📅 KW 16 / Status: April 14, 2025

Palantir Technologies is in an exciting market situation: the share price is showing short-term strength, but is coming up against technical limits. Fundamental stimuli such as NATO contracts and innovations in the AI sector are providing support. Here is a look at the current situation.

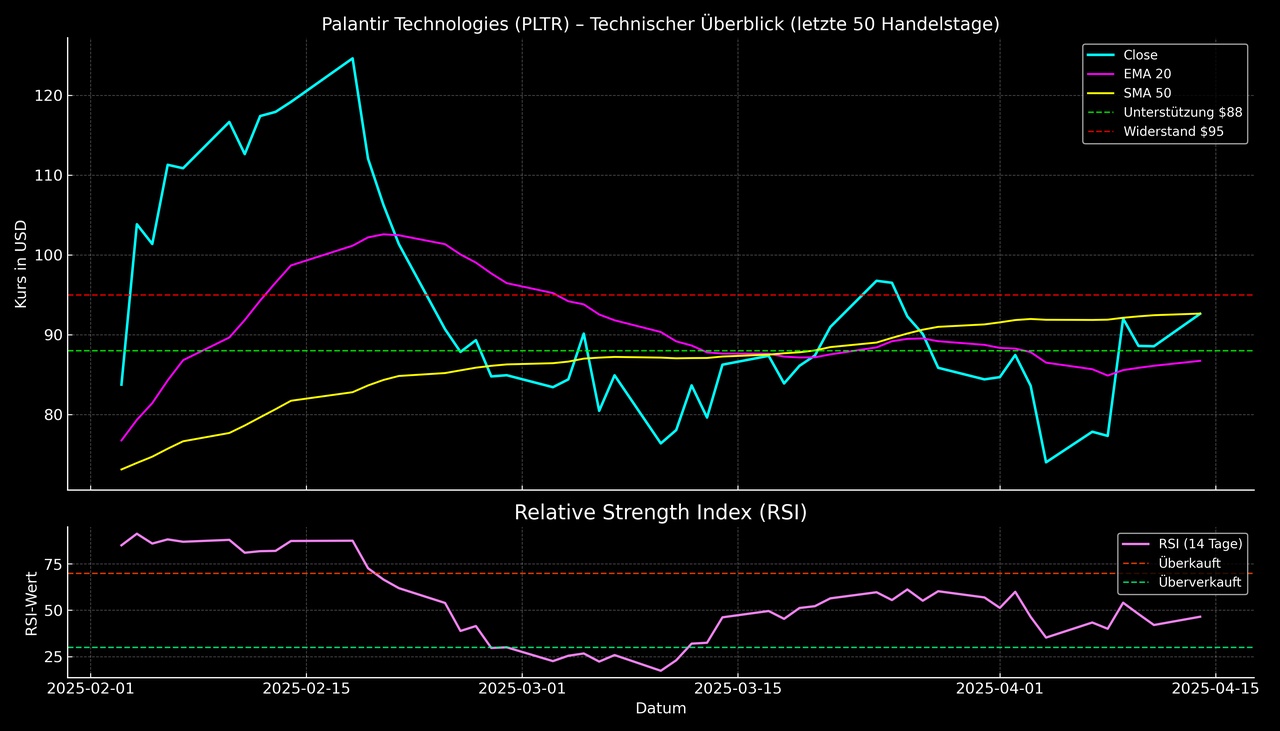

📊 Current market data

- Price (closing price): $92.62

- EMA20: $86.72

- SMA50: $92.64

- RSI (14): 46.48 (slightly below neutral)

- 52W High / Low: $125.41 / $20.33

➡️ The price is currently trading above the EMA20which is positive in the short term.

➡️ However, the price is practically exactly on the SMA50 linewhich could be a potential turning point.

➡️ The RSI at 46.48 currently signals a cautious market sentiment.

🔼 Resistance levels

- $95.00: Technically and psychologically important resistance.

- $100.00: Next price target on breakout above $95.

- $105.00+: Zone with increased selling interest from February-March 2025.

🔽 Support zones

- $88.00: First important short-term support.

- $86.70 (EMA20): Dynamic line for trend confirmation.

- $82.00 - $80.00: Solid area for pullback on market weakness.

🕒 Intraday-Tendenzen (14.04.2025)

- +0.10 % (5 min)

- +0.30 % (1 hr)

- +1.50 % (4 hours)

- ➡️ Intraday Palantir is stable with moderate upward momentum.

📰 Fundamental impulses & news situation

1. major NATO orders boost confidence

Palantir was able to conclude several contracts in the defense sector.

📈 Effect: Tailwind for the core business and institutional confidence.

2. technological innovations (AI & AIP)

The further development of the Palantir platform and the integration of AI-supported modules are meeting with a positive response on the market.

🚀 Effect: Potential for expansion in civil and industrial sectors.

3. market volatility remains a factor of uncertainty

The general uncertainty in the tech sector could lead to greater fluctuations - especially for high-growth stocks such as PLTR.

⚠️ Effect: Traders should expect setbacks.

🔮 Weekly outlook & valuation

- Expected range: $88 - $95

- Breakout scenario: Above $95 → Target at $100

- Critical: The price must well above the SMA50 ($92.64) establish itself

- News situation remains bullishbut technically it needs confirmation

📣 Conclusion

Palantir shows relative strength in the short term - supported by news on orders and product development.

A breakout above $95 could initiate a move towards $100.

However, as long as the price consolidates below this level, patience will be required.