Earnings next week 🚀

ON Semiconductor Action Forum

ActionActionDiscussion sur ON

Postes

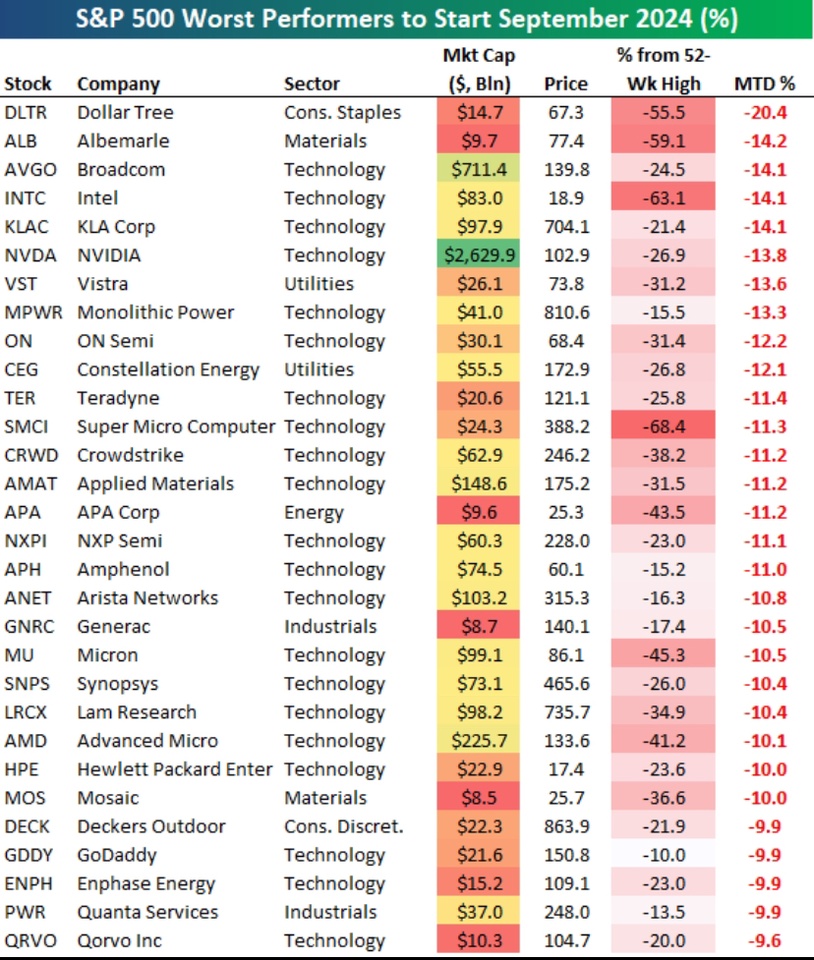

8Semiconductor shares since their 52-week highs

-61% Intel $INTC (+0,53 %)

-54% Aixtron $AIXA (-2,14 %)

-45% STMicroelectronics $STMPA (-1,72 %)

-44% Micron Technology $MU (-0,29 %)

-37% Globalfoundries $GFS (-2,07 %)

-36% BE Semiconductor $OXVE

-33% Lam Research $LRCX

-29% AMD $AMD (-0,12 %)

-29% Qualcomm $QCOM (-0,3 %)

-28% ON Semiconductor $ON (-1,56 %)

-27% ASML $ASML (-0,38 %)

-26% Applied Materials $AMAT (-0,37 %)

-26% Elmos Semiconductor $ELG (-0,47 %)

-24% Microchip Techn. $MCHP (-1 %)

-23% ARM $ARM (-1,08 %)

-23% Synopsys $SNPS (-2,03 %)

-23% Infineon $IFX (-0,83 %)

-22% NXP Semiconductors $NXPI (-0,46 %)

-20% Cadence Design $CDNS (+0,45 %)

-17% Nvidia $NVDA (-0,03 %)

-17% VanEck Semicon. ETF $IE00BMC38736 (+0,49 %)

-17% Nordic Semi $NRS

-17% KLA Corporation $KLAC (+1,4 %)

-13% Marvell Technology $MRVL (+0,81 %)

-12% TSMC $2330

-11% Broadcom $AVGO (+1,15 %)

-7% Texas Instruments $TXN (+2,43 %)

-6% Monolithic Power Syst. $MPWR (-1,03 %)

>> Which stocks are you invested in and how are they performing? Which of these stocks do you have on your watchlist? #semiconductor

#halbleiter

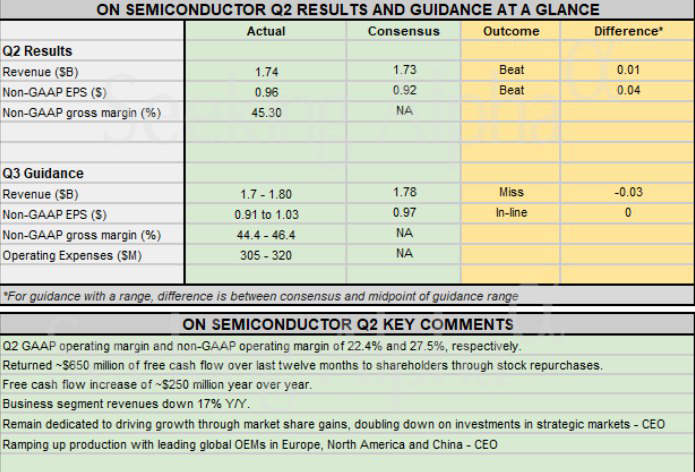

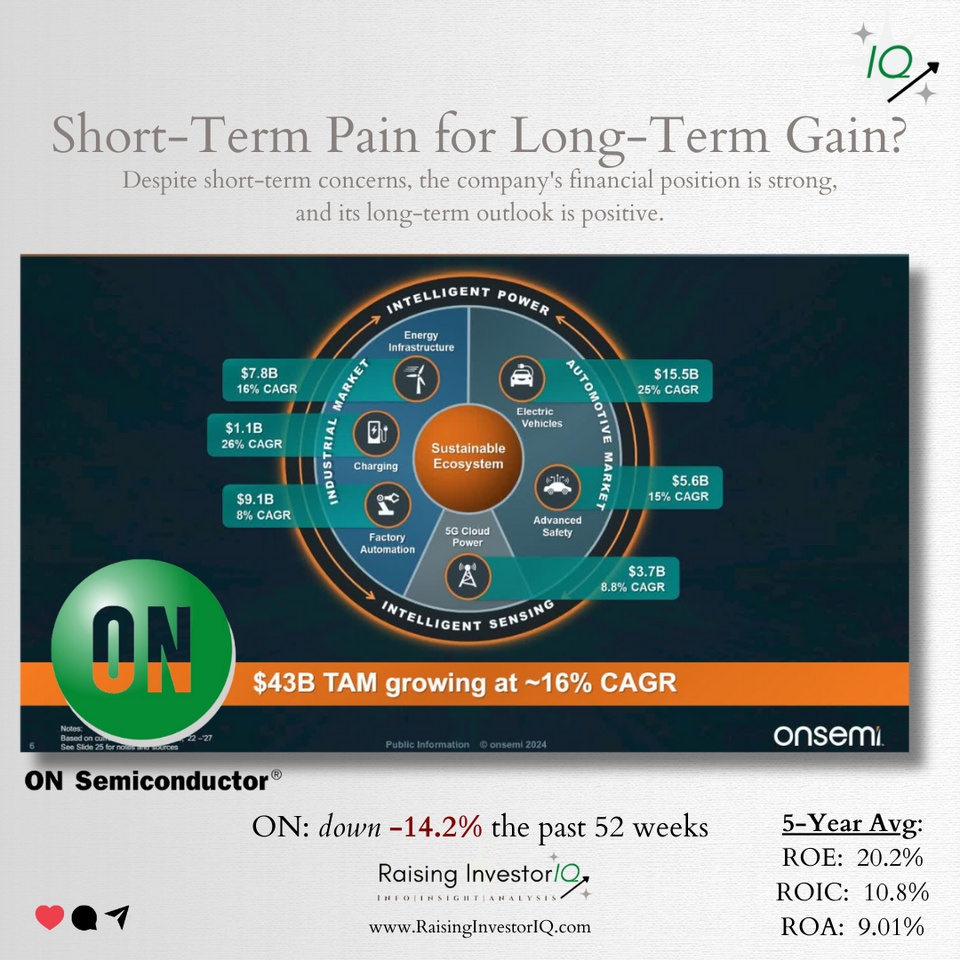

Despite short-term concerns, $ON (-1,56 %) 's financial position is strong, and its long-term outlook is positive, especially in the automotive sector with the rise of hybrid electric vehicles.

We expect onsemi to capitalize on the automotive’s growth drivers due to its wide range of products. We believe the long-term for the company looks great when we look at FY25 and beyond.

Thoughts on $ON (-1,56 %) ?🤔

Upcoming events this week:

Monday

- Earnings reports from McDonald's ($MCD (+2,19 %) ), Caterpillar Inc. ($CAT (-2,91 %) ), Palantir Technologies Inc. ($PLTR (+5,8 %) ), ON Semiconductor Corp. ($ON (-1,56 %) ) and Tyson Foods Inc. ($TSN (+2,26 %) )

- Speech by Atlanta Fed President Raphael Bostic

- S&P final U.S. Services PMI (January)

- ISM Services PMI (January)

- Senior Loan Officer Survey

Tuesday

- Earnings Reports from Eli Lilly

$LLY (+5,07 %) ), Amgen ($AMGN (+2,01 %) ), BP ($BP. (-1,72 %) ), Gilead Sciences Inc. ($GILD (-0,06 %) ), Ford ($F (+0,87 %) ), GE HealthCare Technologies Inc. ($GEHC (+0,24 %) ) and Snap Inc. ($SNAP (-1,92 %) ) - Speeches by Minneapolis Fed President Neel Kashkari, Cleveland Fed President Loretta Mester and Philadelphia Fed President Patrick Harker

Wednesday

- Earnings Reports from Alibaba Group Holding Ltd. ($BABA (-5,18 %) ), Disney ($DIS (+0,84 %) ), Uber Technologies Inc. ($UBER (-1,3 %) ), CVS Health Corp. ($CVS (-1,87 %) ), Arm Holdings PLC ($ARM (-1,08 %) ) and PayPal Holdings Inc. ($PYPL (+3 %) )

- Speeches by Fed Gov. Adriana Kugler, Fed Gov. Michelle Bowman and Richmond Fed President Tom Barkin

- US trade deficit (December)

- Consumer credit (January)

Congressional Budget Office (CBO)

Thursday

- Earnings Reports from S&P Global Inc. ($SPGI (+2,14 %) ), Philip Morris International Inc. ($PM (+1,85 %) ), ConocoPhillips ($COP (+0,01 %) ), Unilever ($UL (+0 %) ), Honda ($HMC (-2,33 %) ) and AstraZeneca ($AZN (+0,56 %) )

- Initial claims for unemployment benefits (week ending February 3)

- Wholesale inventories (December)

- Speech by Richmond Fed President Tom Barkin

- Financial stability statement by Treasury Secretary Janet Yellen before Congress

Friday

- Earnings Report from PepsiCo ($PEP (+1,38 %) )

- Annual seasonal adjustments (CPI)

Titres populaires

Meilleurs créateurs cette semaine