Strong earnings from the $BAM (+1,18 %)

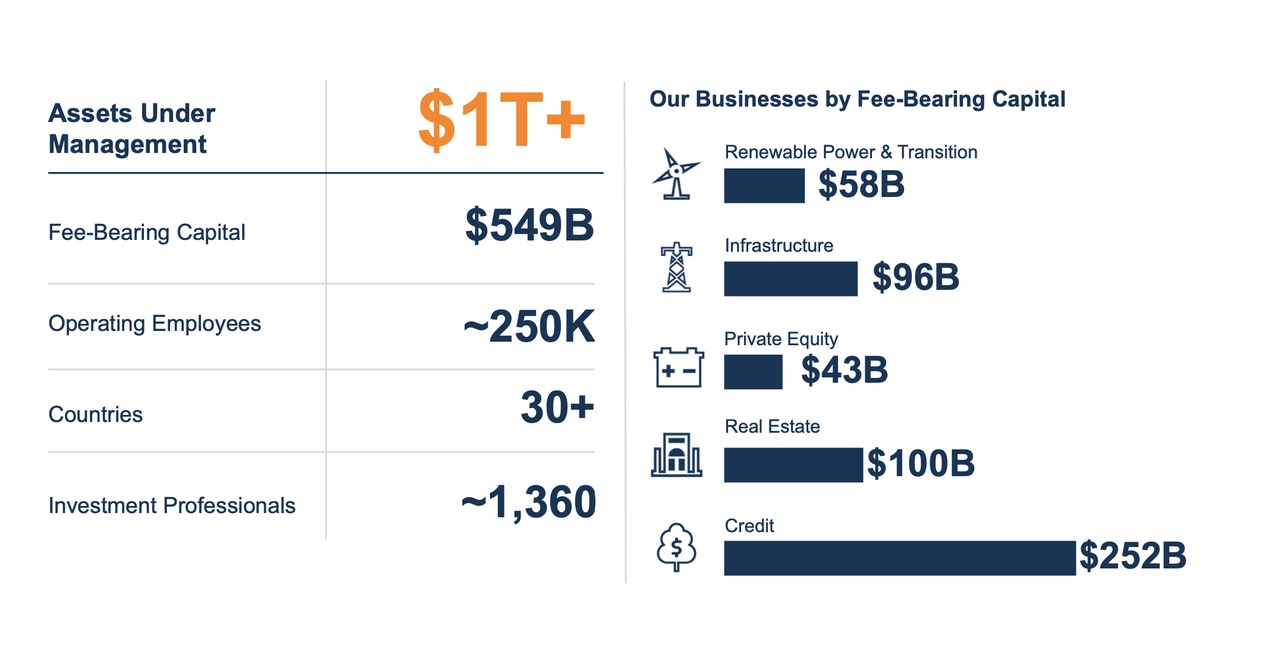

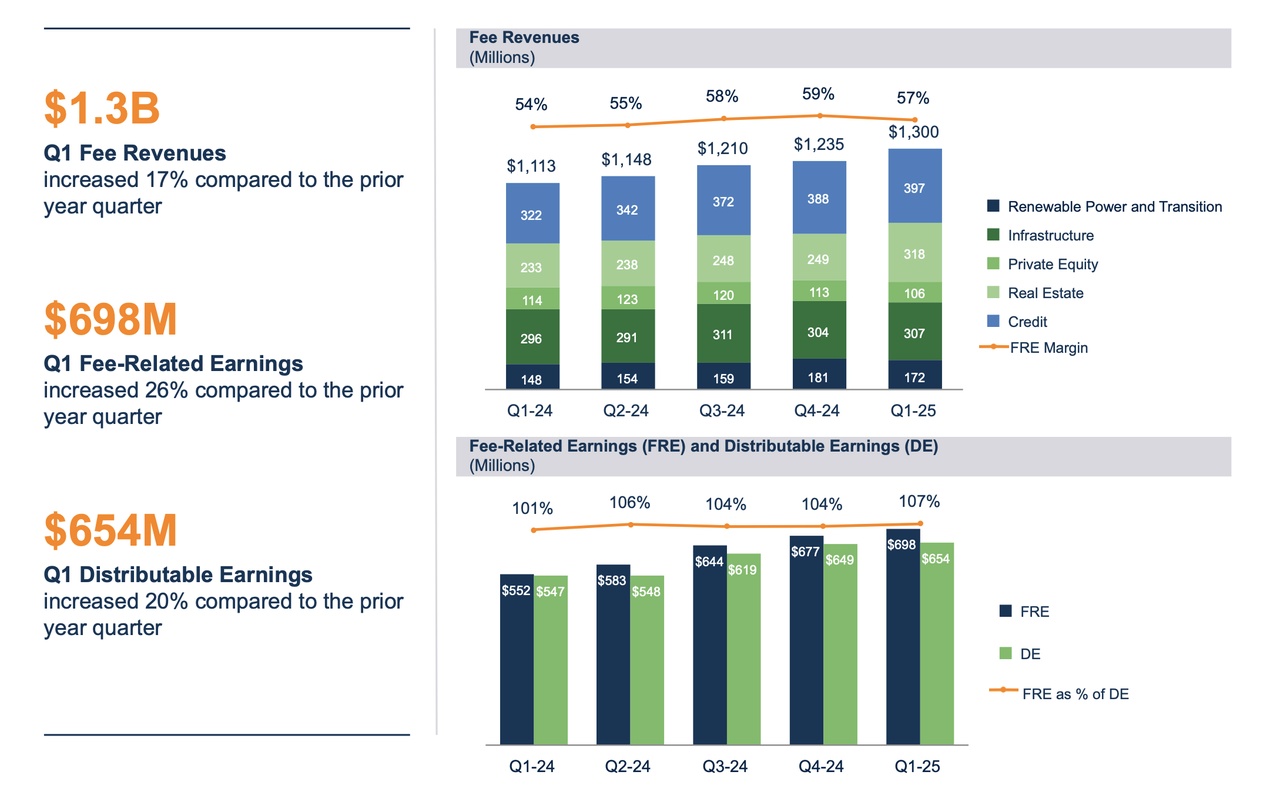

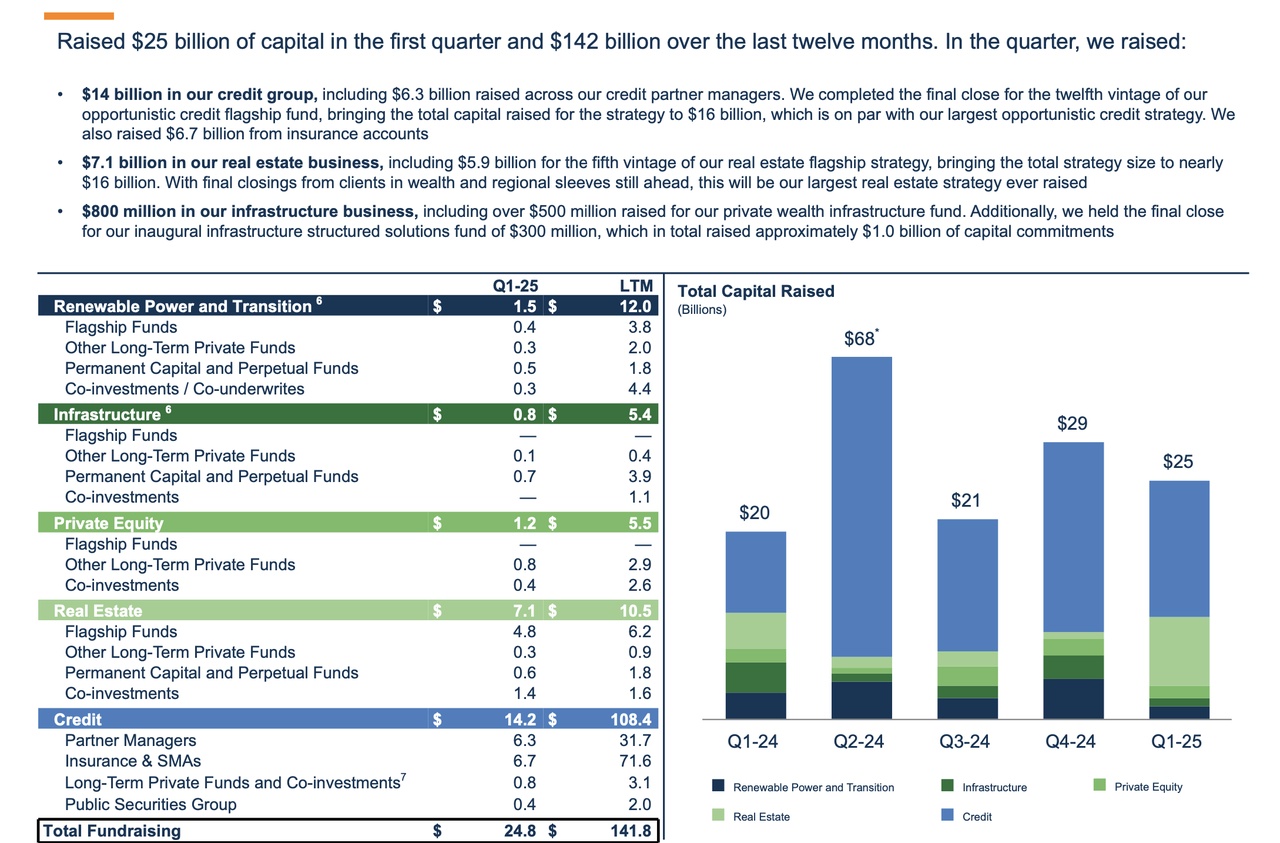

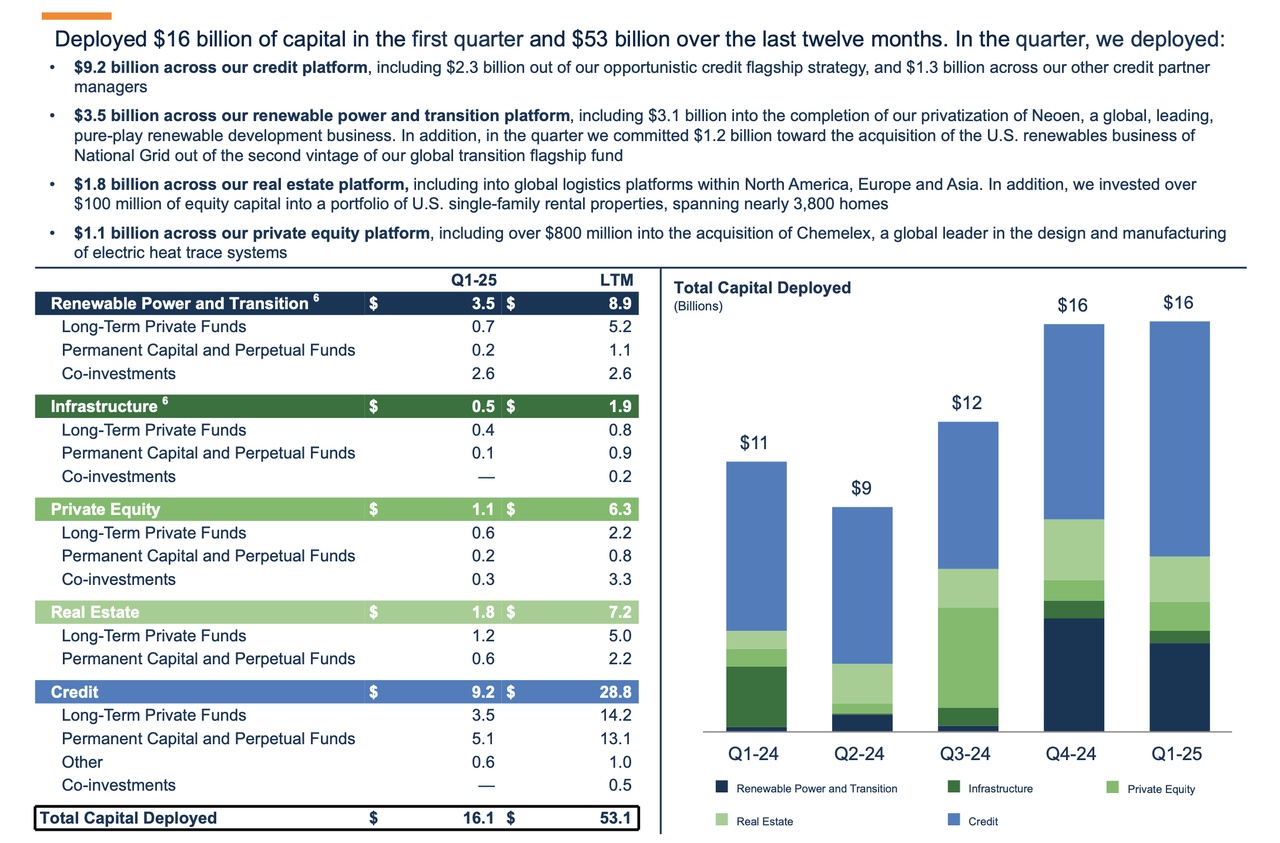

Brookfield Asset Management delivered strong results in Q1 2025 with record FRE of USD 698 million (+26%) and DE of USD 654 million (+20%). Fee-bearing capital grew by 20% to USD 549 billion, driven by USD 25 billion in new capital raised and USD 16.1 billion in investments. The credit and real estate segments were particularly strong, while renewable energy shone through large transactions such as NeOen. BAM's focus on long-term, stable revenues (87% of fee-bearing capital) and its strategic positioning in growth sectors such as decarbonization and digitalization underpin the potential for further growth. The robust liquidity and optimistic market outlook position BAM well for 2025.

1. financial results

Distributable Earnings (DE):

- In the first quarter of 2024, BAM achieved a distributable earnings of USD 552 millionan increase of 7 % compared to USD 515 million in Q1 2023. This corresponds to USD 0.38 per sharecompared to USD 0.35 in the previous year.

- The increase is due to higher fee-related income and improved carry income (performance-based income from funds).

- DE is a key indicator for BAM as it reflects the funds available for dividends, share buybacks and reinvestments.

Net income:

- The net profit amounted to USD 102 milliona decrease from USD 125 million in Q1 2023, due to one-time write-downs in certain real estate portfolios driven by challenging market conditions in the commercial real estate sector.

- Despite the decline, net income remains solid as BAM continues to benefit from diversified revenue streams.

Fee income:

- The fee-related income increased by 9 % to USD 459 millioncompared to USD 421 million in the previous year. This growth resulted from the increase in assets under management and new funds that generate management fees.

- The average fee basis (fee-bearing capital) grew by 10 % to USD 475 billion, underlining the scalability of BAM's business model.

Carry revenue:

- The realized carried interest-income (share of fund profits) amounted to USD 93 millionan increase from USD 85 million in Q1 2023, reflecting successful exits in private equity and infrastructure investments.

- Unbooked (unrealized) carried interest was USD 2.1 billion, signaling strong potential for future returns as funds are liquidated

Assets under management (AUM):

- The total assets under management exceeded the mark of 1 trillion USDan increase of 14 % compared to USD 880 billion in Q1 2023.

- This growth was supported by organic inflows, positive market developments and strategic acquisitions, particularly in the infrastructure and renewable energy sectors.

Capital raising:

- BAM raised in Q1 2024 USD 30 billion in new capital, of which:

- USD 15 billion for a new global real estate fund (Brookfield Strategic Real Estate Partners V).

- USD 10 billion for renewable energy and decarbonization funds.

- USD 5 billion for private equity and infrastructure funds.

- The strong fundraising underlines the confidence of institutional investors (e.g. pension funds, sovereign wealth funds) in BAM's expertise in alternative investments.

Dividend:

- BAM declared a quarterly dividend of USD 0.38 per sharepayable on June 28, 2024, representing an annualized dividend of USD 1.52 per share.

- The dividend was increased by 19 % compared to the previous year,

2. operational highlights

Demand for alternative investments:

- Demand for alternative investments (real estate, infrastructure, renewable energy, private equity, credit) remains robust, despite macroeconomic uncertainties such as inflation and geopolitical tensions.

- BAM benefits from its leading position in these sectors as institutional investors increasingly invest in real assets to achieve inflation protection and stable returns.

Segment results:

- Real EstateDespite challenges in the commercial real estate sector (e.g. office properties due to remote work), the real estate business remains a core pillar. The new real estate fund attracted USD 15 billion in capital due to the attractiveness of logistics and residential real estate.

- InfrastructureInfrastructure business grew strongly, supported by investments in digital infrastructure (e.g. data centers) and transportation. AUM in the infrastructure segment increased by 12%.

- Renewable energiesRenewable energy and decarbonization saw an inflow of USD 10 billion, driven by the global energy transition and investments in wind, solar and hydrogen projects.

- Private equity: Strong exits in this segment contributed to higher carried interest income. BAM focuses on technology-driven companies and SMEs.

- Credit: The lending business expanded as BAM increasingly provides debt capital for real estate and infrastructure projects, which generates stable margins.

Strategic initiatives:

- BAM launched several new funds, including:

- A global real estate fund with a target volume of USD 20 billion.

- A renewable energy fund with a focus on decarbonization.

- A private equity fund targeting technology and healthcare companies.

- The company entered into a strategic partnership with a leading pension fund to invest USD 5 billion in infrastructure projects.

- BAM is strengthening its presence in Asia, particularly in India and Southeast Asia, where demand for infrastructure and real estate is growing.

Market and economic outlook:

- Management is optimistic for the remainder of 2024 as interest rates become more stable in most markets and capital markets gain momentum.

- BAM expects the energy transition and the need for digital infrastructure (e.g. 5G, AI data centers) to continue to drive growth in the coming years.

- Challenges such as geopolitical uncertainties and inflationary pressures will be closely monitored, but BAM's diversified portfolio offers resilience.

3. commentary from management

- Bruce Flatt, CEO of BAMemphasized: "Our record first quarter results reflect the strength of our global business model and the continued demand for real assets. With over USD 1 trillion in assets under management and robust capital raising, we are well positioned to deliver further growth."

- Flatt emphasized that the new funds and strategic partnerships underscore BAM's ability to add value in a complex market environment.

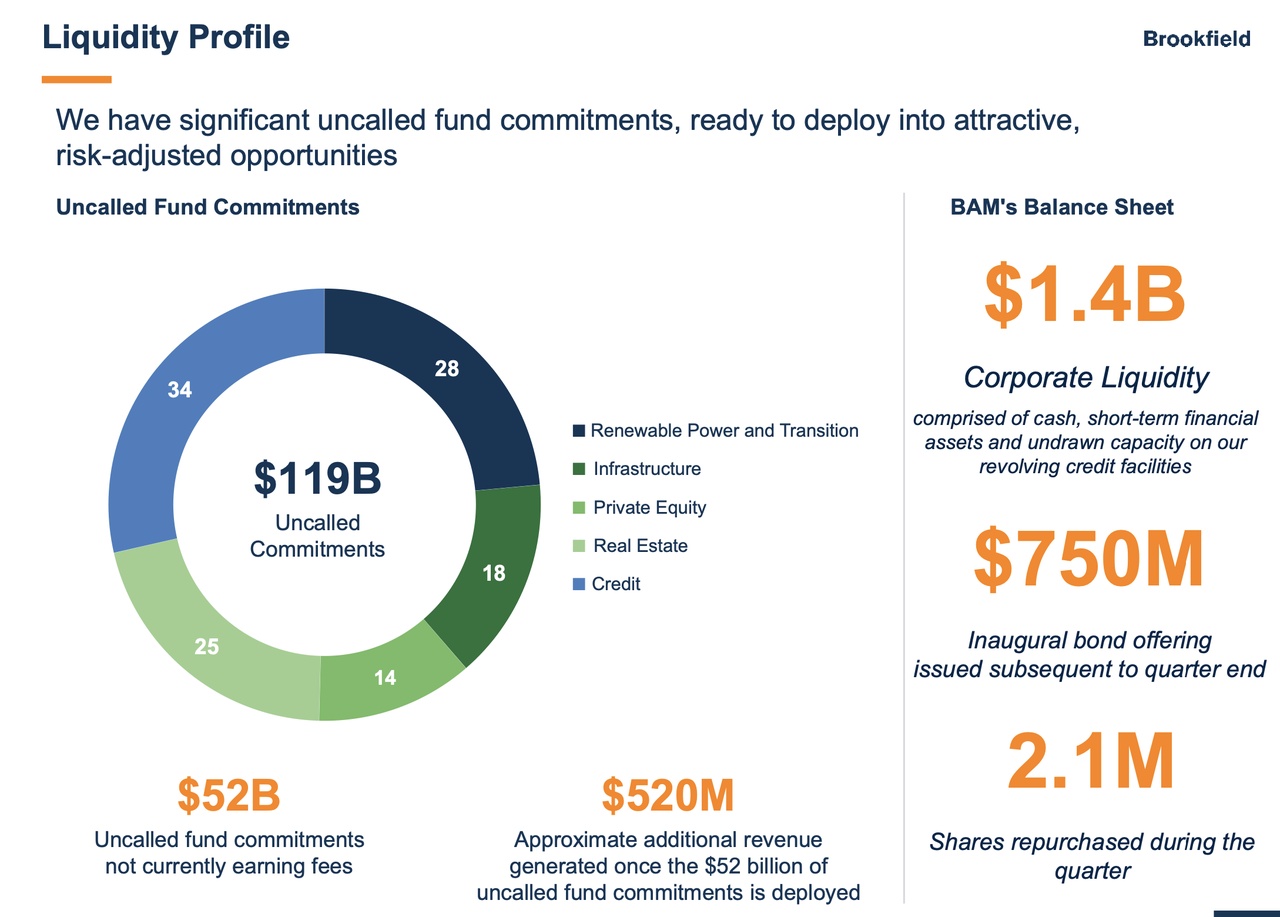

4. financial stability and liquidity

- BAM has a solid balance sheet with liquidity of USD 10 billionincluding cash and unutilized credit facilities.

- Debt remains moderate, with a debt-to-AUM ratio below 20%, providing financial flexibility for new investments.

- In Q1, the company carried out a share buyback of USD 50 million in Q1 to increase shareholder value.