Interim conclusion: my YTD performance in 2024

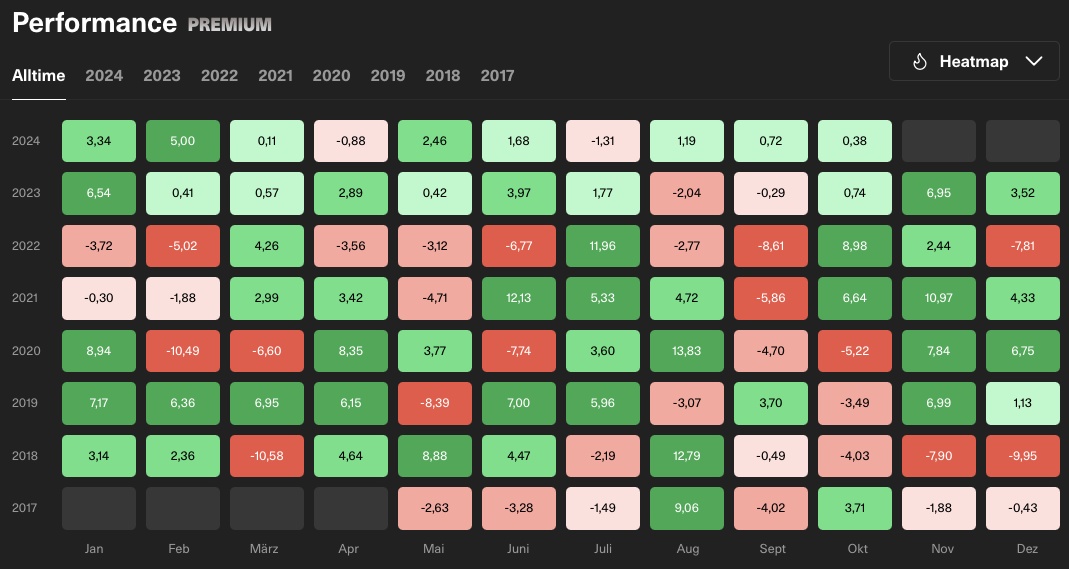

The third quarter of 2024 ended just over a week ago and the fourth and final quarter of the year has begun. Time to draw an interim conclusion on the performance of my portfolio. The aim of my portfolio is - as every year - to beat the MSCI World benchmark. However, I am also aware that it will not work every year and that the overall performance should rather be compared over a period of 3-5 years. Nevertheless, it is a way for me to analyze how my portfolio is performing compared to the benchmark.

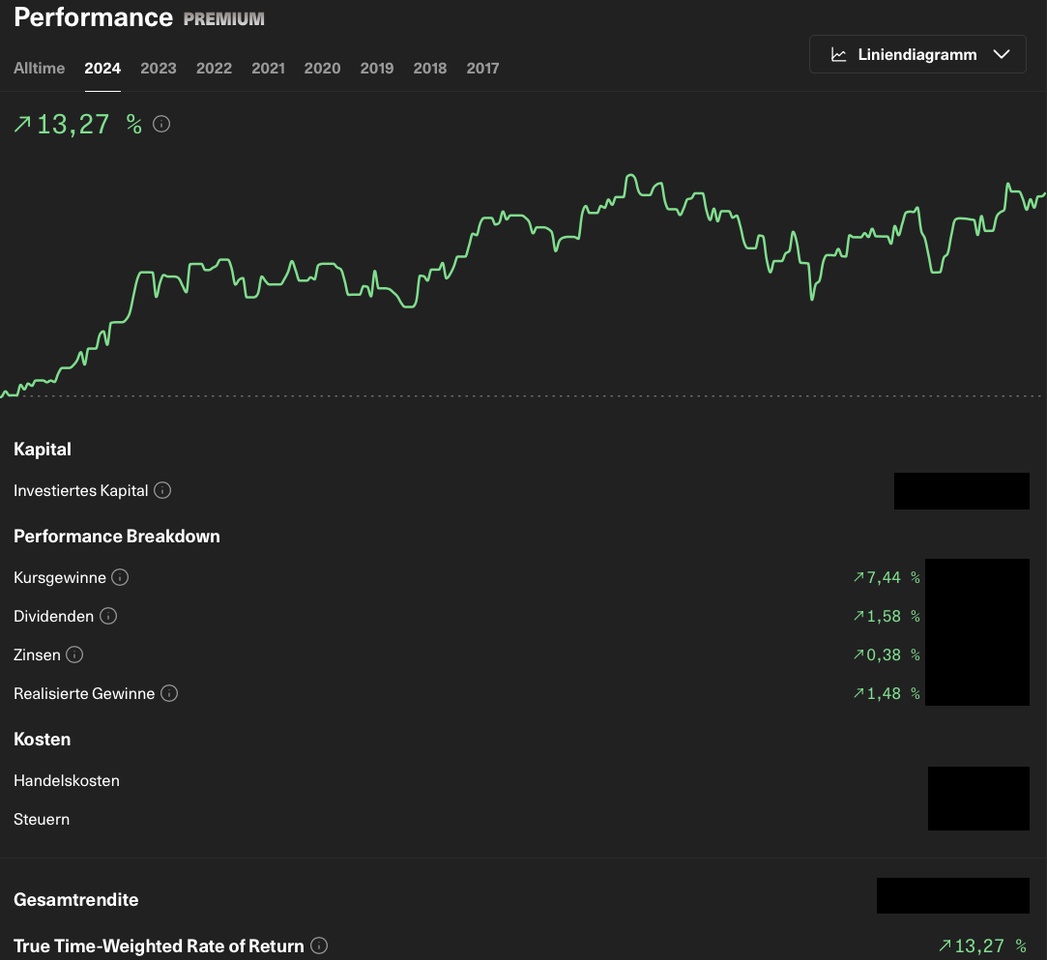

The MSCI World, measured in euros on the ETF $IWDA (-0,91 %)has so far had a YTD performance of +19.24% so far. My portfolio is at +13.27%. So far this year I have underperformed the MSCI World underperformed.

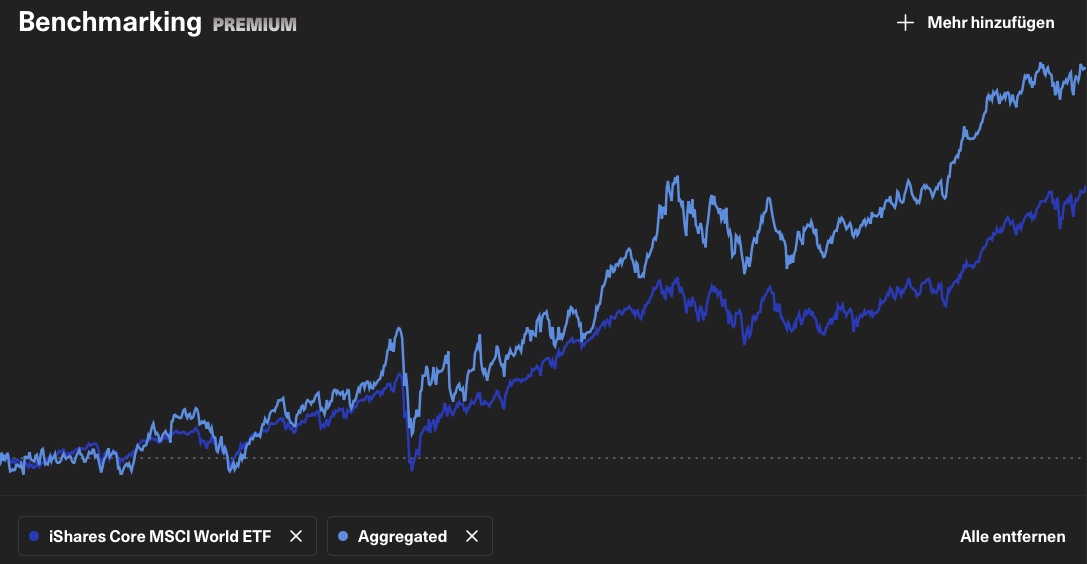

The overall picture since June 2017 looks better:

With a TTWROR performance of +177.47%, I am well ahead of the MSCI World with +121.17%. That is an average outperformance of +3.68% per year since June 2017.

An important note at this point: I do not adapt my strategy to current circumstances, but invest in high-quality companies - regardless of whether AI stocks are performing or whether oil stocks are the hot shit on the market. In this respect, phases of underperformance are normal and predictable.

UNDERPERFORMER

Time to take a look at the YTD underperformers.

Dino Polska $DNP (+4,53 %)

-14.5%

As I have only been invested here since March 2024, I have chosen the total return since purchase as performance. I expect a significantly better performance here in the long term. The position will be held and not increased or sold.

ASML $ASML (-0,16 %)

-6.6%

Also a fairly new position. In July 2024 I started to build up a larger position in several tranches. I expect a significantly better performance here in the longer term.

Alphabet $GOOGL (-0,79 %)

+3.8%

This is also a position that I only built up in August 2024. The plan is to continue to build up the position at this valuation level using a savings plan.

OUTPERFORMER

If you have a number of underperformers in your portfolio, there should ideally also be a few outperformers. My top 3 YTD outperformers are:

KLA Corp $KLAC (-1,7 %)

+38.3%

I established this position in April 2023 at a price of €336.80 per share. I have not bought or sold since then.

Costco $COST (+0,11 %)

+35.43%

I have been a shareholder in this outstanding company since September 2022. Since then, the position has been increased several times through acquisitions - most recently in May 2023 at a price of €455.45 per share.

Philip Morris $PM (+0,76 %)

+27.9%

This year has so far been a very good year for the "Big Tobacco" stocks. So I am not only pleased about the performance of $PM (+0,76 %) but also about $BATS (+0,38 %)which I also have in my portfolio. I invest continuously in both via a savings plan and enjoy regular dividends.

CONCLUSION

My top 3 underperformers are all stocks that I only bought this year and will hopefully perform better over time. The top 3 outperformers are all stocks that I have had in my portfolio for a long time and have performed very well overall since then. One "honorable mention" is also deserved $CMG (-3,2 %)which, with a YTD performance of +25.9%, just failed to make it into the top 3.

How are things looking for you this year?

Stay tuned,

Yours Nico Uhlig