23.10.2024

Arm revokes Qualcomm's architecture license + Exciting figures today + McDonald's falls after E. coli cases in the USA + Solar shares in free fall: Enphase Energy disappoints + Deutsche Bank's profits jump thanks to Postbank settlement

The legal dispute that has been simmering for two years between Arm $ARM (-1,08 %) and Qualcomm $QCOM (-0,3 %) has been escalated to a new level with the recent withdrawal of the architecture license by Arm. In essence, it is about the takeover of Nuvia and the implementation at Qualcomm derived from its CPU design as the Snapdragon X Elite.

The share price of McDonald's $MCD (+2,19 %) plummeted after the chain's restaurants in several US states were linked to an outbreak of E. coli bacteria. According to the CDC, one elderly person died and ten were hospitalized. A total of 49 cases have been reported in ten states, most of them in Colorado and Nebraska. The share price of the world's largest fast food chain fell by almost ten percent at times in early after-hours trading in the US on Tuesday. However, the stock was recently able to recover somewhat from this heavy loss and ended after-hours trading down six percent at around 296 dollars. However, McDonald's shares had also risen sharply in recent weeks, with the share price hitting another record high of almost 318 dollars on Monday. According to McDonald's, the trigger is suspected to be chopped onions, which are only used in the Quarter Pounder, the American equivalent of the Hamburger Royal. They came from a supplier that supplies three distribution centers. In five states and parts of seven others, the Quarter Pounder is now being temporarily withdrawn from supply.

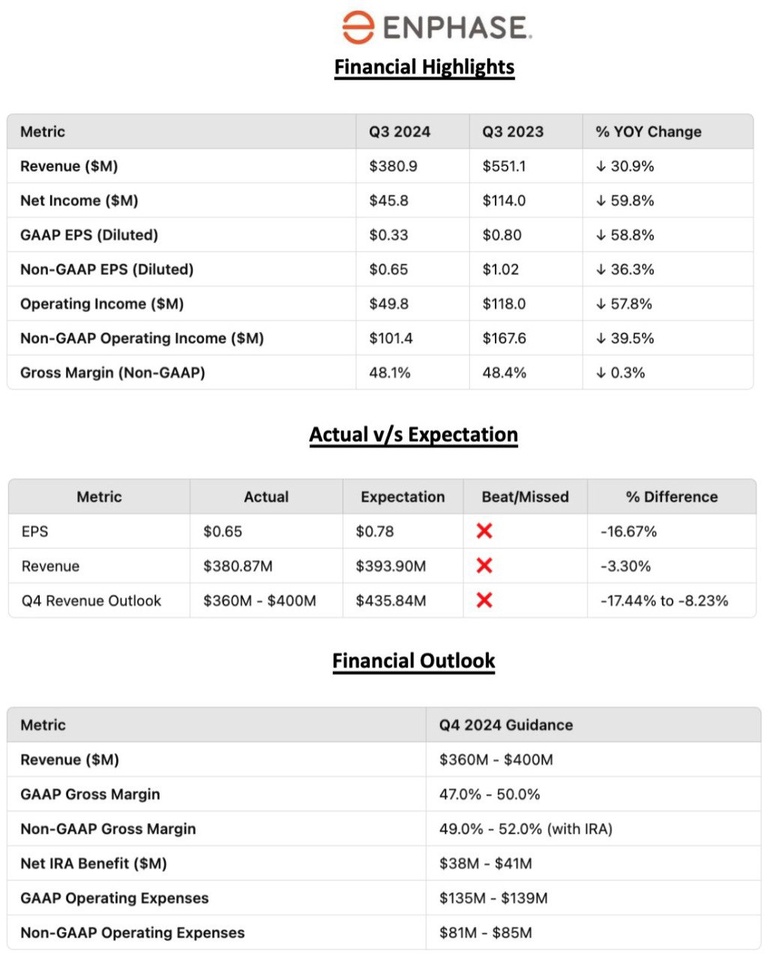

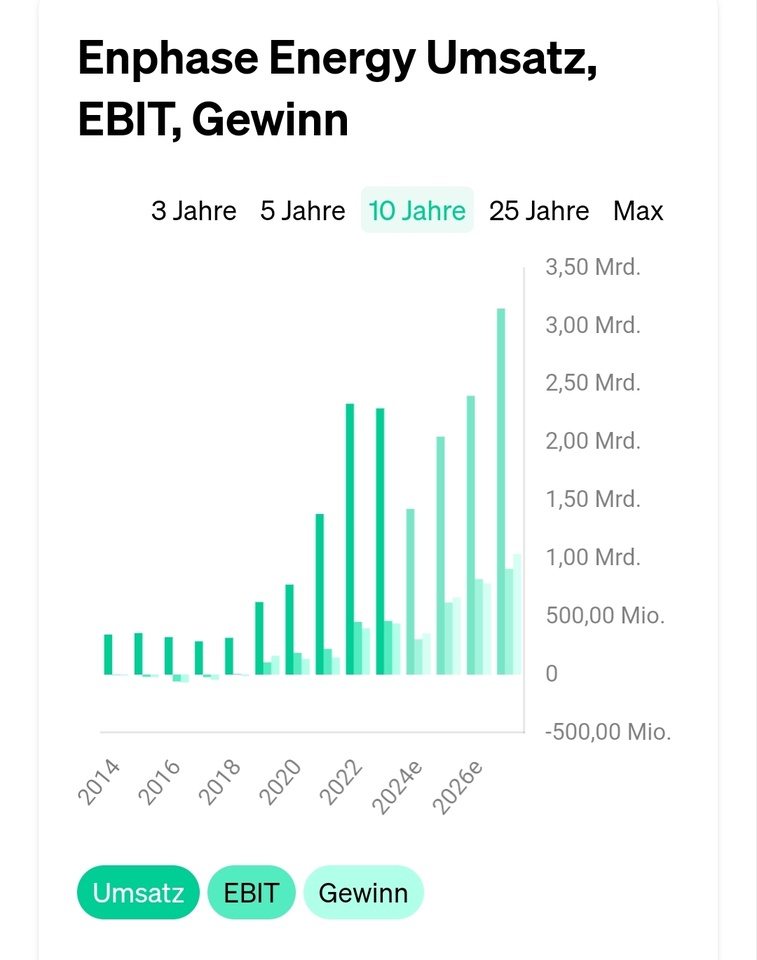

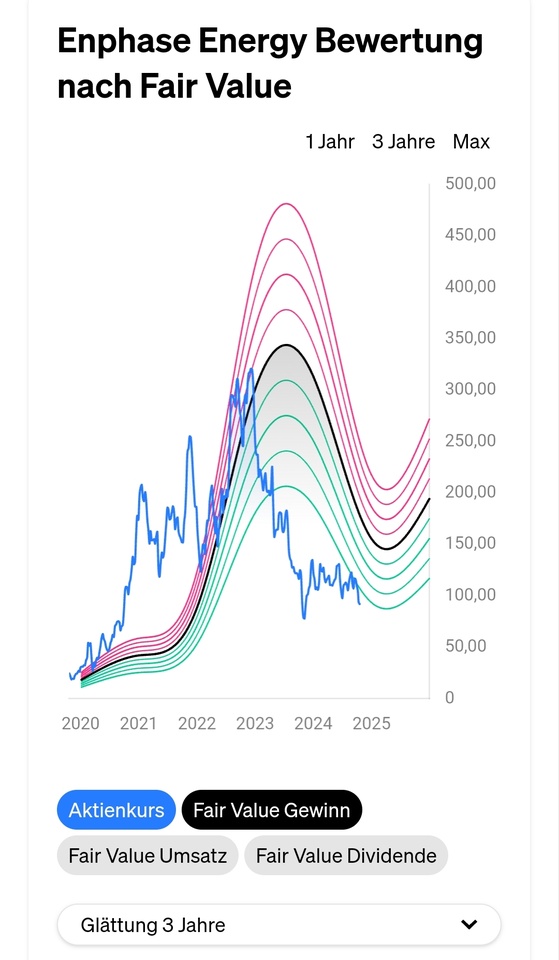

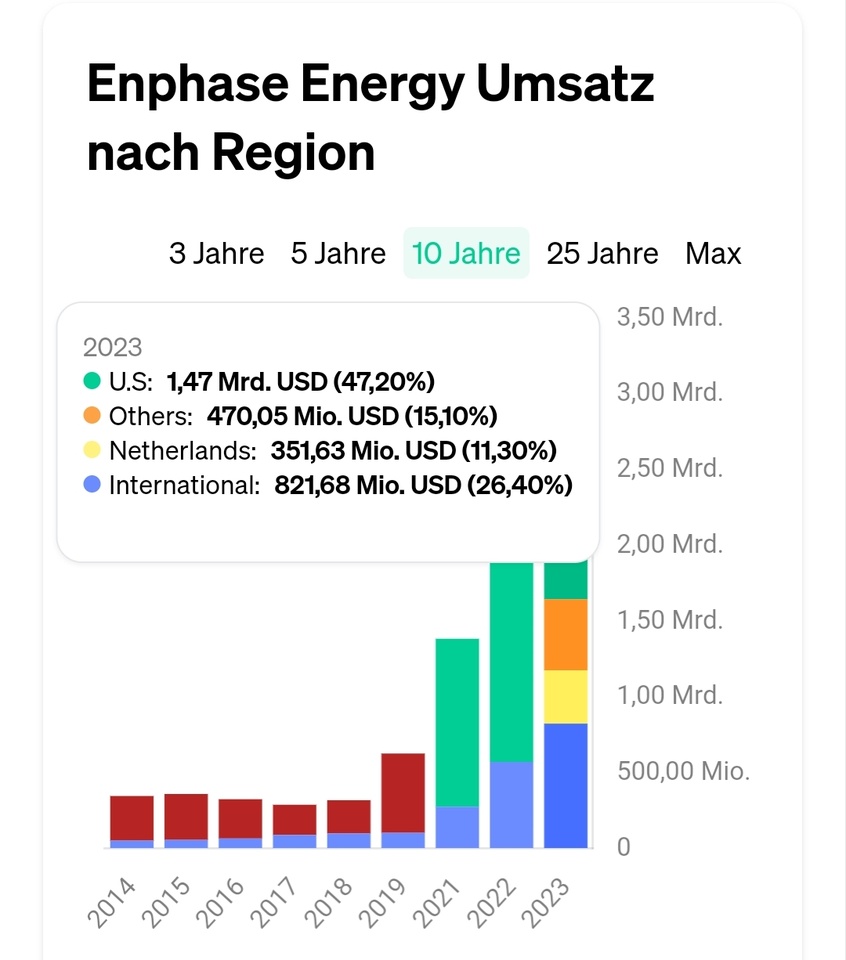

Enphase Energy Inc. $ENPH (-6,08 %) generated net sales of USD 380.873 million in the third quarter of 2024 (previous quarter: USD 303.458 million), a decline of 30.9% compared to the previous year. The Californian solar inverter provider's negative revenue growth thus slowed further. In the previous quarter, this was still down 57.3% on the previous year (Q1 2024: down 63.7%, Q4 2023: down 58.2%, Q3: up 13.2%, Q2: up 34.1%, Q1: up 64%). Enphase Energy's gross margin in the same period was around 46.8% (previous quarter: 45.2%, previous year: 47.5%). The solar technology company's operating result fell to plus USD 49.788 million in the reporting period (previous quarter: USD 1.799 million, previous year: USD 117.989 million). This left the US company with a net result of USD 45.762 million (previous year: USD 113.953 million) or (diluted) earnings per share (US GAAP) of USD 0.33 (previous year: USD 0.80).

The back and forth in the legal dispute over Postbank $DPB-takeover has had a negative impact on Deutsche Bank $DBK (-2,66 %) Deutsche Bank's profits in the third quarter. Because the DAX-listed group was able to partially release a provision from the second quarter, shareholders received almost 1.5 billion euros on the bottom line. This was 42 percent more than a year earlier and more than analysts had expected on average. CEO Christian Sewing also considered buying back more shares when presenting the interim results on Wednesday. He expressed confidence that he would be able to distribute more capital to shareholders than originally planned. In the summer, Deutsche Bank still had worse news in store. Due to a provision of 1.3 billion euros in the Postbank legal dispute, it had even slipped into the red. However, following an agreement with the majority of the plaintiffs from among the former Postbank shareholders, it has now been able to release 440 million euros of this. The Management Board also reported positive developments in day-to-day business. CFO James von Moltke confirmed the target of generating income of 30 billion euros this year. The management also believes the bank is on track with its targets for 2025. Above all, the return on tangible equity should then reach more than 10 percent. In the third quarter, it was even slightly above this mark at 10.2 percent. Without the reversal of the provision, however, it would only have amounted to 7.6%.

Wednesday: Stock market dates, economic data, quarterly figures

ex-dividend of individual stocks

Lowe's Companies 1.15 US

Quarterly figures / company dates USA / Asia

12:30 AT&T | GE Vernova quarterly figures

12:55 Coca-Cola quarterly figures

13:30 Boeing | General Dynamics quarterly figures

22:05 Tesla | Align Technology | Whirlpool quarterly figures

22:08 IBM quarterly figures

22:30 T-Mobile US quarterly figures

Untimed: Boeing union "International Association of Machinists and Aerospace Workers Union", vote on offer regarding wage increase

Quarterly figures / Company dates Europe

07:00 Deutsche Bank | DWS | Amadeus Fire | Akzo Nobel | Kühne & Nagel | Volvo Car quarterly figures | Roche 3Q sales

07:20 Air Liquide sales 3Q

07:30 Atoss Software 9 months results

08:00 Deutsche Bank PK | Lloyds Banking Quarterly Figures | Reckitt Benckiser | Heineken Trading Update 3Q

09:30 Iberdrola 9 months results

10:00 Flatexdegiro analyst conference on the quarterly figures

11:00 Deutsche Bank Analyst Conference

14:00 Deutsche Börse Analyst and Investor Conference on the quarterly figures

17:40 Michelin | Kering Sales 9 months

17:50 Carrefour 3Q sales

Untimed: Givaudan end of investor day (since 22.10.)

Economic data

08:00 DE: Leading indicator foreign trade on exports to non-EU countries | Turnover in the service sector

14:00 DE: Deutsche Börse analyst and investor conference on the quarterly figures

15:00 US: Fed Governor Bowman, speech at the Philadelphia Fed's Annual Fintech Conference | IMF Fiscal Monitor

16:00 EU: Eurozone Consumer Confidence Index (flash estimate) October FORECAST: -12.5 previous: -12.9

16:00 US: Existing Home Sales September FORECAST: -0.5% yoy previous: -2.5% yoy

16:30 US: Crude oil inventory data (week) from the Energy Information Administration (EIA)

20:00 US: Fed, Beige Book