The first month of the new year is already over. While the first half of January was characterized by Trump euphoria and rising markets, the second half was much more volatile, particularly due to DeepSeek and its impact on the AI sector.

For me personally, the savings rate was unfortunately somewhat lower due to the issue of house building, as already mentioned at the end of 2024. Currently (and probably also for the coming months) it will therefore only be around €500-700.

I am aware that this is of course still a very high savings rate, but it is significantly lower than the ~€2,000 of recent years.

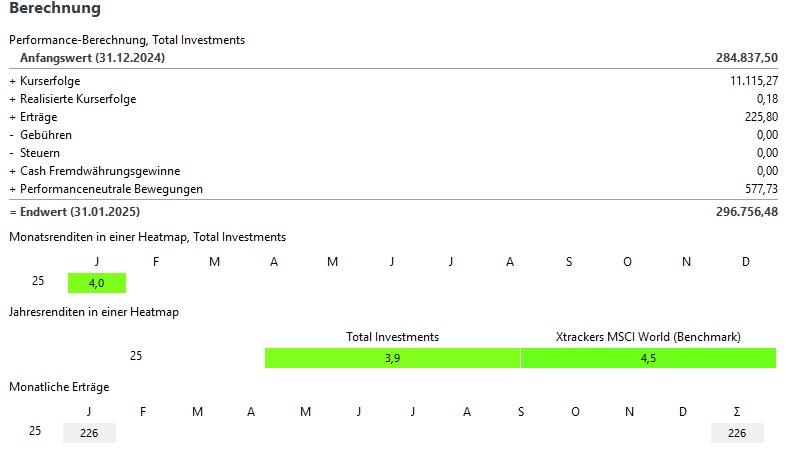

Also very exciting: In November, I withdrew over €20,000 from my custody account to raise the equity for the bank. Just 2 months later, my custody account is back to the same value of almost €300,000.

But now it's finally time to look at the hard figures:

In total, January was +3,9%. This corresponds to price gains of ~11.000€.

The MSCI World (benchmark) was +3.5% and the S&P500 +2.7%

Winners & losers:

A look at the winners and losers shows an unusual picture in January:

The biggest loser by far is NVIDIA! With price losses of almost €3,000, the emergence of DeepSeek caused substantial losses in the portfolio.

The other losers, on the other hand, are only worth a side note. After NVIDIA, Apple has already lost significantly less with ~€400 losses. The remaining loser stocks then only lost around €200.

On the winners' side at the top with a total of almost €2,000 in price gains is the Meta share. Followed by Bitcoin with €1,500 price gains and 2 other tech stocks: Alphabet with €1,200 and Crowdstrike with €1,000. 5th place goes to Starbucks, also with gains of almost €1,000.

The performance-neutral movements were clearly negative in January, as some of the cash was used to buy the property. The property is of course also an asset, but I would rather focus on liquid assets here.

The performance-neutral movements in relation to my portfolio were ~€600

Dividend:

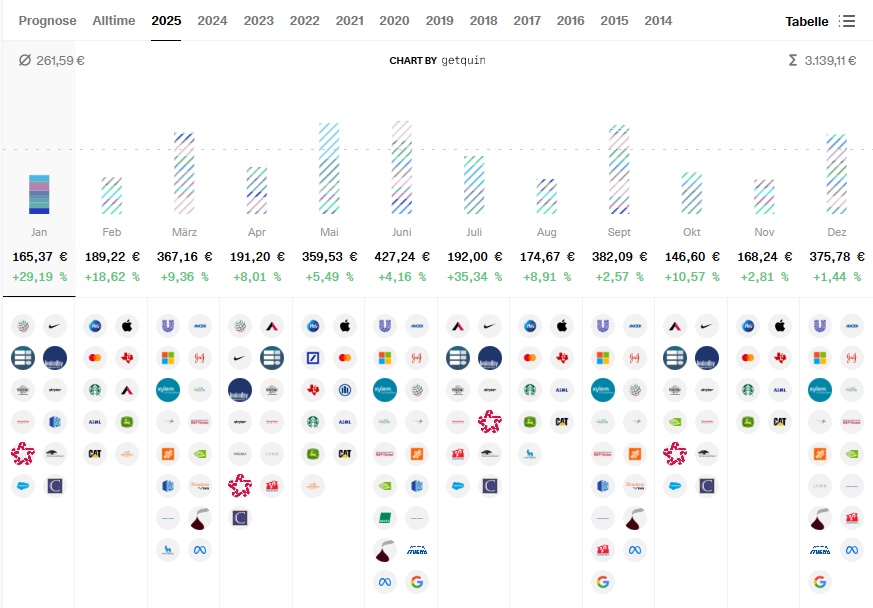

- The dividends in January were 30% above the previous year at ~€166

- TSMC is in the lead with over 30€ (gross) dividend every 3 months.

Buys & Sells:

- I bought in November for significantly reduced ~600€

- As always, my savings plans were executed:

- Blue ChipsMicrosoft $MSFT (-0,15 %) Stryker $SYK (+1,84 %) Apple $AAPL (-0,07 %) Home Depot $HD (-0,26 %) Starbucks $SBUX (-0,84 %) Texas Instruments $TXN (-0,99 %) Nike $NKE (-3,52 %) Novo Nordisk $NOVO B (+1,06 %) Lockheed Martin $LMT (+1,13 %) LVMH $MC (+1,65 %)

Growth: -- ETFsMSCI World $XDWD and the WisdomTree Global Quality Dividend Growth $GGRP

- Crypto: Bitcoin $BTC and Ethereum $ETH

- Sales -

YouTube:

In mid-January, I uploaded my first video to YouTube. I am particularly proud of a video explaining my dividend strategy. The video has already reached almost 200 views and a playback time of ~10 hours!

Even though I'm still not really sure what exactly I want to do on YouTube, I really enjoy editing videos and talking about shares.

That's why I created my January portfolio update as a video for the first time. Of course I would love to hear your feedback!

Target 2025

Building a house makes it particularly difficult to formulate a goal this year.

A certain savings rate? Difficult if additional costs are suddenly added

A certain deposit value? Also difficult, as I can't really back this up with my savings rate this year.

Nevertheless, I would formulate the following goal for this year:

Current portfolio balance is €300,000. I would estimate additional investments at ~€15,000. With an average market return of ~7%, that would be price gains of ~€21,000.

This would put my portfolio at €330,000 to €340,000 at the end of 2025.

-> I would therefore aim for a portfolio value of well over €300,000, so that a 2% fluctuation does not lead directly back below €300k.