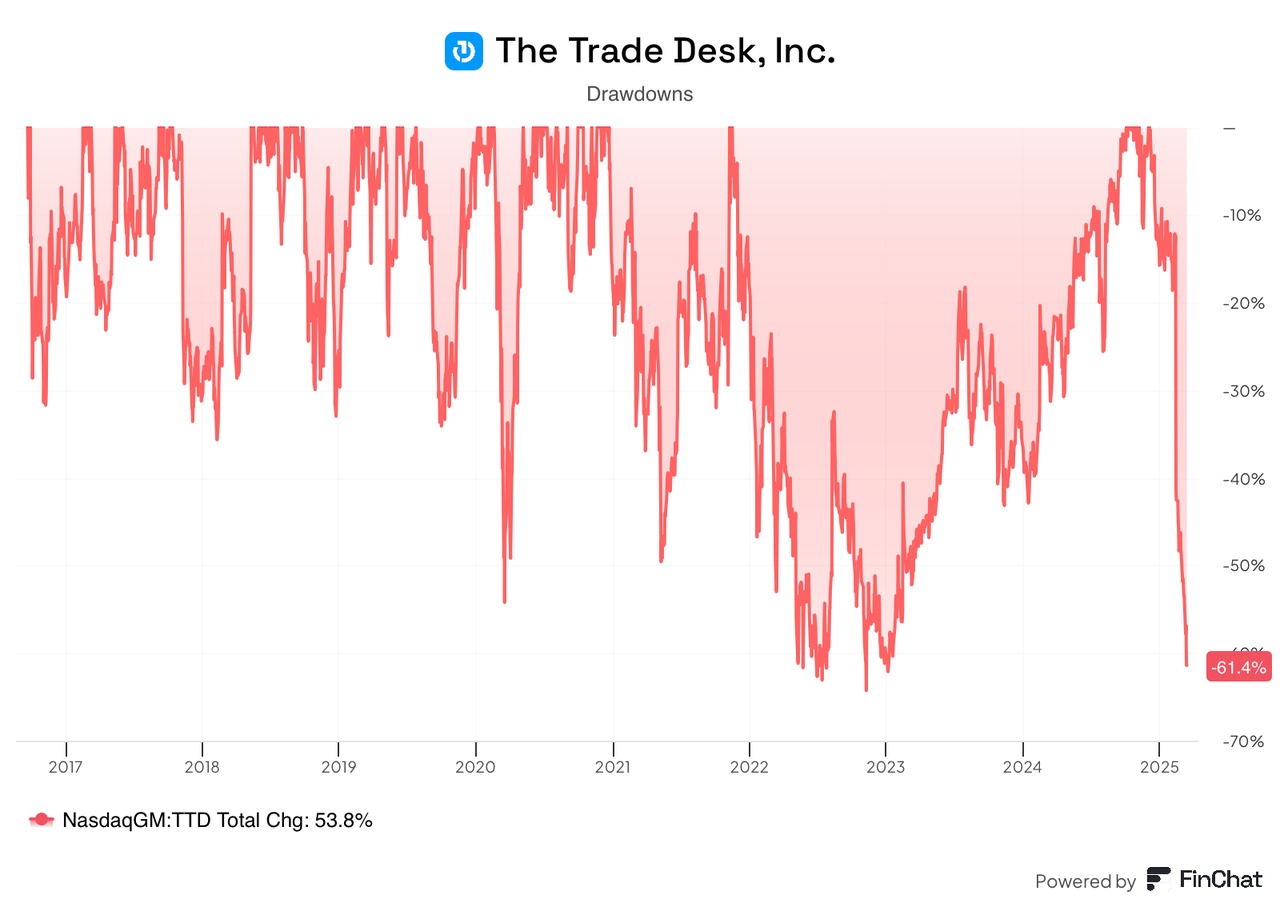

The share $TTD (-0,14 %) has been in free fall since the last earnings and is approaching the worst drawdown in its history.

But how are things going operationally?

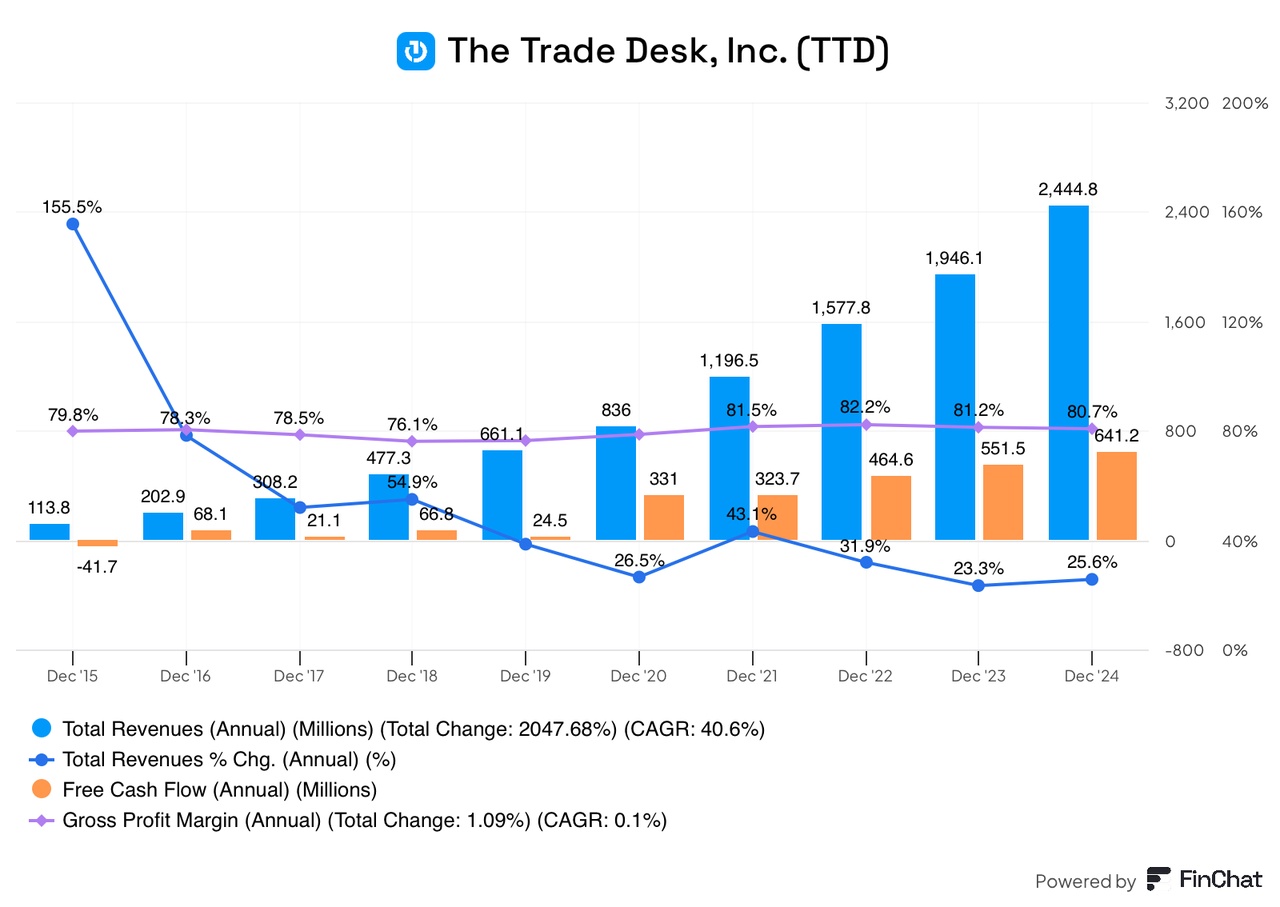

- Sales are still rising strongly, albeit more slowly than in previous years (growth downturn is now being fed through)

- Robust gross margins

- Rising free cash flows

- SBC is high, but showing downward trend (Dec-22 still at 26% of sales, now at 17%)

- No debt and >$1.9bn cash

- ...

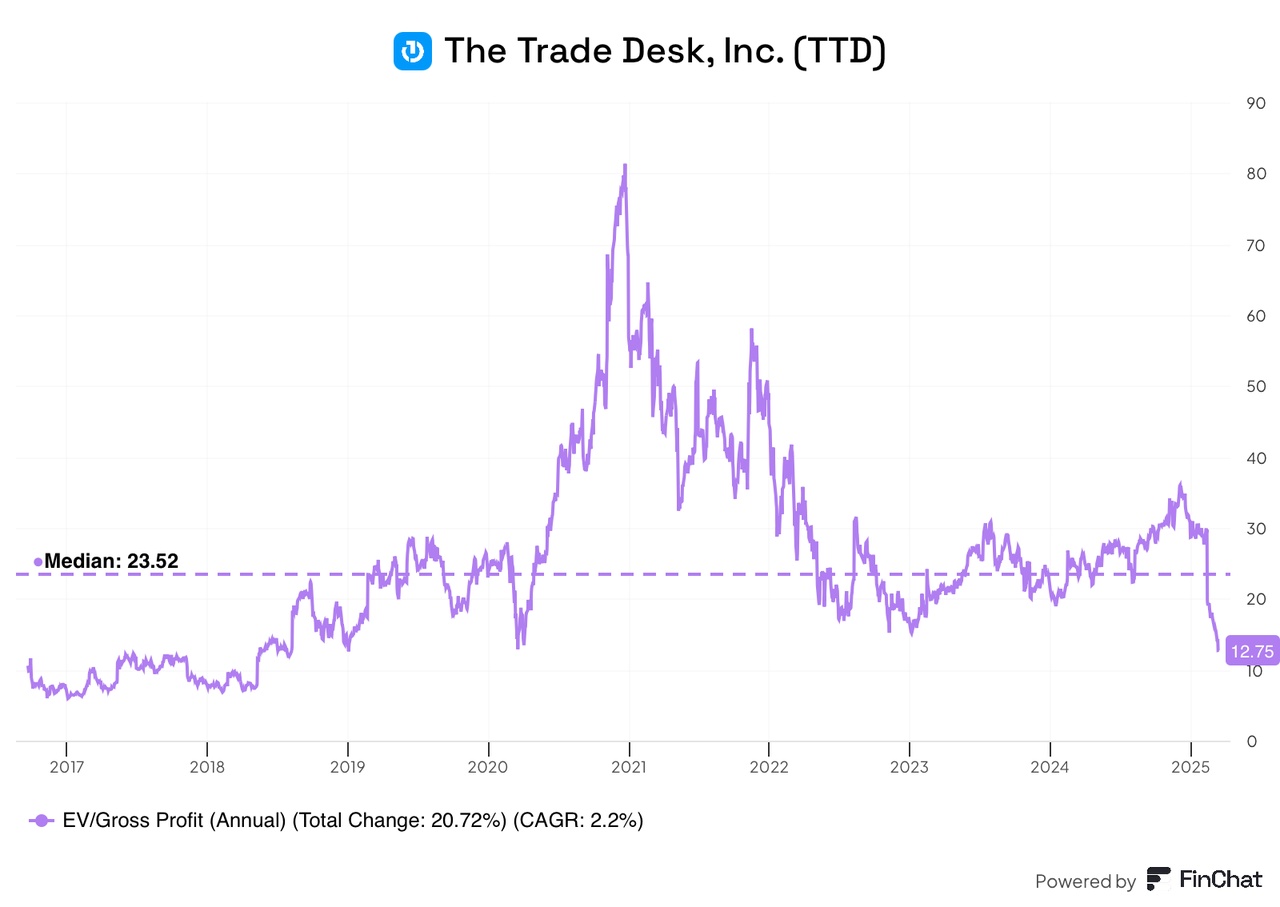

Valuation: EV/Gross Profit at the lowest level since 2018

Your opinion: Trap or opportunity?