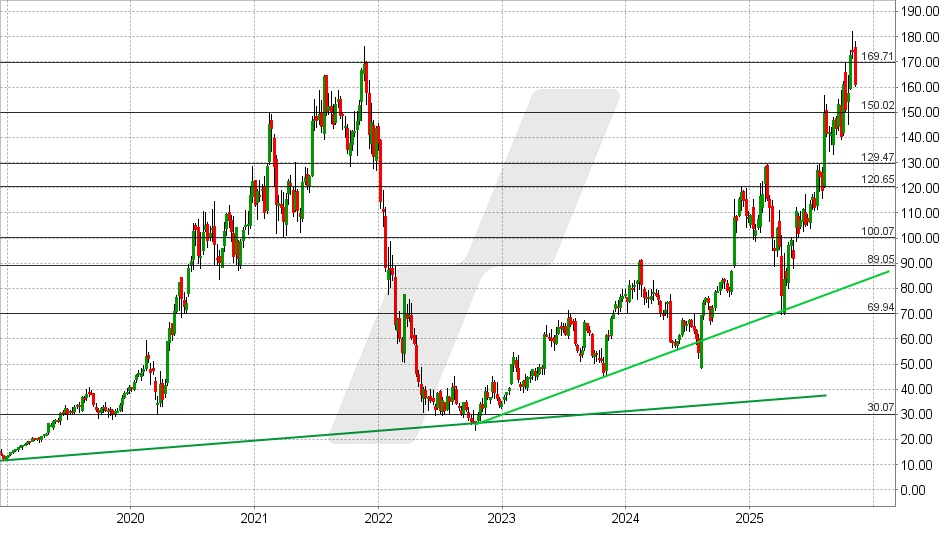

What a comeback

Shopify is one of the biggest comeback stories that the Börse has produced in recent years.

A price drop from USD 176 to USD 24 was followed by a picture-book rally that catapulted the share price to a new all-time high of just over USD 180.

I have highlighted the company's progress several times in articles, most recently in May at a price of USD 94:

Shopify: Das Geschäft in Europa boomt

Since then, the company has twice Quartalszahlen that are quite something.

In the second quarter of 2025, earnings of USD 0.35 per share were well above expectations of USD 0.28. With revenue of USD 2.68 billion, analysts' estimates of USD 2.54 billion were also exceeded.

For the year as a whole, this corresponds to a 31% increase in sales and a 35% jump in profits.

Free cash flow increased by 27% to USD 422 million and the FCF margin was 16%.

Cash is king

The strong performance continued in the third quarter. At USD 0.34 per share, earnings exceeded expectations of USD 0.32. With sales of USD 2.68 billion, analysts' estimates of USD 2.54 billion were also exceeded.

For the year as a whole, this corresponds to an increase in sales of 32%, although profit (non-GAAP) fell slightly.

However, Shopify's reported profit is not very meaningful anyway and can be used to paint a positive or negative picture almost at will. According to non-GAAP, the result has fallen slightly, but according to GAAP it has risen by more than 50%.

As old master Rappaport said so well: "Profit is an opinion, cash is a fact."

Free cash flow increased by 20% to USD 507 million in the third quarter and the FCF margin was 18%.

Shopify is now highly profitable and is also growing at a considerable pace - the momentum has even increased recently.

The gross merchandise value transacted via Shopify's systems rose from USD 69.7 billion to USD 92.0 billion in the last quarter.

The only problem is the valuation, as the share has already gone completely through the roof in recent months. However, if there is a major correction, this could turn out to be an opportunity

Shopify share: Chart from 05.11.2025, price: USD 160.94 - symbol: SHOP | Source: TWS

The quarterly figures led to selling pressure in yesterday's trading. If the share price now falls below USD 160, this will lead to a Verkaufssignal with possible price targets at USD 150 and USD 136-140.

A strong increase in buying interest can be expected between 120 and 130 at the latest.

If, on the other hand, there is a rapid return above USD 170, the all-time high is likely to be targeted again. Above this level, an extrapolated Kursziel at USD 200.

Source