Brief comments on $PNG (+6,17 %) (Additions to @Klein-Anleger )

I. The bare figures: Why I am enthusiastic about profitability

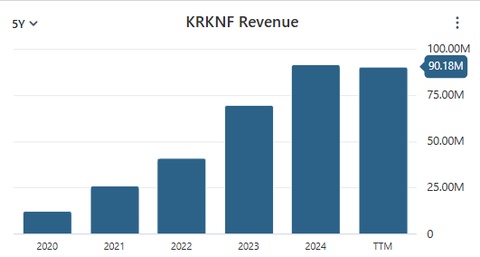

I think you have to look at the Q3 figures for 2025 on the tip of your tongue. We are talking here about a sales increase of 60% to CAD 31.3 million in just one quarter. But what really blows my mind is the efficiency behind this growth.

I see a gross margin of 59 %. This is absolutely extraordinary for a company that produces physical hardware (batteries and sonars). By comparison, traditional industrial companies often struggle to achieve 20-30%. For me, this shows two things: firstly, immense pricing power and secondly, that the market is willing to pay premium prices for Kraken's centimeter-accurate SAS technology.

Even more important to me is the Adjusted EBITDAwhich increased by 92 % to CAD 8.0 million. has increased. I see a massive "operating leverage" here. This means that Kraken has its fixed costs under control, while every new dollar of revenue is passed through to the bottom line almost one-to-one. If I extrapolate this to the full year 2025, I expect EBITDA at the upper end of the guidance of CAD 34 million. That is a doubling within a very short period of time.

II The "hidden champion" behind the giants: The Anduril Connection

I often think about who is supplying the shovels for the gold rush. In the field of autonomous underwater warfare, for me it's Kraken. When I look at how companies like Anduril (valued at over $14 billion) are ramping up production for the Ghost Shark program in Australia and the Dive-LD factories in the US, I see Kraken technology everywhere.

I have seen reports that Anduril's factories are ramping up to production of up to 200 units per year per year. Each of these autonomous submarines requires high performance batteries and sensors. Since Kraken is the exclusive supplier for the SAS sensors and pressure tolerant batteries, I see a massive multiplier effect here. I don't think the market has even priced in what will happen when these platforms enter mass production in 2026. mass production go into mass production.

III Battery expansion: a strategic stroke of genius

I am holding the new 60,000 sq. ft. factory in Nova Scotia perhaps the most important share price driver for 2026. Kraken plans to increase battery production there to almost 200 million CAD annually annually.

Why is this so important? I see the demand for underwater energy exploding. Not just for drones, but also for monitoring undersea cables. I think Kraken is transforming from a pure sensor manufacturer to an energy infrastructure provider. energy infrastructure provider of the oceans. Whoever supplies the batteries controls the endurance of NATO's entire drone fleet. In addition, Kraken could become an exciting value for rare earths, and this would open up a new business field. (Currently Defense 70% of sales) this is a thorn for me!

IV. Geopolitics as a tailwind: The end of the "blind" seas

I look at the world situation at the end of 2025: this year alone we had over 150-200 cable breaks worldwide. Sabotage in the Red Sea, incidents in the Baltic - the seabed has become the "Invisible Frontline". I see governments like the UK and the US massively increasing their budgets for underwater robotics.

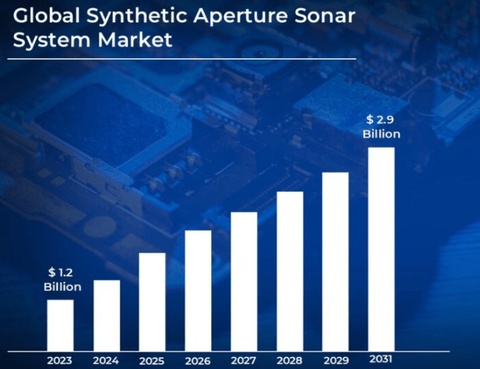

I think Kraken occupies a moral and technological pole position here. Their Synthetic Aperture Sonar (SAS) offers a resolution of 2cm x 2cm. When I imagine that you can detect a small sabotage charge on a cable at a distance of 200 meters, I understand why Kraken receives orders from almost all major NATO navies. For me, this is not hype, but a vital investment in national security.

V. My forecast on valuation and NASDAQ uplisting

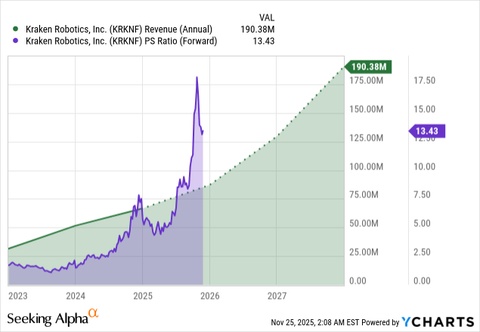

90KGV expensive? I think so: No. One must not forget that Kraken is sitting on a mountain of cash of over CAD 126 million (after the 115m financing in July).

I see the upcoming NASDAQ uplisting in 2026 as the moment of truth. Currently, only about 12 institutions hold significant positions. As soon as the stock is listed on NASDAQ, US pension funds and defense ETFs will be able to get in. I then expect a massive multiple expansion. Analysts such as George Maybach von Fintel have already raised their price targets to USD 4.58 - for me this is just the beginning.

I think that if Kraken manages to increase sales towards 280-350 million CAD in the next three years (which I think is very realistic with the current pipeline of CAD 2 billion), then a market capitalization of 4-5 billion CAD is absolutely conceivable. That would be a quadrupling from the current level.

VI My personal conclusion

I see Kraken Robotics as a rare example of a tech company that has left the "Valley of Death". They are profitable, they are scaling, and they have a product that the world needs more urgently than ever before. I think anyone who fears short-term volatility here is overlooking the gigantic big picture: the conquest and securing of the seabed has only just begun - and Kraken is the one supplying the flashlights and the batteries for it.

The forecasts give Kraken a four-year CAGR (EPS) of around 30%. With a forward P/E of around 15, this results in a PEG ratio of around 0.5, indicating an attractive valuation, purely from the PEG ratio (PEG < 1) this reinforces the buy opportunity!

Nevertheless, the hype has slowly arrived:

Daily volume has risen dramatically and so has the historical valuation. This could mean that we can also expect a setback in the short/medium term. For these reasons, I will take another deep-dive look at the company over the next few weeks and possibly wait in the short term for chart reasons. I am not invested in the status quo, as I still want to validate a few things and understand the company in depth!

Best wishes and have a good year 2026!

Thoughts from me, written with LLM - Thanks for reading