Hi guys,

I've been intensively involved with fintech for years - starting with my bachelor thesis on NU (which was a failure academically, but very profitable financially - Nu bought at €4! This semester, I took a module on fintech at the University of Mannheim, where I was able to learn a lot more and which once again confirmed my interest: Fintech is here to stay!

I've been bullish on fintech for a long time and accordingly invested in PayPal, Wise, Mastercard, Nu (largest position) and Meli. Since most people already know Nu, I wanted to make a small contribution to $WISE (-0,89 %) probably the best Fintech out of...believe it or not EUROPA!

1.the problem of banks and the core drivers of the fintech revolution since the 2008 financial crisis:

(a) Inefficiency of the established financial system

b) Regulatory and economic environment after the financial crisis

c) Growing distrust in traditional financial institutions, especially after 2008

d) Open banking and APIs promote competition and innovation

e) Customer expectations and demographics

a) Inefficiencies in the traditional financial system

The established financial system is characterized by high costs and structural inefficiencies, especially for international payments:

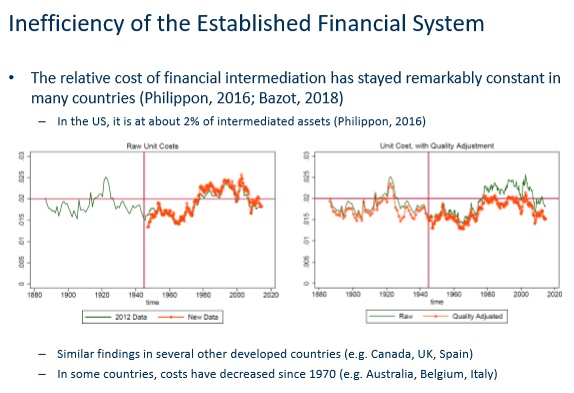

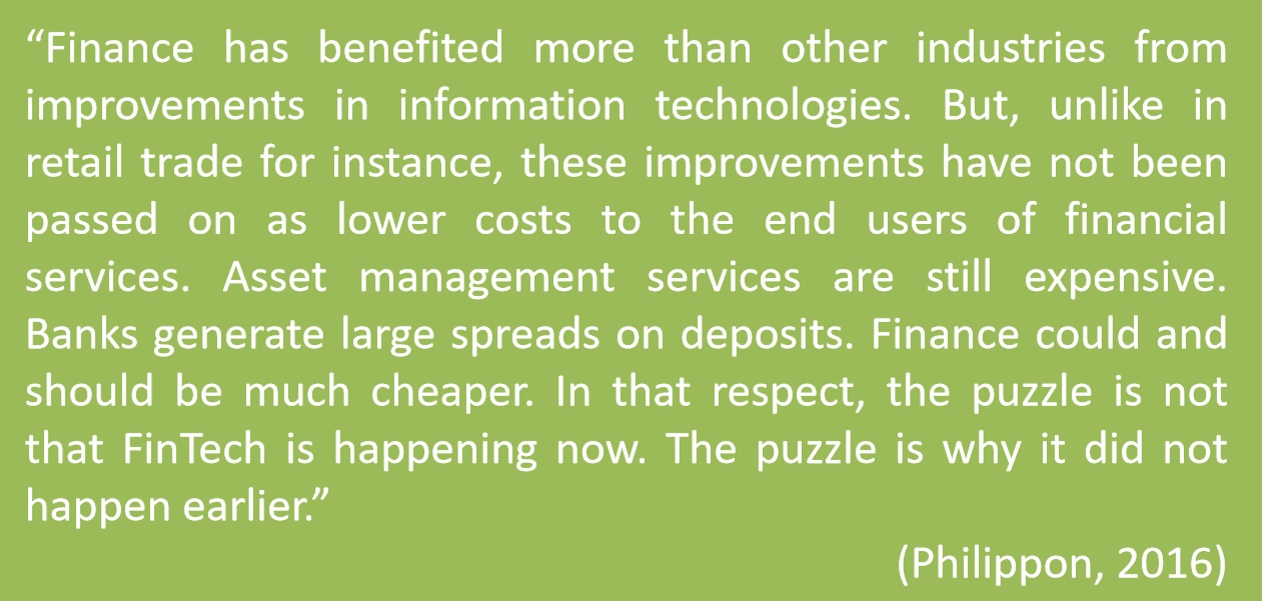

- High intermediation costs: The cost of financial intermediation has been constant for decades (~2% of intermediated assets in the US) as banks do not pass on economies of scale to customers.

- Banks profit from interest income on customer deposits: Traditional banks use customers' unused capital as a hidden profit pool instead of benefiting customers. (see Savings banks - ~28 bn net interest income in 2023 - What the fuck?)

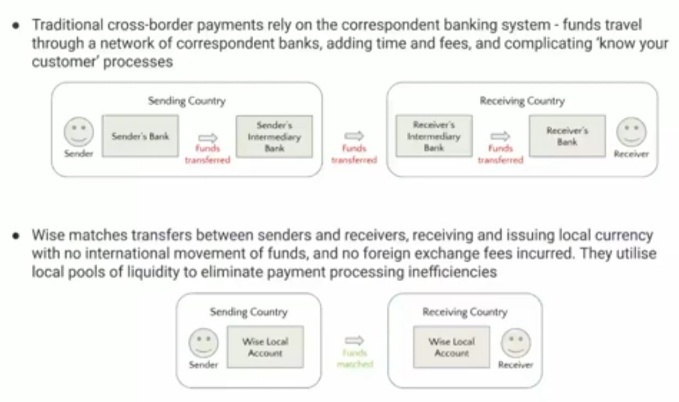

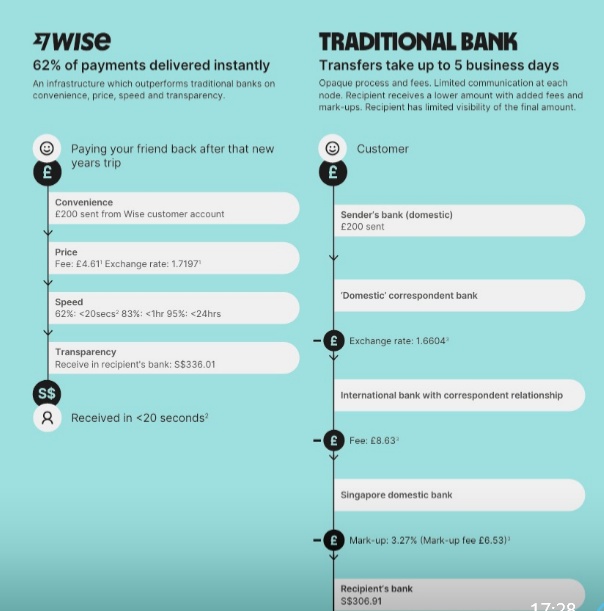

- Slow and expensive cross-border transfers: banks work with correspondent banks, resulting in slow transaction times and high fees. (See Figure 5)

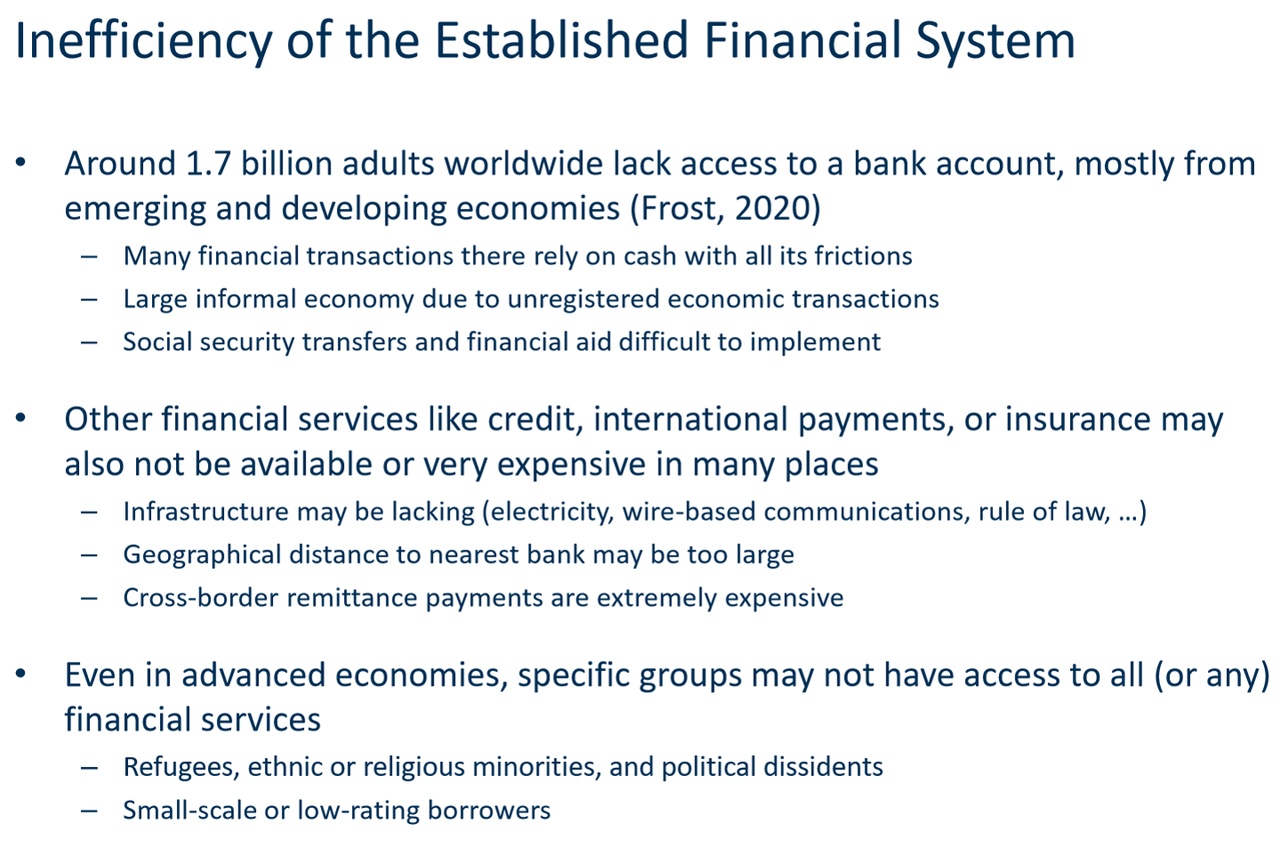

- Many people around the world lack access to financial services because they are either too expensive or denied to them,

Greed in the financial sector is real!

b)c)d) not implemented

e) Customer expectations and demographics

- Customers' expectations of financial services have changed.

- Expectations are increasingly shaped by BigTech and other internet companies.

- Customers expect more convenience

- access to financial services anytime and anywhere.

- Services should be simple and easy to understand.

- Customers feel less tied to individual institutions and are more willing to switch providers or use several at the same time. (made possible by open banking and APIs)

- Comparison of products and prices is becoming increasingly important.

- Social aspects are gaining in importance

- Small-value payments in everyday life.

- Sharing investments and investment strategies.

- Awareness of social responsibility influences investment decisions.

The system is inefficient and overpriced - Wise offers a technological solution that solves a significant part of these problems.

2. how Wise is revolutionizing international payments

Wise replaces the traditional model with an end-to-end end-to-end payment platformthat bypasses intermediaries:

- Matching instead of physical money movement: Wise matches payments between senders and receivers via local liquidity pools instead of physically moving money across borders - this reduces costs and increases the speed of transactions DRASTICALLY .

- International payments used to be a huge pain point for customers. Anyone who has ever withdrawn money abroad (exchange rate rip-off), sent money with Western Union or similar. knows what I'm talking about. A long, non-transparent and expensive process. Wise has put an end to this:

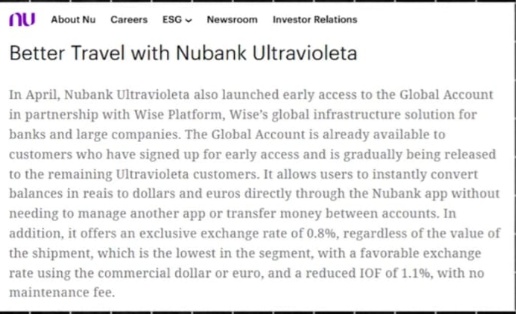

- A platform model with global reach: More than 85 banks and FinTechs, including Monzo, N26, Brex, Ramp and Nubank, already use the Wise platform.

- Partnership with Nubank: The fact that Nubank - one of the world's largest FinTechs - uses the Wise platform shows that even the most innovative banks don't think it makes sense to build their own infrastructure.

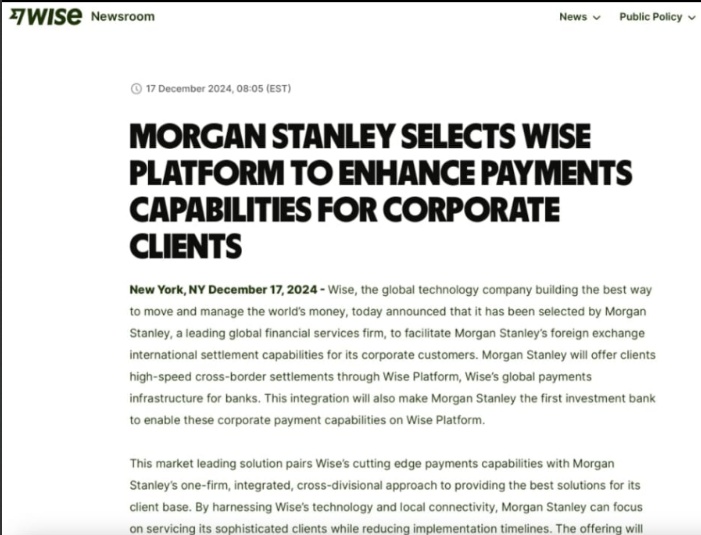

These partnerships prove that Wise cannot simply be copied or replicated. The platform is deeply integrated into the financial system through decades of investment in technology and regulatory licenses.

3 THE THESIS: Shared economies of scale as a competitive advantage

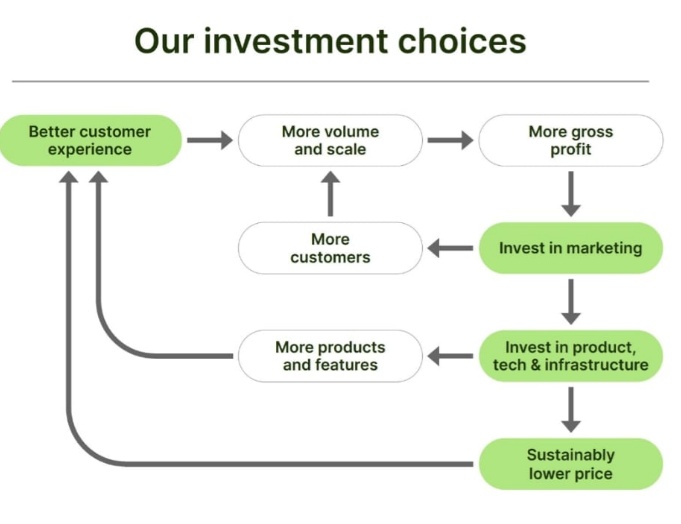

Wise pursues the "Scale Economies Shared (SES)" model model, which actively shares its economies of scale with customers:

- The larger the volume, the lower the fees: High transaction volumes allow Wise to spread fixed costs and continuously reduce costs.

- 80% of interest income from customer deposits is passed on: Unlike banks that keep this income, Wise passes on the majority of interest income to its users. WHAT COMPANY DOES THIS JUST TO MAKE ITS CUSTOMERS HAPPIER ?! (see savings banks above)

- Price leadership as a long-term strategy: Wise continuously lowers fees (currently ~0.64%), putting pressure on the competition.

This structural cost leadership makes it almost impossible for banks to remain competitive withoutwithout revising their entire fee models.

For this reason, even big banks are starting to cooperate with Wise instead of competing with them:

(i) Morgan Stanley

(ii) Standard Chartered

4. financial potential & valuation (WAS OF SEPTEMBER 2024 VALUATION IS NO LONGER CURRENT!)

- Market capitalization: ~£7.4bn ($9.7bn)

- Free cash flow: ~$486m

- Valuation: 15x FCF, 22x earnings - moderate valuation for a fast-growing FinTech

- Profit growth (CAGR 3 years): +127%

The Profitability grows with scalingwhile regulatory licenses and network effects provide Wise with a significant moat.

Risks

- Regulatory uncertainties: Access to centralized payment systems could become more difficult for non-banks.

- STABLECOINS/CRYPTO - If crypto becomes established as a means of payment, no FX transactions will be required.

- Foreign currency volatility: Fluctuations in currency movements could impact margins in the short term.

- Competition from real-time payment systems (e.g. RTP): Governments are increasingly developing their own cross-border solutions.

However, Wise, with its network effect, deep regulatory integration and a superior cost structure, Wise has a strong defensive position. a strong defensive position.

5 Conclusion and closing remarks

Wise disintermediates the traditional banking systemby providing a more efficient, cheaper and faster scaling infrastructure for international payments.

The partnerships with major FinTechs such as Nubank confirm that even leading digital banks are relying on Wiseinstead of developing their own alternatives.

With strong growth, a sustainable moat strategy and a fair valuation, Wise could become a long-term leader in global payments.

At the end of the day than investing in a company that is not only commercially successful, but also makes a positive contribution to society - by enabling fair, transparent and affordable financial services for all.

Exciting, isn't it? Let me know what you thought of this short article. I could go on forever and go into more detail about the figures, but this should only serve as inspiration for you.

Cheers!

-O.G. RÈDAIS CAPITAL FONDS