Stock analysis/Share presentation ⬇️

Today we are talking about the company Expedia Group: $EXPE (+1,46 %)

What is and what does the Expedia Group do at all: 🤔

Expedia Group (Expedia for short) says it is the fourth largest travel agency in the United States and one of the largest online travel providers in Germany. Beyond the United States, Expedia operates in 31 countries. In addition to the travel portal of the same name, Exedia includes sister site Hotels.com, business travel specialist Egencia and vacation rental agent Homeaway (known in Germany as Fewo-direkt.de). Expedia also holds a majority stake in the travel search engine Trivago.

The company brokers individual services such as flights, hotel accommodation and rental cars as well as package tours. In addition, on-site services such as entrance tickets, sightseeing tours, transfers and restaurant reservations are also offered independently of a travel booking. It also offers a service for corporate and business travelers through Egencia.

The United States accounts for 68% of net sales.

When was Expedia Group founded?

Expedia was founded in 1995 within Microsoft as "Microsoft Expedia Travel Services". One year later, the website "expedia.com" went online. The company is headquartered in Seattle in the West Coast state of Washington.

How many employees does the company have: 🙋🏽♂️🙋🏻♀️

The Expedia Group currently employs a total of over 16,500 people.

P/E RATIO:

Expedia has a current P/E ratio of just under 43.9, which is currently quite high in my opinion.

Market capitalization: 🏦

Currently, Expedia has a market capitalization of around 12.76 billion euros.

Dividend yield:

The company has not paid dividends to its shareholders since the Corona Pandemic. Prior to the Corona pandemic, shareholders received a quarterly dividend of just under 0.30 cents per share.

Strengths of the share: 📈

- The gap between the current price and the average price target of analysts following the company is relatively wide, suggesting significant potential upside.

- The earnings growth currently expected by analysts for the coming years is particularly strong.

- The company has a solid financial position given its high cash position and large profit margins.

Weaknesses of the share: 📉

- Expedia Group has not paid dividends to its shareholders since the Corona pandemic (March 2020)

- Analyst estimates on the company's business performance differ significantly from the rest. Predictability seems to be difficult in connection with the company's business activity.

- With a P/E ratio of currently just under 44, the company is fairly highly valued in my opinion

- In the past, the group has often disappointed analysts with lower than expected results.

A little more about the industry: ⬇️

Expedia, as an online travel agency, belongs to the tourism industry.

Tourism belongs to cyclical consumption. This refers to the products and services that we do not need in our daily lives. Travel for the vast majority of people in life a fairly low priority and this has made the industry unattractive to investors.

The tourism market is growing at around 3.5% per year and that is evenly across all segments such as package tours, hotels and vacation rentals - but quite cyclically. During economic crises, the number of travelers decreases. Just a 10% drop in demand is enough to destroy the profits of the entire industry. In economic crises or even in a bad season like autumn, there is too much supply with high fixed costs and this leads to price battles at the expense of all companies' profits.

The travel and tourism industry is a market that has recently been hit hardest by Corona. Forecasts are for recovery by 2025.

Asia is a particularly attractive market. While the travel industry in the industrialized nations is already saturated, many people in Asia are just moving up into the middle class. That is why the market there is also growing at around 7% per year.

Expedia Group business model:

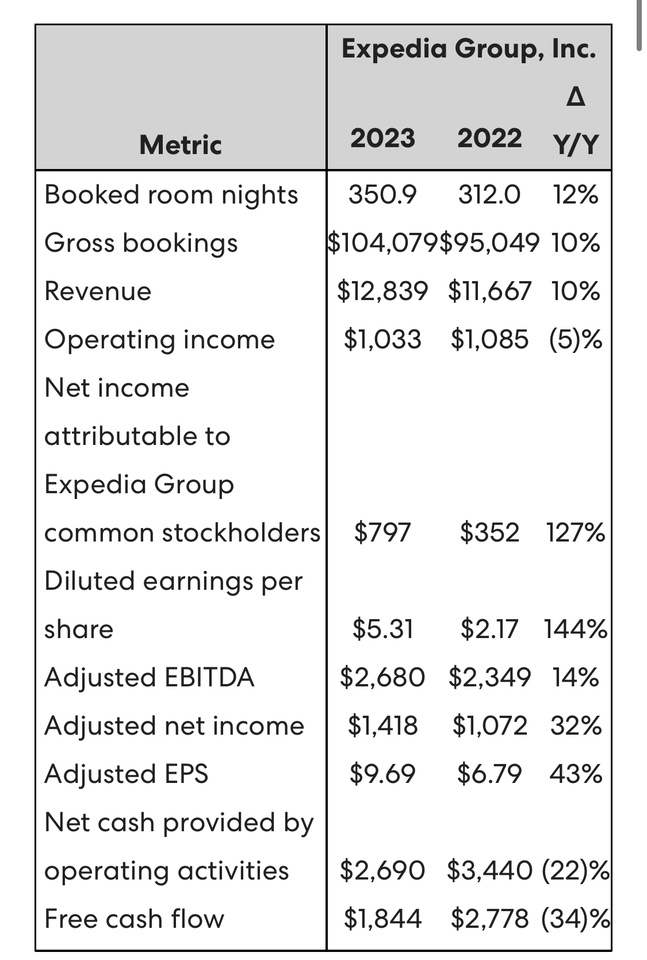

Expedia currently has three main business segments.

The largest part of the sales - about 78% of the total sales - is generated in the so-called retail area. The Retail segment comprises the core business of the online travel agency. Revenues in this segment are generated, for example, from the brokerage of hotels, vacation apartments, flights, rental vehicles, and admission tickets.

The second segment is the business-to-business (B2B) business. This accounts for around 17% of revenue. The B2B business relies on partners using Expedia's TAAP booking tool to broker travel. The tool allows other travel agents to leverage Expedia's network and significantly increase their compensation for bookings with international hotel chains such as Marriott, Highgate and Club Quarters.

The third segment is trivago, although it accounts for only about 4% of all revenues. trivago is a hotel metasearch on the Internet. There, the prices of hotels, hostels or "bed and breakfast" accommodations can be compared. According to its own information, the website searches prices of more than one million hotels worldwide from over 250 booking sites.

What does the share look like on the chart? (U.S. dollars converted into euros) 📈📉

Currently, the price here is at €83.70. At the moment, the share price is just above a support zone. This lies at around €81.30 and has held very well so far. If we run up to this zone again soon and it is then sustainably breached, the next support zone would be at just under 76.20€. Our first resistance is at just under 88.30€. This has now been approached three times and slightly exceeded. Afterwards, however, it was sold off again directly. This means that we also have a very strong resistance here, which must be taken out with momentum, so that the share can continue to rise. If the zone is taken out, the next target would be at 95 €. If this zone is also taken out, there would be room at the top to the next resistance which is at about 110€.

Target of the Expedia Group: 🏁

Expedia's mission is to drive global travel for everyone, everywhere.

Expedia's goal, he said, is to bring the full breadth of its global platform to fruition. Expedia wants to bring the entire world within reach for travelers and for partner companies.

Your opinion: 🧐

Now I would like to hear your opinion about this stock in the comments.

What do you think of Expedia and did you already know this company?

Do you have this stock in your portfolio?

Feel free to let me know in the comments.

Of course, this is not an investment advice but just my own opinion that I would like to share with you.