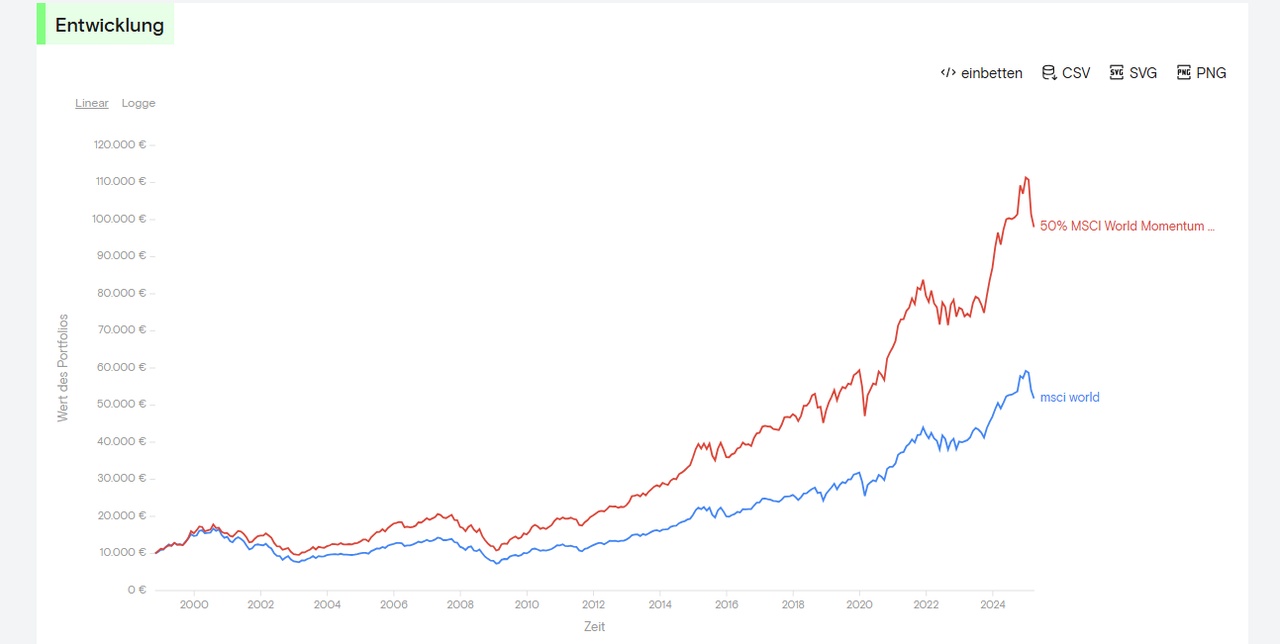

How do you all feel about factor investing? Based on personal preference and research, I’ve put together a simple sample portfolio to illustrate its potential. I've benchmarked it against the MSCI World Index $IWDA (+1,45 %) .

The results are quite compelling—the factor-based portfolio consistently outperforms the benchmark in both return and risk-adjusted terms:

Annual return:

Factor portfolio: 9.02%

MSCI World: 6.42%

Volatility (Standard Deviation):

Factor portfolio: 14.76%

MSCI World: 14.48%

Sharpe Ratio:

Factor portfolio: 0.55

MSCI World: 0.39

Max Drawdown (during 2008 financial crisis):

Factor portfolio: -47.7%

MSCI World: -56.5%

Value at Risk (VaR, 95% confidence, 1-year horizon):

Factor portfolio: -14.5%

MSCI World: -16.5%

This suggests that a thoughtfully constructed factor portfolio can offer superior returns while managing downside risk more effectively than a broad-market benchmark like the MSCI World.

Would love to hear your thoughts or see how this compares with any strategies you're exploring.