After two extremely good stock market years, the year 2025 is under particular scrutiny.

- After two years with price increases of over 20%, can it go any higher?

- How will Trump affect the stock market? Liberal policies vs. tariffs?

- Inflation and interest rate trends - will the central banks continue to lower rates or will inflation return?

What will not change is my basic investment strategy. I will continue to invest in dividend growth stocks and buy them every month via a savings plan - regardless of other influences and developments.

Investment amount:

In my private life, building a house is a big issue. My monthly savings will therefore be significantly lower in 2025 than in previous years.

In the last few years, my savings sum was usually between €1,500 and €2,500.

I will now reduce this significantly to approx. 700€ per month.

The rest will go into a call money account to save money for additional costs, kitchen, furniture and so on.

However, I am absolutely aware that €500-700 is still a very high investment amount per month.

Around half (€250) already comes from dividend income, which I will reinvest.

Investment breakdown:

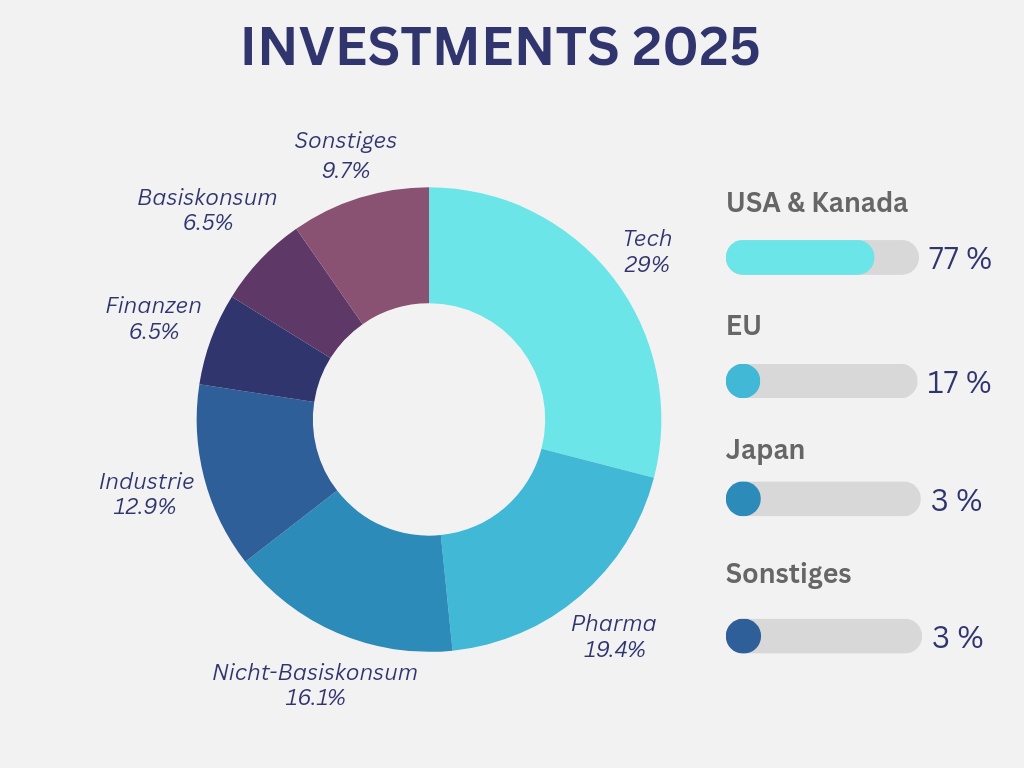

This year, the majority of my investments will again be in individual stocks with the following allocation:

I will continue to overweight the USA and underweight Europe (especially Germany).

My main focus will also remain on the technology and pharmaceutical sectors with almost 50%. This is where I continue to see the greatest growth in the long term - both for sales, profits and dividends.

There will be no changes to the savings plans for the time being. I will not be adding any new shares to my savings plan for the time being.

In addition, I will continue to invest the net savings from private health insurance compared to statutory health insurance in the WisdomTree Global Quality Dividend Growth

$GGRP (+0,49 %)

In total, that's around €90 per month + the one-off premium refund of over €2,000 for 2024.

The capital-forming benefits from my employer flow into an MSCI World

$XDWD (+0,41 %) with finvesto.

In addition, €100 goes into two crypto savings plans every month. 65 flows into Bitcoin

$BTC (-0,18 %) and €35 in Ethereum

$ETH (+1,17 %)

Dividend expectation:

For this year, I also expect around 15-20% more dividends than in 2024.

This would mean total dividends of €3,300-3,500 for 2025.

What is your investment strategy for 2025?