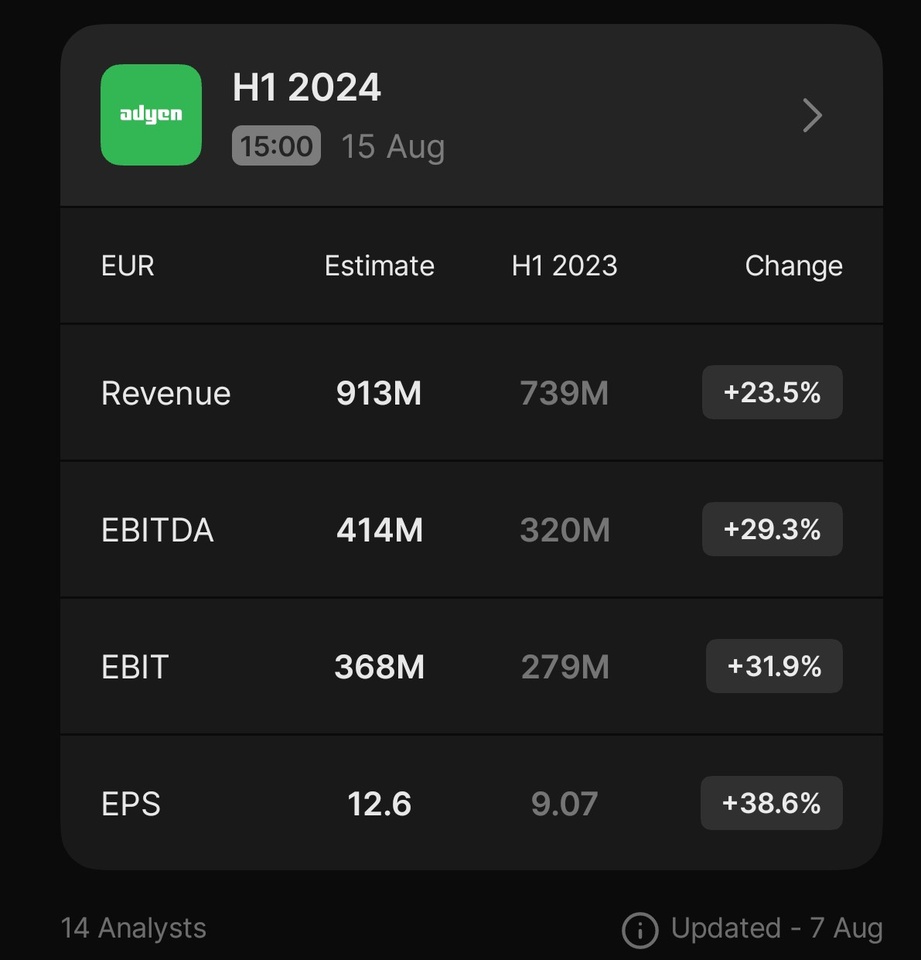

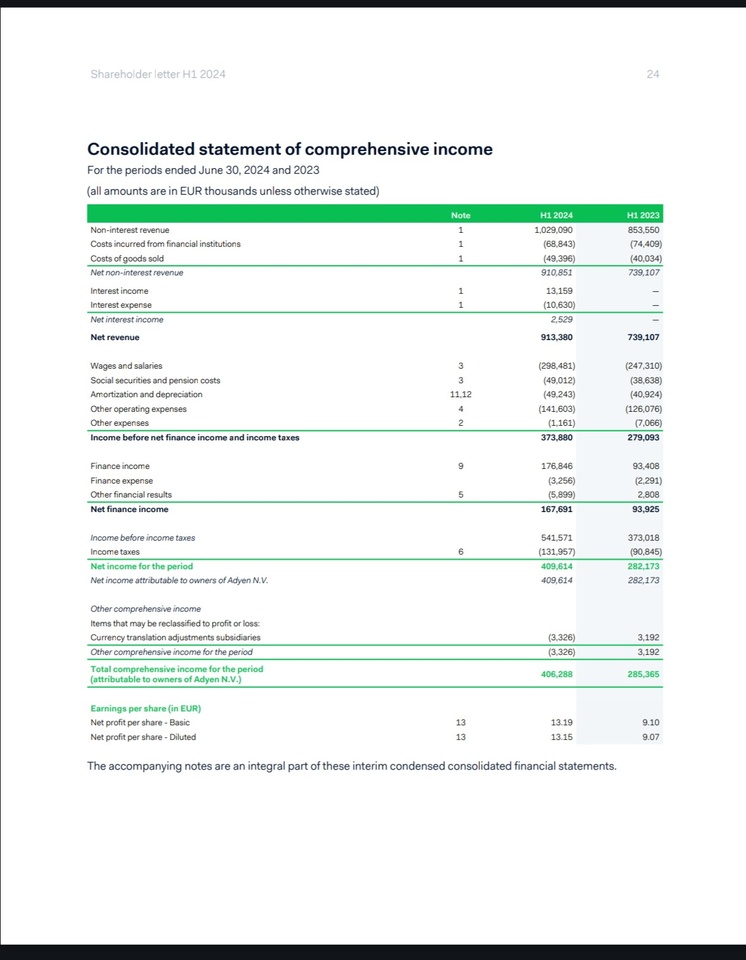

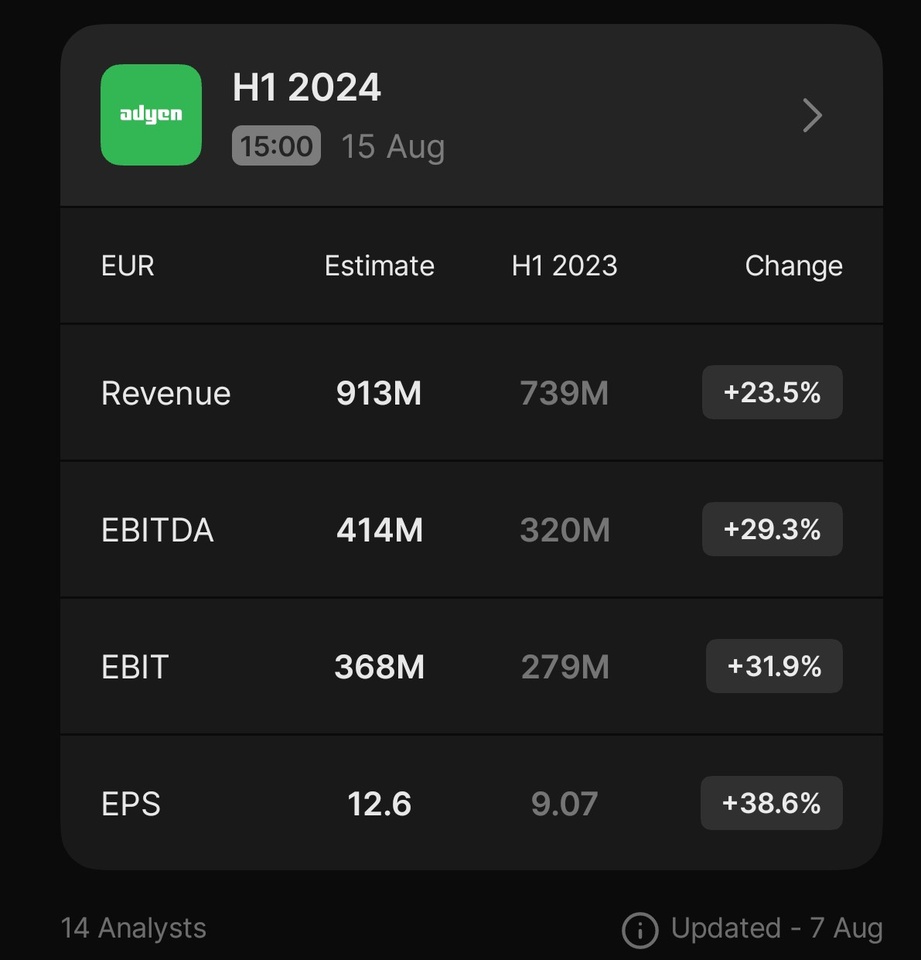

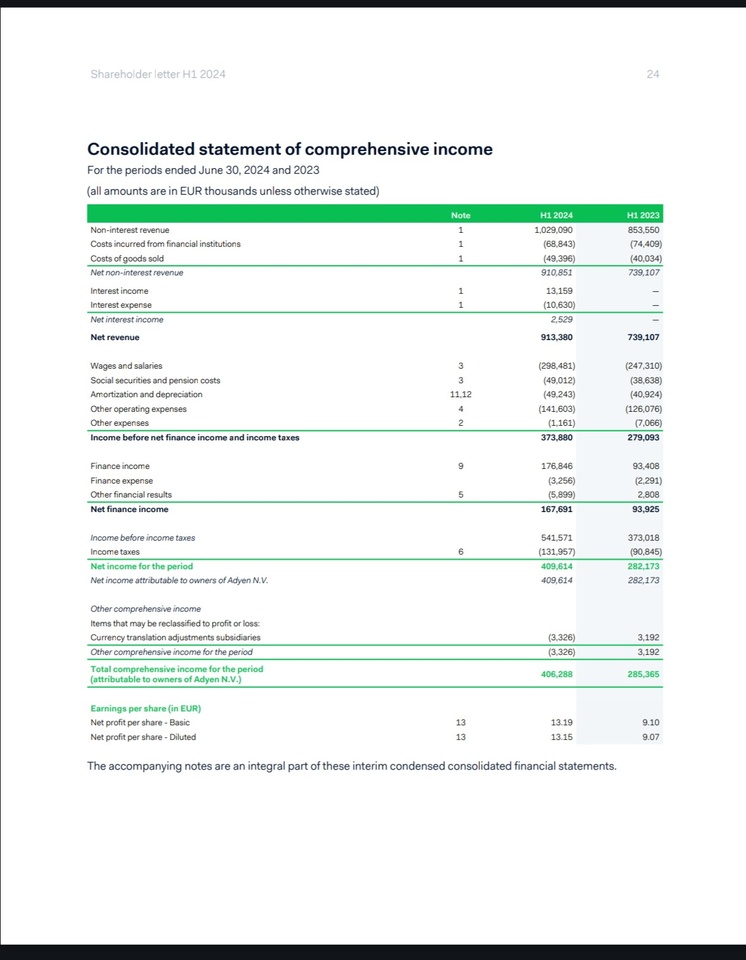

A small bet on my part that went quite okay. Apart from that $ADYEN (+0,17 %) delivered good figures and it is unbelievable how much income they are generating. Currently up 22%

A small bet on my part that went quite okay. Apart from that $ADYEN (+0,17 %) delivered good figures and it is unbelievable how much income they are generating. Currently up 22%