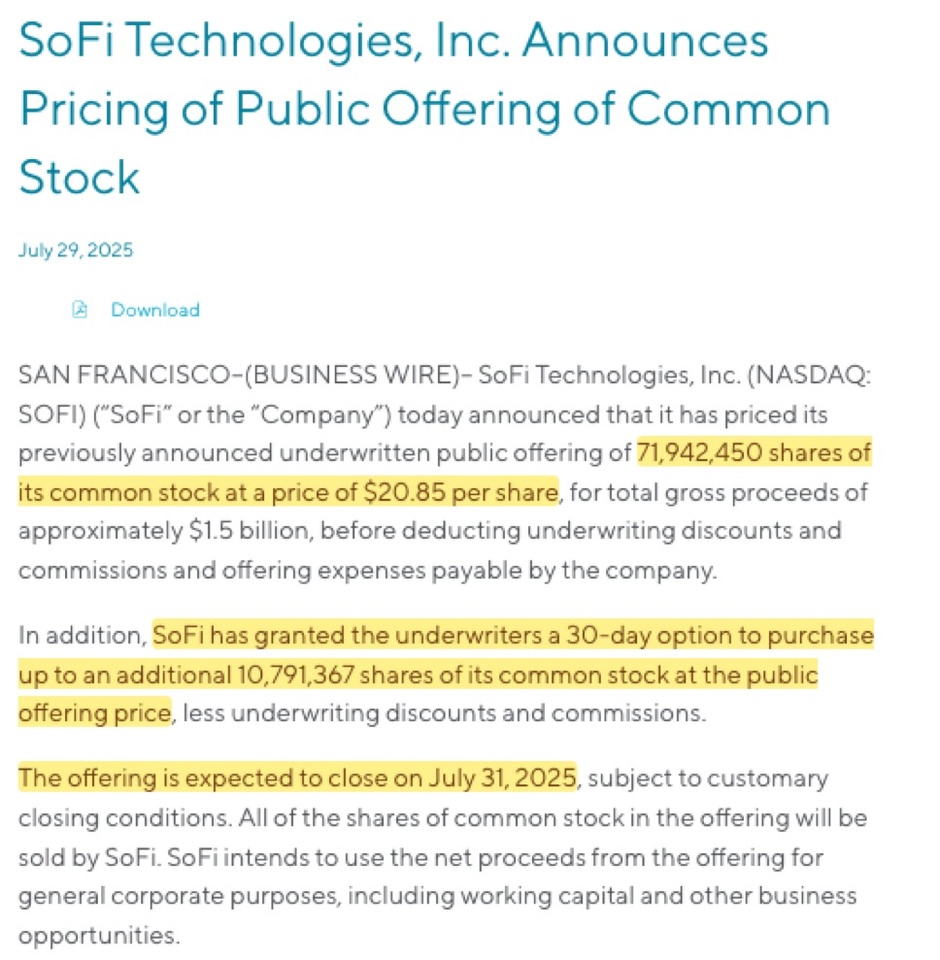

$SOFI (+2,88 %) has published a further press release with the final price for its share offer of USD 20.85 per share. This means 71.94 million shares for the initial offer and up to a further 10.79 million for the 15% increase.

I don't expect a company that has been successful and profitable for the last three years to make mistakes.

In my opinion, it is likely that $SOFI (+2,88 %) will become a major player in issuing stablecoins and offering cryptocurrencies and will also be successful in developing the structure used by Sofi and others via Galileo for stablecoins and cryptocurrencies. ✌️