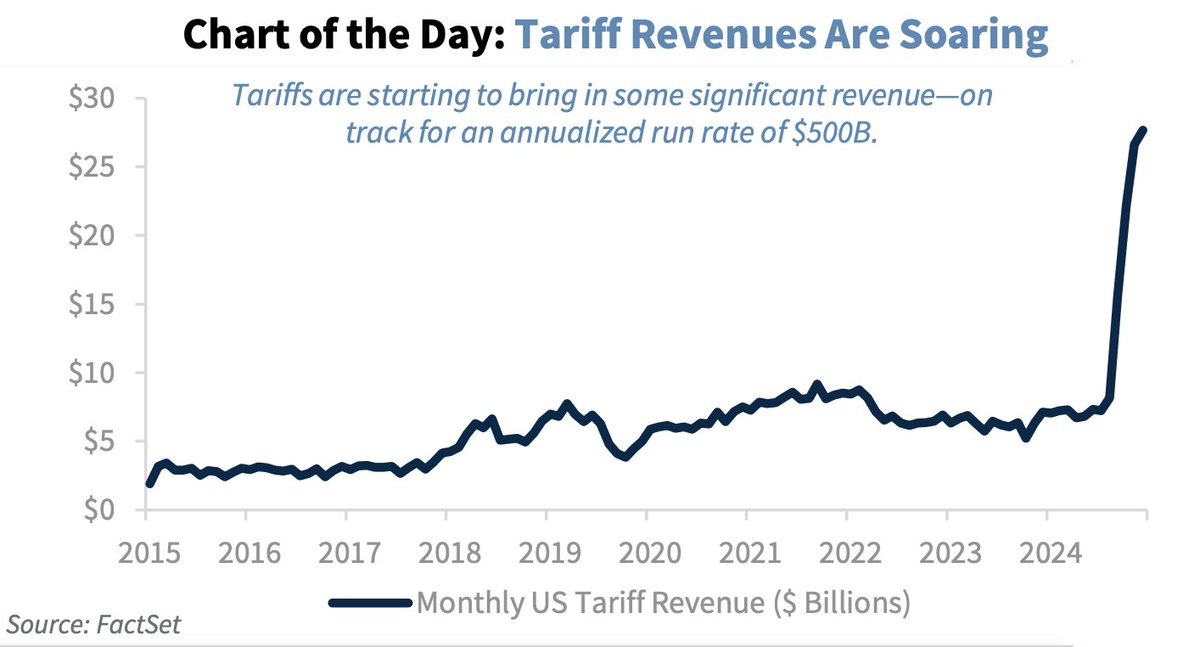

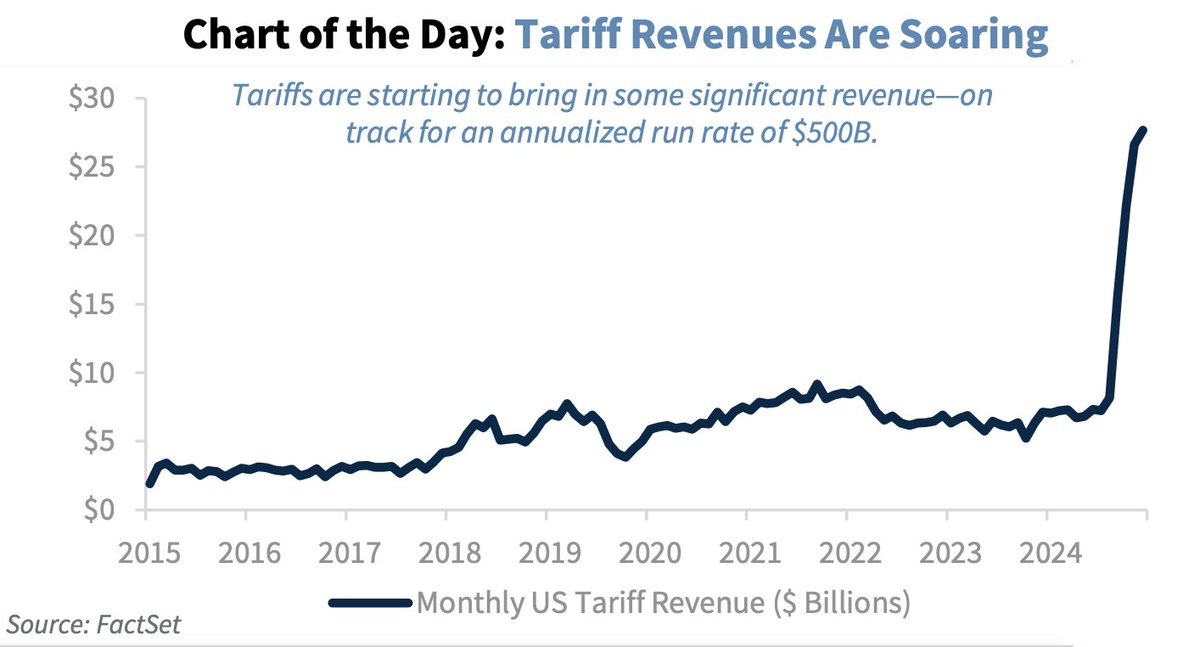

Customs revenue in the USA is rising rapidly and reached a new monthly record of 28 billion US dollars in July - almost four times as much as in January.

Customs revenue in the USA is rising rapidly and reached a new monthly record of 28 billion US dollars in July - almost four times as much as in January.