Hello my dears,

I'm still here for you during the Christmas week, working on new company presentations.

Last week COPILOT told me

" Increase energy sector "

Anyone who knows me knows that I like to look at the scoop suppliers.

And so my idea today is also a scoop on the energy sector.

I'd love to hear your thoughts on this long-established company in the comments.

My dear @EpsEra do you know the company and what is your opinion?

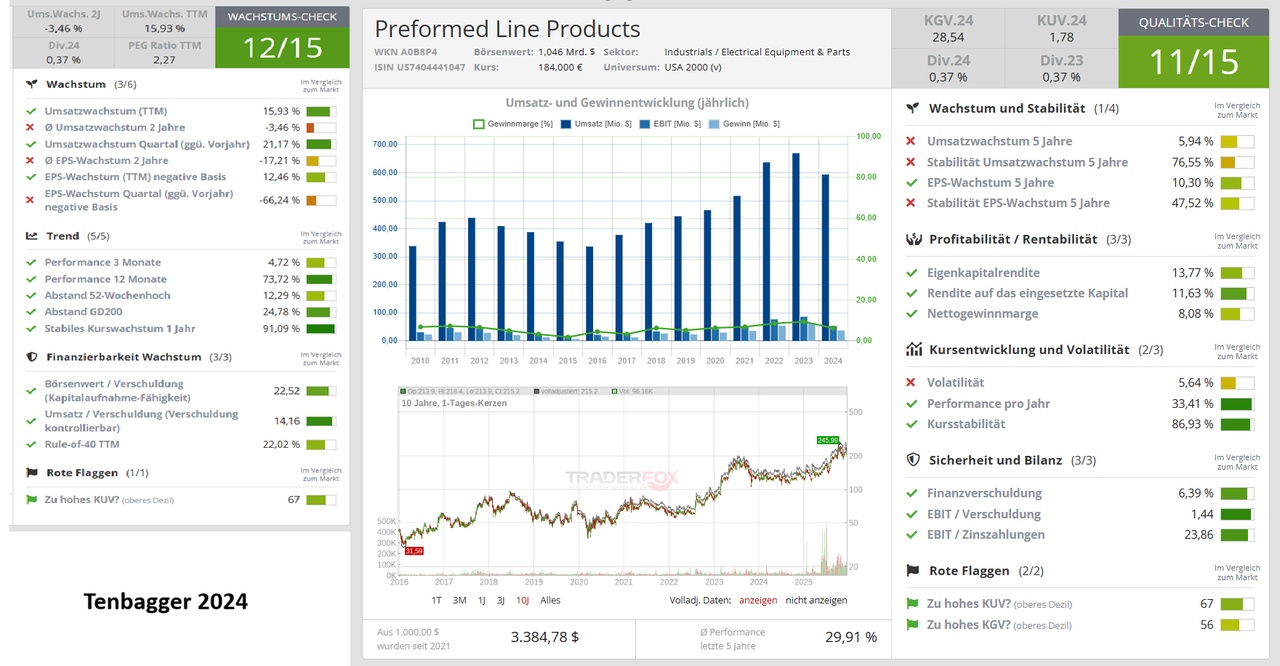

Preformed Line Products' business model is based on the manufacture of critical components for power, telecommunications and broadband infrastructure. The company benefits from the global demand for the expansion and modernization of power grids and communication infrastructures. Impressive figures were presented in the second quarter of 2025. Sales increased by 22% to USD 169.6 million compared to USD 138.7 million in the same quarter of the previous year. Net profit grew by 35% to USD 12.7 million.

Preformed Line Products: The invisible infrastructure winner - Why the company is benefiting from global megatrends

The company is benefiting from the global need to modernize aging power grids and expand fiber optic networks. It is regarded as a leading supplier of essential components for these projects. Demand is secured in the long term by megatrends such as the energy transition and advancing digitalization, which offers the company a stable basis and long-term growth opportunities. PLPC is characterized by its strong focus on research and development, which has led to numerous patents and technological progress.

PLP protects the world's most critical connections by creating stronger and more reliable networks. The company's precision-engineered solutions are trusted by energy and communications providers worldwide to work better and last longer. With locations in over 20 countries, PLP operates as a unified global company, delivering high-quality products and unparalleled service to customers worldwide.

PLP's critical infrastructure solutions serve a wide range of customers, including:

- Utilities

- Telecommunications network operators

- Cable television and broadband service providers

- Construction contractors

- Agricultural businesses

- Businesses and business networks

- Government agencies

- Educational institutions

Founded in 1947, PLP's flexibility and global presence enables the company to respond quickly and accurately to customer needs. Modern manufacturing technologies ensure that PLP can quickly and efficiently produce a variety of products to meet market needs worldwide. PLP is certified by a leading certification body (ABS Quality Evaluations) to the international standard ISO 9001:2015 and meets or exceeds testing requirements as defined globally and locally.

An unwavering commitment to quality is not just a goal at PLP, it is the guiding principle of everything we do. You can rest assured that the reliability of our products and the dedication of our employees are the things that make PLP "the connection you can count on.®"

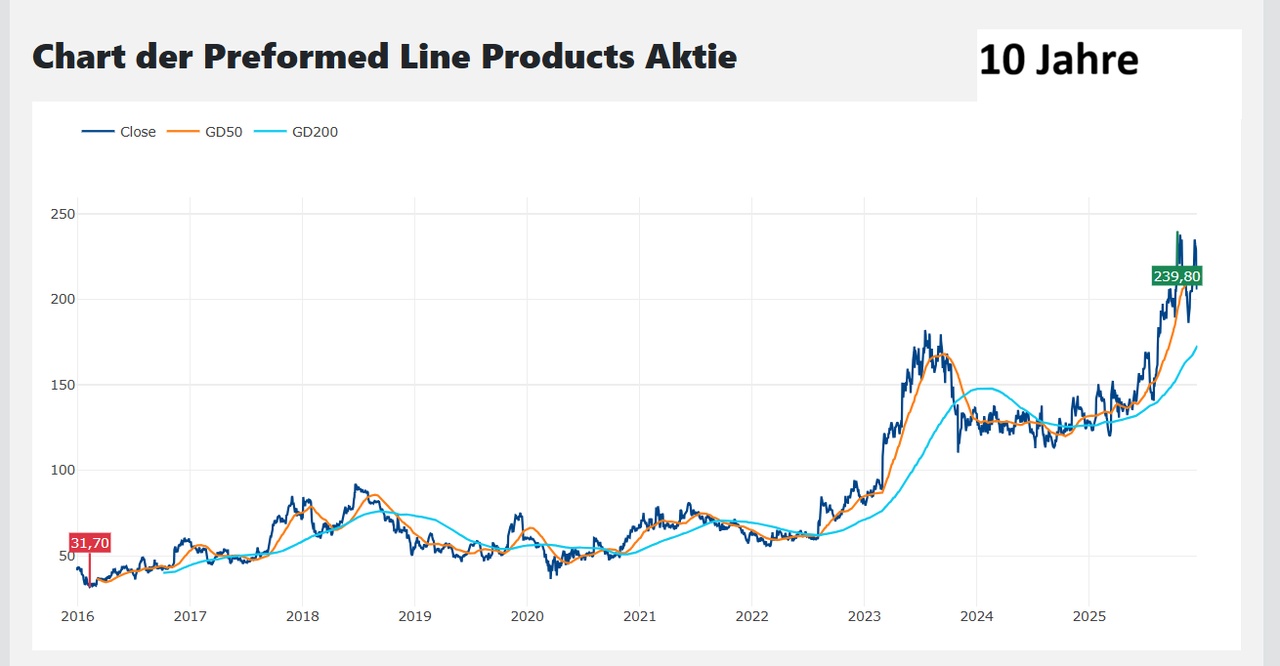

What was the performance of the Preformed Line Products share?

Current year +53.33 %

2024 -1,64 %

2023 +56,41 %

2022 +43,12 %

2007-2008 Alternative energies

After years of researching the solar energy market, just the right partner was found. DPW Solar, based in Albuquerque, New Mexico, was acquired in 2007. DPW Solar specializes in the development, design and installation of turnkey photovoltaic systems for residential, commercial and industrial applications. It is also a major manufacturer of photovoltaic racks, equipment and battery enclosures. In 2008, we began marketing our solar capabilities under the PLP Solar brand to our traditional electric utility customers and distributors.

2009 - 2010 Global expansion

PLP continued to strengthen its ability to respond to market needs both globally and locally,

In 2009, PLP acquired the Dulmison product line and its facilities in Indonesia and Malaysia. Dulmison was a former licensee from 1960 to 1977 and subsequently became a strong competitor in both the gearbox and distribution markets. The successful seven-year acquisition project strengthened PLP's position in the energy market, now offering the most comprehensive product line in the industry.

2010 ended with another acquisition, Electropar, a company that designs, manufactures and markets pole line and substation hardware for the global power distribution industry. Electropar is headquartered in New Zealand and has a subsidiary in Australia. This acquisition strengthened Preformed's position in the power distribution, transmission and substation hardware markets across the Asia Pacific region and will provide a strong and established channel in New Zealand for PLP's global offerings.

2012 Ranchmate® expands markets for specialty industries

Ranchmate®, launched by PLP in 2012, is an innovative product line for the construction and repair of wire fencing. Ranchmate enables farmers and ranchers to build and repair wire fencing in the same way that utility lines have been erected and lines tied down for years. This product line became PLP's first entry into the retail market.

2013 PLP France established and global headquarters expanded

PLP France was established at INNEOS in February 2013 and is a wholly owned subsidiary of Preformed Line Products. PLP has always marketed a wide range of transmission, distribution and communication products to the French market, and this new location will enhance the excellent customer service PLP provides to its customers.

PLP completed an addition to its Global Headquarters that included a major expansion of its laboratory and test facility.

2014 PLP acquires HELIX Canada and builds a new injection molding facility at the Rogers Manufacturing Plant

In February 2014, PLP acquired Helix Uniformed Limited, based in Montreal, Quebec, Canada. HELIX Uniformed Limited's extensive research and engineering expertise and established manufacturing operations will greatly enhance the service and support PLP provides to its customers in the Canadian market.

A new 40,000 square foot state-of-the-art injection molding facility was completed at PLP Rogers, Arkansas.

2019 PLP acquires MICOS Telecom

Global expansion continues in April 2019 when PLP signs an agreement with MICOS TELCOM S.R.O. in PROSTĚJOV, Czech Republic. The acquisition complements PLP's existing product base, as Micos is a leading manufacturer of passive components for high-speed telecommunications networks.

2019 PLP acquires SubCon electrical installations

The acquisition of SubCon expanded technical expertise in high voltage AC and DC substation systems and brought together a talented group of technical professionals with knowledge of substation products, technologies and customers.

2023 PLP acquires Pilot Plastics

The Pilot acquisition expands PLP's injection molding capabilities and further expands the company's extensive manufacturing footprint. Located in Peninsula, Ohio, it joins Rogers, Arkansas, and Albemarle, North Carolina, to become PLP's third U.S. manufacturing facility.

Today - the connection you can rely on®.

As for the future, Winston Churchill once said, "The farther back you can look, the farther forward you are likely to see." At Preformed Line Products, we can look back on our first 75+ years and know that our future is strong and bright. Built on an entrepreneurial foundation of innovation, quality and service, we are uniquely positioned to meet the challenges of the next generation.

While much about the future is unknown, we can expect the continued growth of foreign markets, industry consolidation, regulatory changes and new technologies to be part of the picture. As the boundaries between the energy and telecommunications industries blur, we see this as an opportunity to consolidate our position as a leader in the protection of conductors and cables, regardless of industry. Our commitment to research and design keeps PLP at the forefront of our customers' minds.

Our past has prepared us to anticipate change, see it as an opportunity and meet it with the same diligence that Tom Peterson brought to his first product design. The talent, commitment and dedication of our people are unmatched anywhere in the world. At home or abroad, PLP is the connection you can rely on.

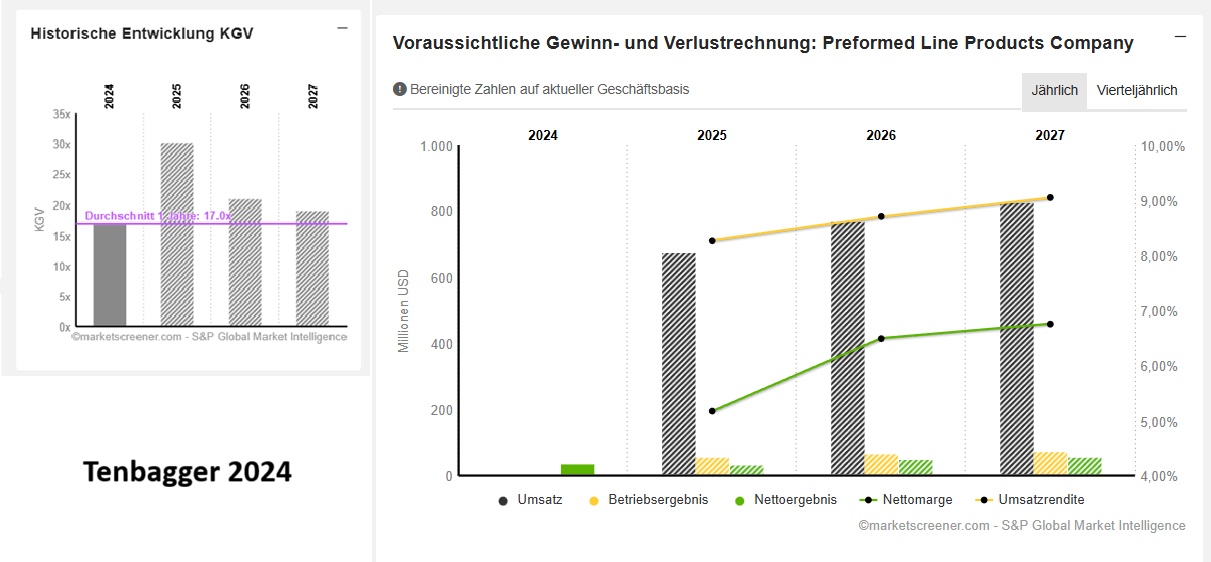

USD in millions USD

Estimates

Year

Turnover

Change in

2025 677

2026 770 13,74 %

2027 829 7,66 %

Year

EBIT

Change in

2025 79,5

2026 91,9 15,6 %

2027 101 9,9 %

Year Net resultChange in

2025 35 - 5,65 %

2026 50 42,86 %

2027 56 12 %

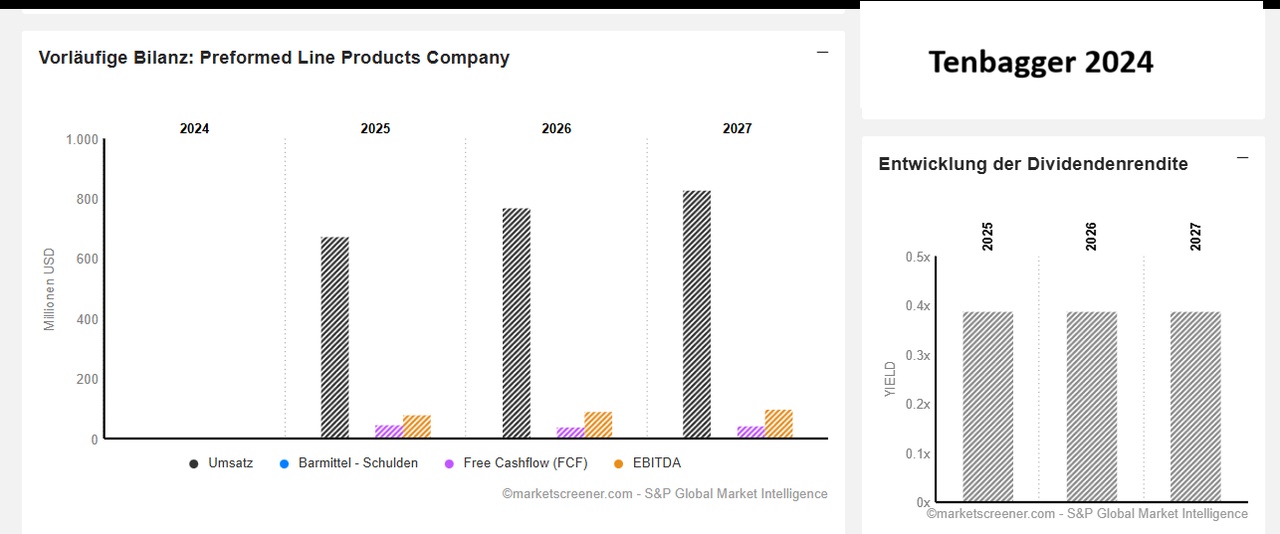

Year

CAPEX

Free cash flow

2025 33 49

2026 29 42

2027 31 44

years

EBITDA margin (%))Earnings per share

2025 11,74 % 7,08

2026 11,94 % 10,17

2027 12,18 % 11,28

Year

P/E RATIO

PEG

2025 30.4x -5.43x

2026 21.2x 0.5x

2027 19.1x 1.7x

Market value 1,055

No. of shares (in thousands) 4,902

Sector

P/E RATIO

Prysmian $PRY (-0,81 %) 20,05x

Friedrich Vorwerk $VH2 (-0,25 %) 27,83x

25Q3 - PLP Investor Presentation

PLP KÜNDIGT DIE ÜBERNAHME VON JAP TELECOM - PLP AN

PLP KÜNDIGT ÜBERNAHME VON PILOT PLASTICS AN