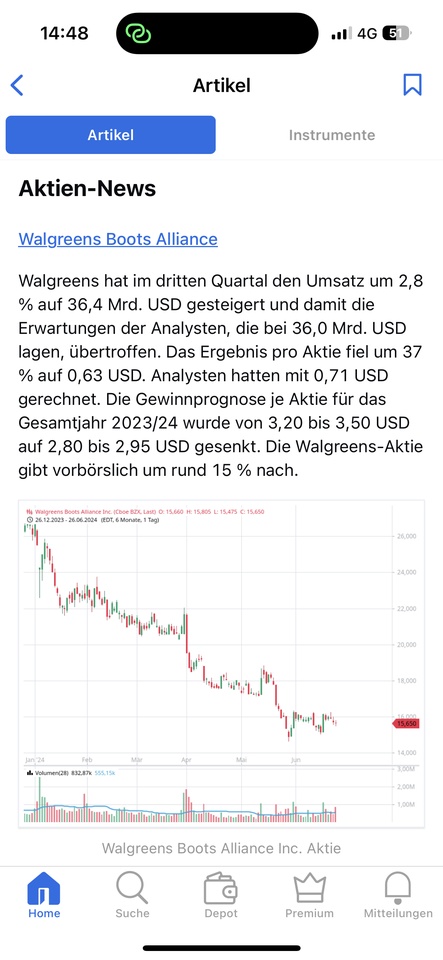

$WBA (-1,4 %) | Walgreens Boots Alliance Q4'24 Earnings Highlights:

🔹 Adj EPS: $0.39 (Est. $0.36) 🟢; DOWN 41% YoY

🔹 Revenue: $37.55B (Est. $35.75B) 🟢; UP 6% YoY

🔹 Targeting ~1,200 Store Closures Over Next 3 Years

FY'25 Guidance:

🔹 Adjusted EPS: $1.40 - $1.80 (Est. $1.73)😕

🔹 Fiscal 2025 Revenue: $147B - $151B (Est. $146.9B) 🟢

🔹 Adjusted Operating Income: $1.6B - $2.0B

Q4 Segment Performance:

U.S. Retail Pharmacy:

🔸 Sales: $29.47B (Est. $27.48B) 🟢; UP 6.5% YoY

🔸 Comparable Pharmacy Sales: UP 11.7%

🔸 Comparable Retail Sales: DOWN 1.7%

🔸 Adjusted Operating Income: $220M; DOWN 60.4% YoY

International:

🔸 Sales: $5.97B (Est. $5.84B) 🟢; UP 3.2% YoY

🔸 Boots UK Comparable Pharmacy Sales: UP 10%

🔸 Boots UK Comparable Retail Sales: UP 6.2%

🔸 Adjusted Operating Income: $231M; DOWN 10.9% YoY

U.S. Healthcare:

🔸 Sales: $2.11B (Est. $2.15B) 🔴; UP 7.1% YoY

🔸 Adjusted Operating Income: $17M (improved from a loss of $83M YoY)

🔸 Adj EBITDA: $65M (improved by $94M YoY)

Strategic Actions:

🔸 Store Closures: Announced a footprint optimization program targeting approximately 1,200 store closures over the next three years, including about 500 closures in fiscal 2025. The closures are expected to be immediately accretive to adjusted EPS and free cash flow.

Other Q4 Metrics:

🔹 Adj Operating Income: $424M; DOWN 38% YoY

🔹 Adj Gross Margin: 16.9% (Est. 17.6%); DOWN from 18.6% YoY

Operational Highlights:

🔸 Cost Savings: Exceeded fiscal 2024 targets for $1B in cost savings, $600M reduction in capital expenditures, and $500M in working capital initiatives.

🔸 Free Cash Flow: $1.1B in Q4; increased by $537M YoY.

🔸 Net Debt Reduction: Fiscal 2024 net debt reduced by $1.9B; lease obligations reduced by $1.2B.

🔸 U.S. Healthcare Segment: Adjusted EBITDA improved to $65M, driven by cost discipline at VillageMD and growth from Shields.