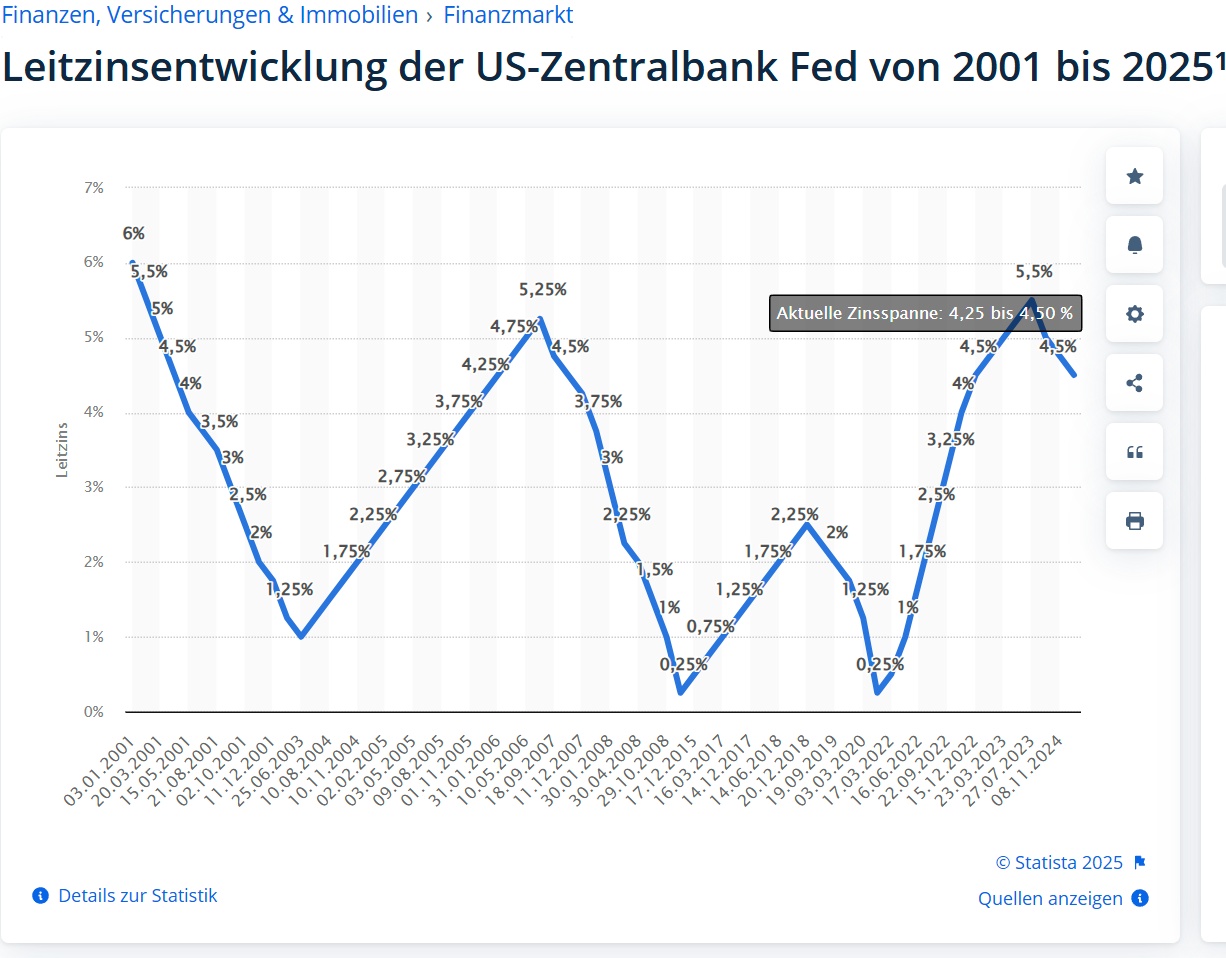

Happy Sunday to the community. I am currently looking at $O (+0,92 %) and things are not going so well for the REIT at the moment. The next quarterly figures will be announced on February 24th, so I'll wait and see. I will (hopefully) not make the mistake $UPS (+1,06 %) I (hopefully) won't make the same mistake again. I took a look at the key interest rate in the USA and it is currently really high. On 27.07.23 it was at 5.5%, but it's currently falling again. Is this related to real estate rentals, or is it the mortgage rate? It is also currently over 7%. I'm sorry if I come across as a bit inexperienced, but I've only been involved in the real estate market for a short time😅

Sources:

Leitzins in den USA bis 2025 | Statista

Vereinigte Staaten von Amerika - Hypothekenzinssatz | 1990-2025 Daten