Berkshire Hathaway Q3 2024 $BRK.B (+1,54 %)

Sales: The Industrial Products Group recorded sales growth of 3.3% in the third quarter and 2.7% in the first nine months of 2024 compared to 2023. PCC achieved a sales increase of 11.9% in the third quarter due to higher demand for aerospace products.

Net income: Net income attributable to Berkshire shareholders totaled $69.3 billion in the first nine months of 2024, including after-tax investment gains of approximately $36.4 billion.

Cash flow: Net operating cash flows totaled $26.0 billion in the first nine months of 2024, reflecting significant payments for income taxes.

Significant changes

Insurance investment income: Income from interest and other investments increased by $1.8 billion in the third quarter and $3.8 billion in the first nine months of 2024 compared to 2023.

Exceptional items

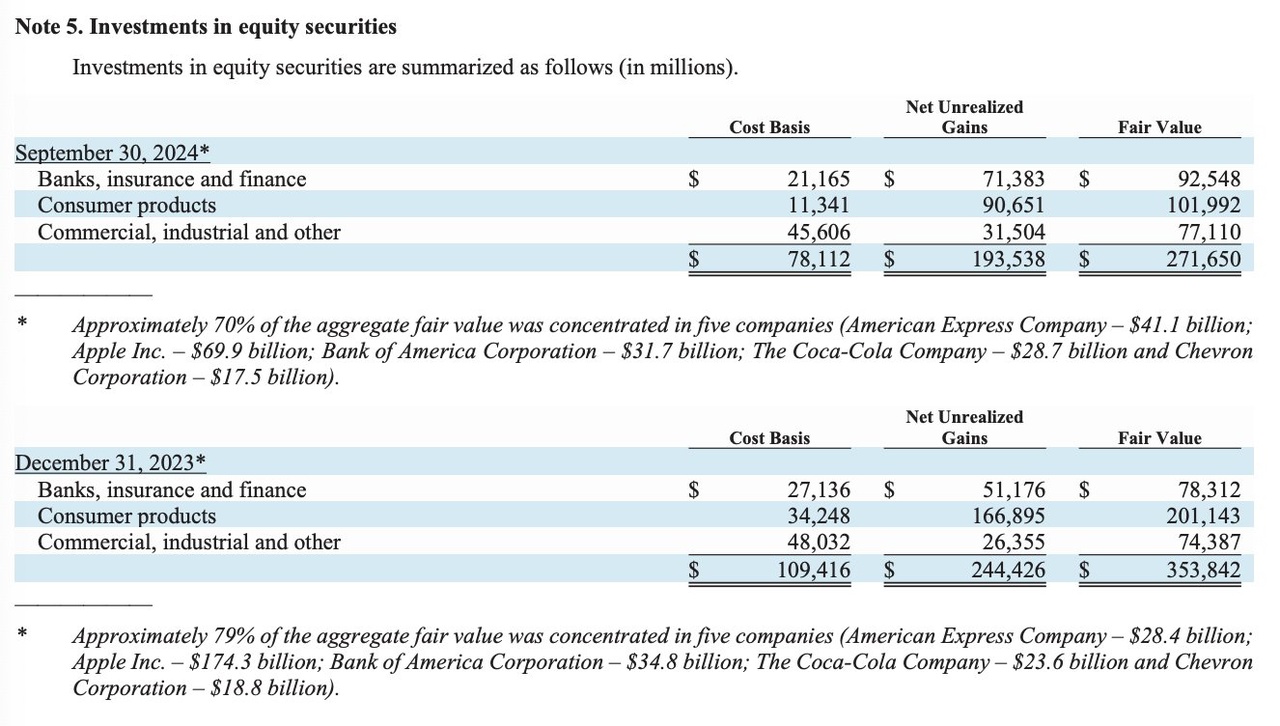

Investment gains: After-tax investment gains of approximately $36.4 billion contributed significantly to net gains.

Analysis of the balance sheet

Assets, liabilities and equity

Assets: As at September 30, 2024, goodwill amounted to USD 84.6 billion, while intangible assets with indefinite useful lives amounted to USD 18.9 billion.

Liabilities: Estimated liabilities for unpaid losses and loss adjustment expenses under insurance and reinsurance contracts amounted to $148.9 billion.

Shareholders' equity: Shareholders' equity was $629.1 billion, an increase of $67.8 billion since December 31, 2023.

Liquidity and debt

Liquidity: Cash, cash equivalents and US government bonds held by insurance and other companies totaled 305.5 billion dollars.

Debt: Consolidated debt totaled $124.5 billion, with significant debt issued by the parent company and its subsidiaries.

Analysis of the income statement

Revenue sources and cost factors

Primary sources of revenue: The insurance, manufacturing, services and retail segments are the main sources of revenue.

Cost factors: Lower raw material costs and improved manufacturing efficiencies had a positive impact on earnings.

Margins

Operating margin: Earnings before tax as a percentage of sales in the manufacturing segment were 16.6% for industrial products.

Gross and net margins: Specific information on gross margins is missing, but net profits amounted to 3,144 million dollars in the third quarter of 2024.

Overview of the cash flow

Operating activities: 26.0 billion dollars in net operating cash flows were generated.

Investing activities: 5.8 billion dollars were paid for the purchase of shares, while 133.2 billion dollars were received from sales.

Financing activities: 2.9 billion dollars were spent on share buybacks.

Investments: In the first nine months of 2024, capital expenditures totaled $13.6 billion, primarily from BNSF and BHE.

Key figures and profitability ratios

Debt ratio: Consolidated debt of $124.5 billion compared to significant equity.

Interest coverage: Strong interest coverage due to substantial operating cash flows and investment income.

Segment information

Most profitable segment: Industrial Products, in particular PCC, with significant sales growth.

Weakening segment: Marmon's earnings before taxes fell by 13.0% in the third quarter.

Competitive position

Market position: Strong in the aviation and insurance sectors, with growing demand for aviation products.

Industry trends: Sustained demand for air travel and aviation products.

Forecasts and management commentary

Strategic plans: Focus on increasing production capacities in aviation and improving supply chains.

Risks and opportunities

SWOT analysis

Strengths: Strong sales growth in key segments, significant investment income.

Weaknesses: Potential liabilities from forest fires and the need for efficient management of goodwill.

Opportunities: Growth in the aviation industry and strategic acquisitions.

Threats: Geopolitical conflicts and market volatility.

Macroeconomic factors

Interest rates: Effects on investment income and borrowing costs.

Currency risks: Unfavorable currency conversions can affect sales.

Summary of results

The company shows a strong financial performance with significant sales growth in the industrial and consumer products segments. The insurance segment remains a key revenue driver, supported by substantial investment income. However, challenges such as potential liabilities from forest fires and geopolitical risks require careful management. The company's strategic focus on aviation and efficient use of capital positions it well for future growth, although macroeconomic factors and market volatility continue to pose risks. Overall, the company has a robust financial position and offers opportunities for continued expansion.

Five positive aspects

Sales growth in Industrial Products: The Industrial Products Group recorded sales growth of 3.3% in the third quarter and 2.7% growth in the first nine months of 2024 compared to 2023. This growth was driven by higher demand for aerospace products, particularly at PCC, which achieved sales growth of 11.9% in the third quarter.

Strong performance in the Insurance segment: The Insurance segment reported total revenues of $26,664 million in the third quarter of 2024, compared to $24,308 million in 2023, demonstrating robust growth and a significant contribution to the company's overall performance.

Increase in shareholders' equity: Shareholders' equity increased by $67.8 billion since December 31, 2023, reaching $629.1 billion as of September 30, 2024. This reflects a strong capital base and financial stability.

Substantial investment income: Income from interest and other investments increased significantly and contributed to overall profitability. This was the result of strategic investment decisions and favorable market conditions.

Effective cash flow management: The company generated net cash flows from operating activities of $26.0 billion in the first nine months of 2024, demonstrating effective cash flow management and the ability to support capital expenditures and share repurchases.

Five negatives

Potential liabilities from wildfires: PacifiCorp faces potential liabilities from wildfires in Oregon and California, with outstanding complaints and claims of approximately $3 billion jeopardizing the company's financial stability.

Decline in Marmon's pre-tax income: Marmon's pre-tax income declined 13.0% in the third quarter, indicating challenges in maintaining profitability in this segment.

Increase in underwriting costs: Property and casualty reinsurance underwriting costs increased 50.8% in the third quarter and 19.3% in the first nine months of 2024 compared to 2023. This increase was partially due to a pre-tax charge related to a settlement.

Losses from currency translation: The company incurred losses from currency translation, which had a negative impact on financial results. This illustrates the risk of currency fluctuations in international activities.

Challenges in dealing with goodwill and intangible assets: The company must efficiently manage its goodwill and intangible assets, which together amounted to 84.6 billion dollars and 18.9 billion dollars respectively. A write-down could have a significant impact on the financial reports.