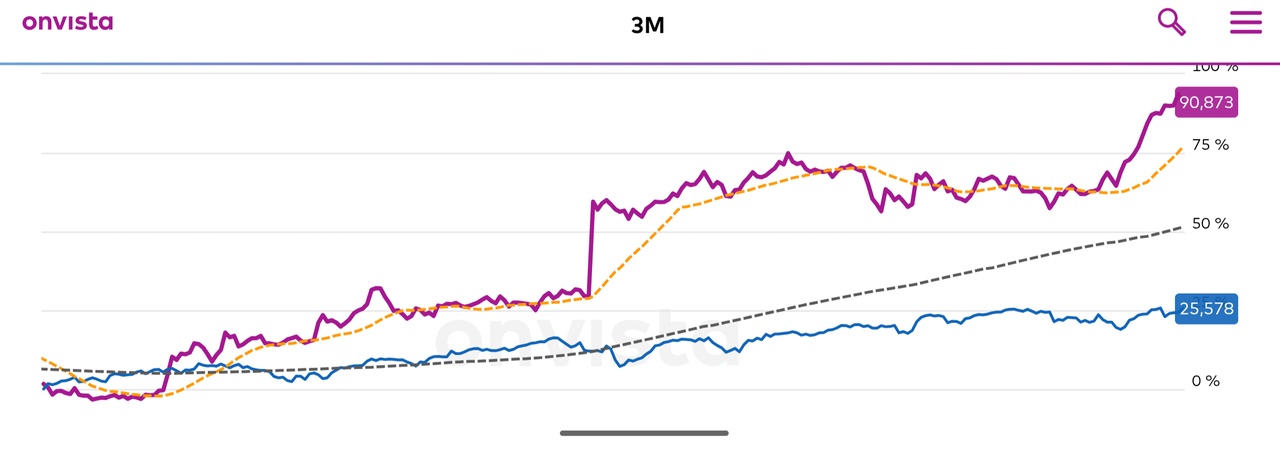

3 M or MMM has risen 90% in the last 12 months. Once a dividend favorite with 1000% price increases.

What happened?

Several lawsuits and restructurings halved the share price. After spin-offs and dividend cuts, the stock went quiet in 2023/2024.

Completely under the radar, 3M has outperformed every MSCi, S&P and Nasdaq reference in recent weeks and months.

I also pursued a dividend strategy with this stock many years ago. Even before there was GQ, I will soon be back at the EK.

What now?

What happens next?

But what do you learn from this?

No matter which strategy you follow: dividends, turnaround, ETF, high runner, recommendations from XY, the stock market is always a risk/opportunity in terms of profits/losses.

Let yourself be motivated, stay tough, look for a strategy, only after years will you realize the result

There is no right or wrong, not even a free ride with a positive return.

So long

Smudo