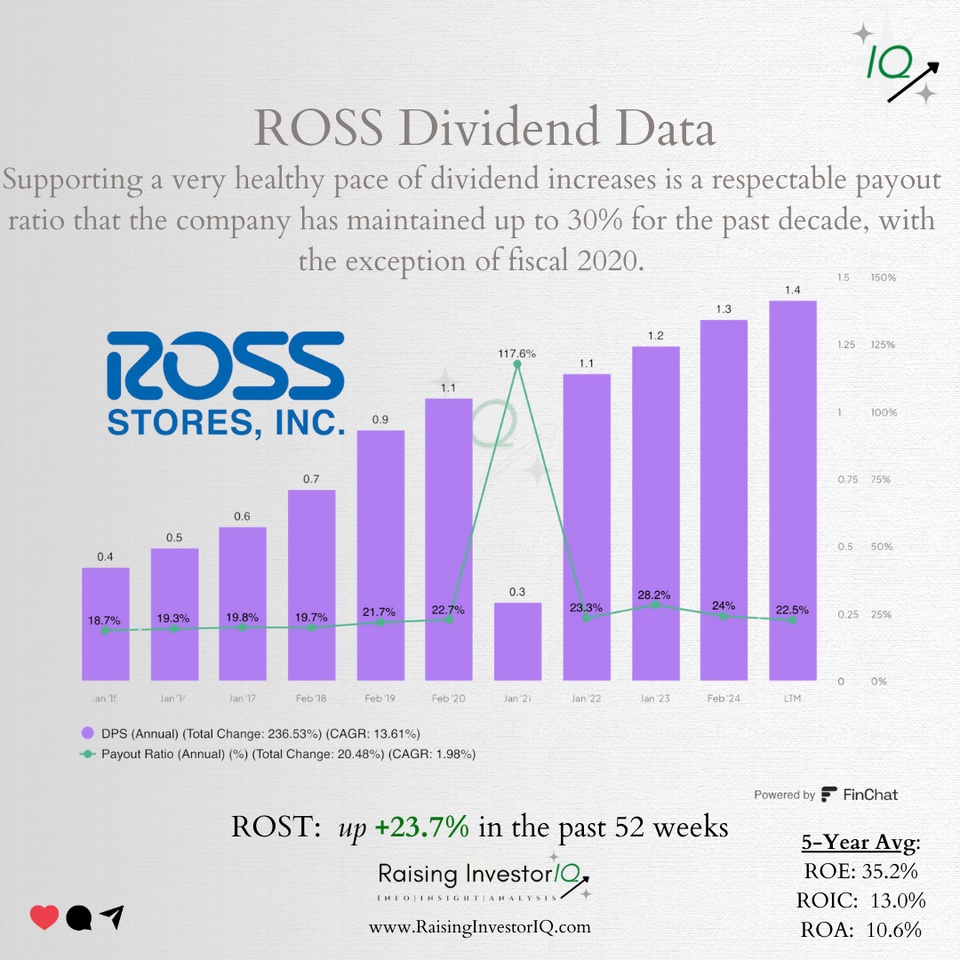

$ROST (+0,91 %) Ross consistently uses its operating cash flows (OCF) to reinvest in the business, pay rising dividends, and repurchase shares.

Ross Stores Action Forum

ActionActionDiscussion sur ROST

Postes

7The upcoming week summarized:

Monday

- Publication of the quarterly reports of GitLab ($GTLB (+2,73 %) )

- Speech by Philadelphia Fed President Tom Harker

Tuesday

- Release of factory orders (January) and the ISM Services PMI (February)

- Super Tuesday pre-elections in 16 states

- Quarterly reports from CrowdStrike ($CRWD (+0,55 %) ), Target Corp ($TGT (-0,48 %) ), Ross Stores ($ROST (+0,91 %) ) and Nordstrom ($JWN (-0,33 %) )

Wednesday

- Release of the ADP Employment Report (February)

- Statements from Fed Chair Jerome Powell before the House of Representatives

- Publication of wholesale inventories (January), job vacancies (January) and the Federal Reserve Beige Book

- Speeches from San Francisco Fed President Mary C. Daly and Minneapolis Fed President Neel Kashkari

- Quarterly reports from Campbell Soup ($CPB (+2,27 %) ) and Abercrombie & Fitch ($ANF (+2,85 %) )

Thursday

- Statements by Fed Chair Jerome Powell before the Senate

- State of the Union Speech

- Publication of initial applications for unemployment benefits (March 2), productivity (revisions to the fourth quarter) and the trade balance

- Speech by Cleveland Fed President Loretta Mester

- Quarterly reports from Broadcom ($AVGO (+1,15 %) ), Costco Wholesale Corp ($COST (+3,88 %) ), Kroger Company ($KR (+1,61 %) ), Marvell Technology ($MRVL (+0,81 %) ) and Victoria's Secret ($VSCO (-1,72 %) )

Friday

- Release of the USlabor market report (February)

- Speech by New York Fed President John C. Williams

Outlook for next week.

Monday

- Mizuho Financial Group ($MFG (+0 %) ), XP Inc. ($XP (-1,8 %) ), Sun Life Financial (SLF), Tyson Foods ($TSN (+2,26 %) ) and AECOM ($ACM (+0,49 %) ) present their quarterly reports are presented.

- Publication of the New York Fed Consumer Inflation Expectations (October).

Tuesday

- The Home Depot ($HD (+2,38 %) ), Sumitomo Mitsui Financial Group ($8316 (+1,1 %) ), Mitsubishi Financial Group ($8306 (-1,07 %) ), Nu Holdings ($NU (+0,57 %) ), Sea Limited ($SE (-1,24 %) ) and Tencent Music Entertainment Group ($TME (-2,74 %) ) report their quarterly results.

- Publication of the NFIB Small Business Optimism Index (October) and the Consumer Price Index (CPI) (October).

Wednesday

- Cisco Systems ($CSCO (+0,48 %) ), TJX Companies ($TJX (+1,65 %) ), Palo Alto Networks ($PANW (+1,75 %) ), Target ($TGT (-0,48 %) ), JD.com ($JD. (-2,66 %) ), XPeng ($XPEV (+2,66 %) ), Catalent ($CTLT (+0 %) ) and Tetra Tech ($TTEK (-0,46 %) ) present their quarterly figures.

- Publication of the Producer Price Index

(PPI) (October), the New York Fed Empire State Manufacturing Index (November), the Business Inventories (September) and the Retail Sales (October).

Thursday

- Walmart ($WMT (+1,81 %) ), Alibaba Group ($BABA (-5,18 %) ), Applied Materials Inc. ($AMAT (-0,37 %) ), NetEase Inc. ($NTES (-4,65 %) ), Ross Stores ($ROST (+0,91 %) ), Warner Music Group ($WMG (+1,14 %) ), NICE Ltd. ($NICE (+0,02 %) ), Bath & Body Works ($BBWI (-4,3 %) ), The Gap Inc. ($GPS (-0,15 %) ), Macy's ($M (-3,93 %) ) and Spire Inc. ($SR (+1,27 %) ) present their quarterly reports.

- Publication of the Industrial Production (October) and the National Association of Home Builders Housing Market Index (November).

Friday

- BJ's Wholesale Club ($BJ (+2,42 %) ), Atkore Inc. ($ATKR (-6,47 %) ) and Spectrum Brands Holdings ($SPB (+1,77 %) ) present their quarterly figures.

- Deadline for funding of the US government.

- Publication of the Housing Starts (October).

𝗴𝗲𝘁𝗾𝘂𝗶𝗻 𝗗𝗮𝗶𝗹𝘆 𝗦𝘂𝗺𝗺𝗮𝗿𝘆 𝟮𝟬.𝟬𝟱.𝟮𝟬𝟮𝟮

Hello getquin,

Mercedes sold for 135 million? Of course only 𝐞𝐢𝐧 rare car! Switzerland signs deal with Pfizer for drug Paxlovid and Asia cuts interest rates. Have a great Friday and a great weekend!

𝗗𝗲𝘂𝘁𝘀𝗰𝗵𝗹𝗮𝗻𝗱🇩🇪:

1. 1955𝘦𝘳 𝘔𝘦𝘳𝘤𝘦𝘥𝘦𝘴 𝘻𝘶 𝘙𝘦𝘬𝘰𝘳𝘥𝘱𝘳𝘦𝘪𝘴 𝘷𝘦𝘳𝘬𝘢𝘶𝘧𝘵

A rare Mercedes-Benz $MBG (-3,33 %) race car was sold earlier this month for $143 million (135 million euros). This is the most expensive car sale ever, surpassing the previous record, which was less than $100 million. The 1955 Mercedes-Benz 300 SLR Uhlenhaut Coupe was sold at a secret and highly unusual auction at the Mercedes-Benz Museum in Stuttgart, Germany.

🟩 $MBG (-3,33 %) Mercedes AG (🔼+10.32%)

Click here to go to the car: https://cnb.cx/3G3xEhQ

𝗘𝘂𝗿𝗼𝗽𝗮🌍:

2. 𝘋𝘪𝘦 𝘚𝘤𝘩𝘸𝘦𝘪𝘻 𝘬𝘢𝘶𝘧𝘵 𝘥𝘢𝘴 𝘢𝘯𝘵𝘪𝘷𝘪𝘳𝘢𝘭𝘦 𝘔𝘦𝘥𝘪𝘬𝘢𝘮𝘦𝘯𝘵 𝘗𝘢𝘹𝘭𝘰𝘷𝘪𝘥 𝘷𝘰𝘯 𝘗𝘧𝘪𝘻𝘦𝘳

Switzerland has signed an agreement to purchase Pfizer's antiviral drug paxlovide $PFE (-1,75 %) for the treatment of covid-19. The contract for the European country covers 12,000 packs, with the first treatments for certain high-risk patients starting this month.

🟩 $PFE (-1,75 %) Pfizer Inc (🔼+3.57%)

The details of the deal are available here: https://reut.rs/3NwvBpn

𝗔𝘀𝗶𝗲𝗻🌏:

3rd 𝘎𝘳öß𝘵𝘦 𝘡𝘪𝘯𝘴𝘴𝘦𝘯𝘬𝘶𝘯𝘨 𝘴𝘦𝘪𝘵 2019 𝘊𝘩𝘪𝘯𝘢

In Germany, rising construction rates are making real estate loans more expensive, but in China, the opposite is true. Beijing's central bank brought good cheer to global markets with its interest rate decision on Friday. It cut the interest rate on five-year loans by a more-than-expected 15 basis points to 4.45 percent, the biggest cut since 2019. The rate applies to mortgages in China's second-largest economy and is intended to help the country's flagging real estate sector.

🟩 $CHIR Global X MSCI China Real Estate ETF (🔼+0.33%)

Construction boom in China? https://bit.ly/3aecKRw

𝗦𝘁𝗼𝗰𝗸𝘀 𝗼𝗳 𝘁𝗵𝗲 𝗱𝗮𝘆:

🟩 TOP, $PANW (+1,75 %) Palo Alto Networks (🔼+10.19%).

🟥 FLOP, $ROST (+0,91 %) Ross Stores Inc (🔽-21.58%)

🟩 Most searched, $AAPL (+0,65 %) Apple Inc (🔼+0.80%)

🟩 Most traded, $AAPL (+0,65 %) Apple Inc (🔼+0.80%)

🟩 S&P500 (🔼+0.26%)

🟩 DAX 13,866.66 (🔼+1.19%)

🟥 $BTC (+0,68 %) Bitcoin ₿, $29,756.30 (🔽-1.71%)

Time: 16:45 CEST

Did you know that banks in the US could print their own money until 1908?

𝗴𝗲𝘁𝗾𝘂𝗶𝗻 𝗗𝗮𝗶𝗹𝘆 𝗦𝘂𝗺𝗺𝗮𝗿𝘆 𝟮𝟬.𝟬𝟱.𝟮𝟬𝟮𝟮

Hello getquin!

More green today, and it’s the weekend, so I guess that’s a reason to smile :) (even if you can't afford a $143 million car...)

𝗚𝗲𝗿𝗺𝗮𝗻𝘆🇩🇪:

1. 1955 Mercedes sold at a record price

An ultra-rare Mercedes-Benz $MBG (-3,33 %) race car sold for $143 million (135 million euros) earlier this month. This is the most expensive car sale of all time, smashing the previous record which was less than 100 million dollars. The 1955 Mercedes-Benz 300 SLR Uhlenhaut Coupe was sold at a secretive and highly unusual auction at the Mercedes-Benz Museum in Stuttgart, Germany.

🟩 $MBG (-3,33 %) Mercedes AG (🔼+0.32%)

ARTICLE: https://cnb.cx/3G3xEhQ

𝗘𝘂𝗿𝗼𝗽𝗲 🌍:

2. Switzerland buys Pfizer antiviral Paxlovid

Switzerland has signed a contract to buy Pfizer’s $PFE (-1,75 %) anti-viral drug, Paxlovid, to treat Covid-19. The European country’s contract is for 12,000 packages, with first treatments for certain at-risk patients starting this month.

🟩 $PFE (-1,75 %) Pfizer Inc (🔼+3.57%)

ARTICLE: https://reut.rs/3NwvBpn

𝗔𝘀𝗶𝗮🌏:

3. Largest rate decrease since 2019

In Germany, rising construction interest rates are making real estate loans more expensive, but in China, the opposite is true. With its interest rate decision on Friday, the Chinese central bank (PBOC), it dropped the interest rate on five-year loans (LPR) by a larger-than-expected 15 basis points to 4.45 percent, the largest reduction since 2019, aiming to help the country's faltering real estate sector.

🟩 $CHIR Global X MSCI China Real Estate ETF (🔼+0.33%)

ARTICLE: https://bit.ly/3aecKRw

𝗦𝘁𝗼𝗰𝗸𝘀 𝗼𝗳 𝘁𝗵𝗲 𝗱𝗮𝘆🔔:

🟩 TOP, $PANW (+1,75 %) Palo Alto Networks (🔼+10.19%)

🟥 FLOP, $ROST (+0,91 %) Ross Stores Inc (🔽-21.58%)

🟩 Most searched, $AAPL (+0,65 %) Apple Inc (🔼+0.80%)

🟩 Most traded, $AAPL (+0,65 %) Apple Inc (🔼+0.80%)

🟩 S&P500 (🔼+0.26%)

🟩 DAX 13.866,66 (🔼+1.19%)

🟥 $BTC (+0,68 %) Bitcoin ₿, $29,756.30 (🔽-1.71%)

Time: 16:45 CEST

Did you know that banks in the USA could print their own money until 1908?

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗪𝗼𝗿𝗹𝗱 𝗼𝗳 𝗧𝗮𝗻𝗸𝘀 / 𝗘𝘃𝗲𝗿𝗴𝗿𝗮𝗻𝗱𝗲 𝘀𝗰𝗵𝘄𝗮𝗻𝗸𝘁 / 𝗦𝗽𝗶𝗲𝗹𝗲𝗻 𝗶𝗻 𝗱𝗲𝗿 𝗦𝗮𝗻𝗱𝗯𝗼𝘅

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, among others, BlackRock ($BLK), Cigna Corporation ($CI (+0,99 %)) and Ross Stores ($ROST (+0,91 %)) are trading ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, among others, mongoDB ($MDB (-1,61 %)), GitLab ($GTLB (+2,73 %) ) and Coupa Software ($COUP) present their figures.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

Defense Industry - In times of Corona when the global economy has contracted, defense corporations remain positive and are seeing growing sales. In 2020, the top 100 corporations reported rising sales for the sixth consecutive year. Forty-one of these companies are from the U.S. and had sales of $285 billion in 2020. This puts the U.S. at the top of the defense industry, followed by China and the UK.

Evergrande ($3333) - A payment of $82.5 million is due today after a 30-day extension. The real estate group already acknowledged that there may not be enough funds to service this liability.

Chinese real estate company Sunshine 100 China Holdings is also under pressure and had to let a $170 million payment lapse yesterday.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

Virtual land in the metaverse dominated NFT sales last week. Demand for digital land surpassed all other items as well as art and other collections. More than $300 million in NFT sales were generated last week, with nearly a quarter of that coming from digital land in The Sandbox ($S (+0 %)AND) Metaverse.

Follow us for french content on @MarketNewsUpdateFR

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗖𝗵𝗶𝗽-𝗔𝘂𝗳𝘀𝗰𝗵𝘄𝘂𝗻𝗴 / 𝗦𝘁𝗮𝗵𝗹𝗵𝗮𝗿𝘁𝗲𝘀 𝗕𝘂𝘀𝗶𝗻𝗲𝘀𝘀 / 𝗛𝗼𝗱𝗹 / 𝗣𝗲𝗿𝘂'𝘀 𝗖𝗕𝗗𝗖

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, among others, 3M ($MMM (+1,14 %)), Cognizant ($COZ (-0,54 %)), Cummins ($CUM (+1,28 %)), Ford ($FMC1 (+0,87 %)), GlaxoSmithKline ($GS7), Hershey Company ($HSY (+1,79 %)), L3Harris Technologies ($HRS (+3,12 %)), Microchip Technology ($MCP (-1 %)), Otis Elevator Company ($4PG (+0,17 %)), Raytheon Technologies ($5UR (+3,63 %)), Sherwin-Williams ($SJ3 (+1,26 %)) and Tyco Electronics ($TY1C) traded ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, among others, Alibaba Group ($2RR (-5,04 %)), Applied Materials ($AP2 (-0,37 %)), Farfetch ($F1F), Full Truck Alliance Co ($YMM (-3,01 %)), Globant ($GLOB (-0,37 %)), Intuit ($ITU (+2,04 %)), JD.com ($013A (-6,23 %)), National Grid ($NNGF (-0,42 %)), Nuance Communications ($SC2), Palo Alto Networks ($5AP (+1,75 %)), Ross Stores ($RSO (+0,91 %)), Williams-Sonoma ($WM1 (-2,32 %)) and Workday ($W7D (+0,04 %)) presented their figures.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

Nvidia ($NVD (-0,03 %)) - In after-hours trading yesterday, NVIDIA shares were able to make strong gains, driven by high demand for chips for data centers and computer games. In the past quarter, NVIDIA reported an 84 percent increase in profits to $2.46 billion. Among other applications, NVIDIA's technology is used for artificial intelligence applications, graphics cards and data center chips. NVIDIA is considering plans to buy British chip designer Arm, whose technology is in almost all smartphones, despite concerns from competition authorities. Based on Arm's chip architecture, companies including Apple ($APC (+0,65 %)), Samsung ($SSUN (+0,89 %)) and Qualcomm ($QCI (-0,3 %)) design their own processors for mobile devices.

thyssenkrupp ($TKA (-3,23 %)) - Steel group thyssenkrupp beat expectations for the past fiscal year 2020/21 (ending September) with significant growth and benefited from the economic recovery. Adjusted earnings before interest and taxes came to 769 million euros. However, shareholders will again have to do without a dividend this year. The Group expects mid-single-digit percentage growth and around a doubling of adjusted EBIT to between 1.5 and 1.8 billion euros and net income of at least 1 billion euros for the recently launched new fiscal year.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

Bitcoin ($BTC-EUR (+0,68 %)) - Recent data shows that bitcoin holders who bought for $20,000 are refusing to sell BTC at all-time highs. Despite tempting triple gains, last November's buyers are determined to continue with the "hodl" strategy. BTC buyers hold their nerve and hold their coins despite various all-time highs.

Peru - The president of Peru's central bank (Julio Velarde) has announced that the country is working with India, Singapore and Hong Kong to develop a central bank digital currency (CBDC). According to the Atlantic Council, 87 countries (accounting for more than 90% of global GDP) are currently researching a CBDC, and seven have already launched their own. By comparison, only 35 countries have considered developing a CBDC in the 2020 mail.

Follow us for french content on @MarketNewsUpdateFR

Titres populaires

Meilleurs créateurs cette semaine