The world's hunger for energy is increasing and, according to the latest estimates, "peak oil" is further in the future than previously thought.

High geopolitical risks, artificially limited supply and robust demand = (in my opinion) a structurally bullish oil outlook.

Today I would like to introduce you to 3 stocks from the "hated" 🛢️Öl and natural gas sector.

Stock 1:

Canadian Natural Resources $CNQ (+0,29 %)

📍Overview of the company:

Canadian Natural Resources is a leading Canadian energy company primarily engaged in the production and processing of crude oil and natural gas.

Its business model includes the mining of bitumen oil sands and their processing into synthetic crude oil, conventional oil and NGL production as well as major natural gas production in Western Canada and selected offshore locations.

Geostrategically, CNQ benefits from a relatively stable regulatory environment in Canada and owns long-term, long-life production assets.

Analysts value the stock at a fair value of around $54-55, which suggests a moderate upside potential of close to +15-20% from the current price of around $47, assuming commodity prices and operating conditions remain stable.

💰Dividend yield (TTM): 5.187%

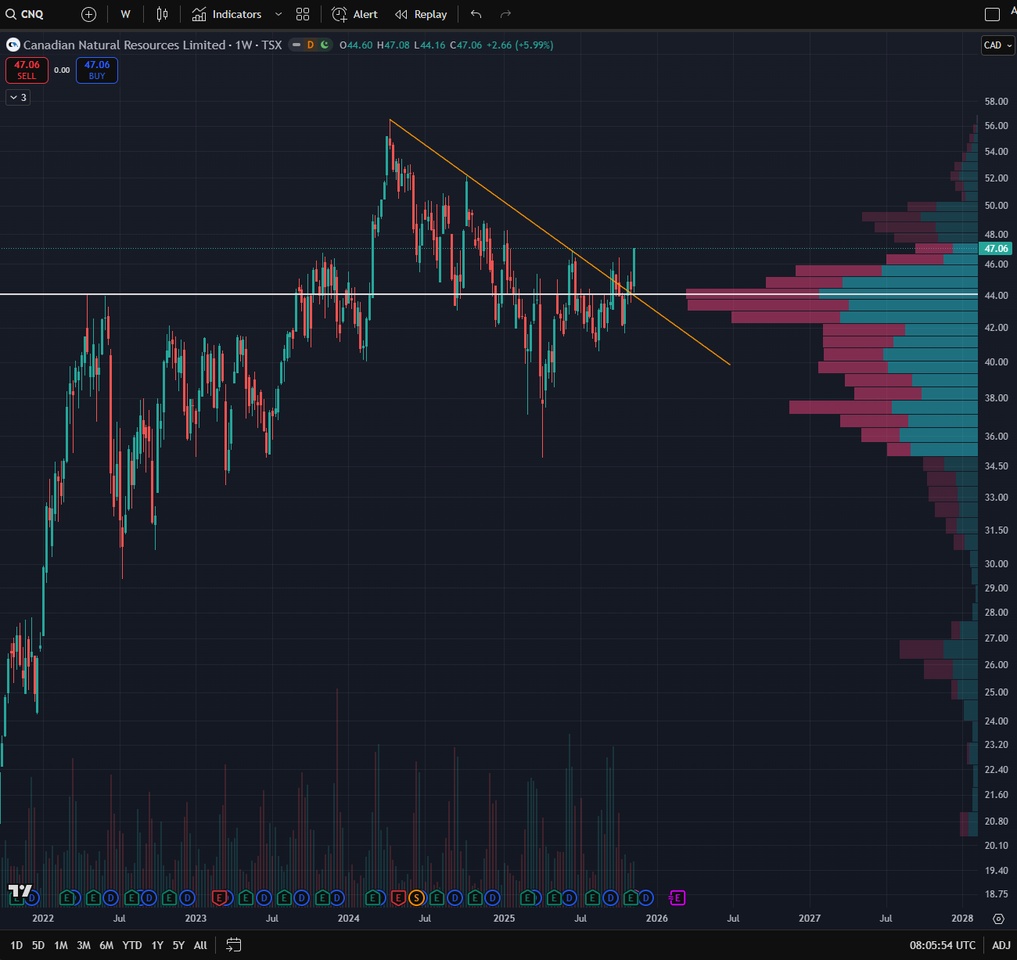

📈Notes on the chart:

What I like here is that $CNQ (+0,29 %) has clearly broken the weekly downtrend to the upside.

The price is also above the volume POC, which should now form a support.

I am already invested and plan to buy on setbacks.

Share 2:

Suncor Energy $SU (-0,01 %)

📍Overview of the company:

Suncor Energy is one of Canada's largest integrated energy companies, making its money primarily from oil sands production, processing into synthetic crude oil, and downstream operations such as refineries and a large Canadian service station network.

Thanks to its strong presence in the politically stable regions of Alberta and Ontario, Suncor is considered to have a relatively secure geostrategic position, as Canada is one of the most reliable oil supply countries and oil sand reserves can be extracted over an extremely long period of time.

Risks arise primarily from North American regulation and ESG pressure, rather than from geopolitical conflicts.

Analysts currently generally see the fair value of SU shares at around C$70-75, while the price on the TSX chart is around C$62 - this results in a moderate expected upside potential in the low double-digit percentage range, depending on oil prices and operating performance.

💰Dividend yield (TTM): 3.816%

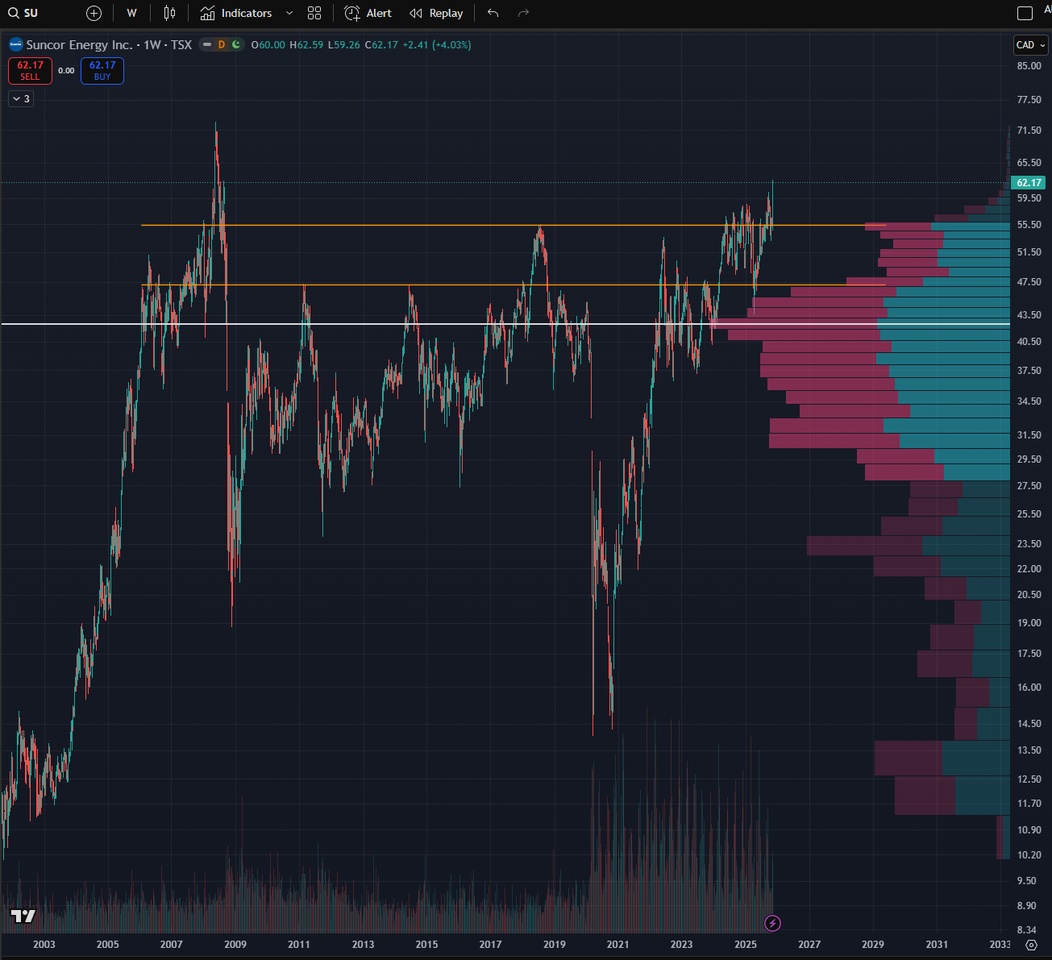

📈Notes on the chart:

$SU (-0,01 %) had a long sideways phase in which the price first consolidated at the ~C$47.2 resistance and for the entire past year at around ~C$55.

Now it looks as if the price has broken out of this range to the upside.

The next price target is the ATH from May 2008 (~C$73).

Here, too, I am already invested and continue to buy.

Share 3:

Aker BP ASA $AKRBP (-2,75 %)

📍Overview of the company:

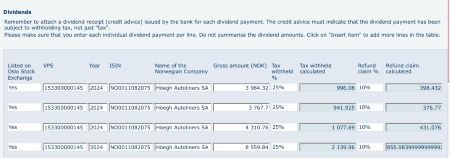

Aker BP ASA is one of the largest independent oil and gas producers in Norway and makes its money mainly through the production of crude oil and natural gas on the Norwegian Continental Shelf.

The company operates several large fields such as Johan Sverdrup, Skarv, Valhall and Alvheim and is characterized by low production costs and high operational efficiency.

Geostrategically, Aker BP is considered very secure, as Norway is politically stable, has reliable regulation and the North Sea assets are not dependent on conflict zones - a clear advantage over many global producers.

Analysts are largely positive on Aker BP; consensus estimates see a fair value slightly above the current price level, supported by robust cash flows, high dividends and expected production increases.

Overall, Aker BP is seen as a high-quality, geostrategically stable oil stock whose valuation depends primarily on the long-term oil price.

💰Dividend yield (TTM): 10.05%

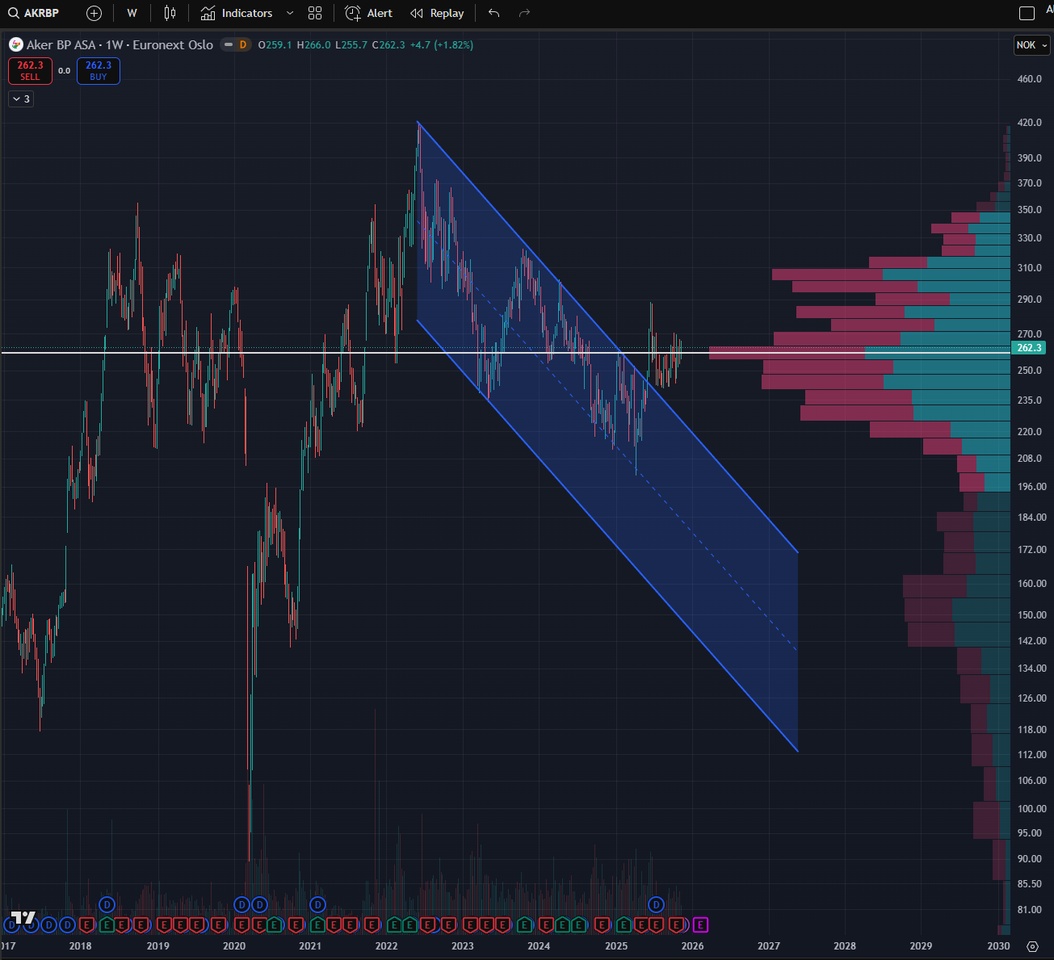

📈Notes on the chart:

Aker BP has successfully broken out of the downtrend since 2022 and is currently consolidating just above the long-term volume POC.

I am invested and will continue to buy if possible.

💬 Closing words

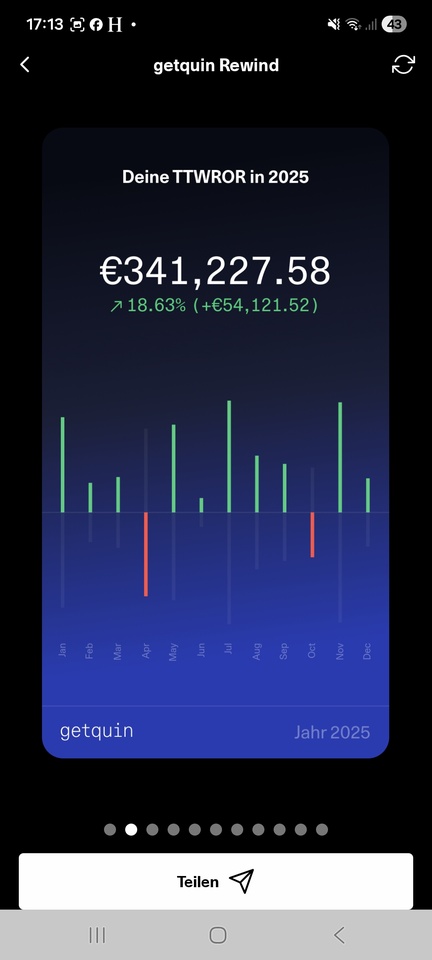

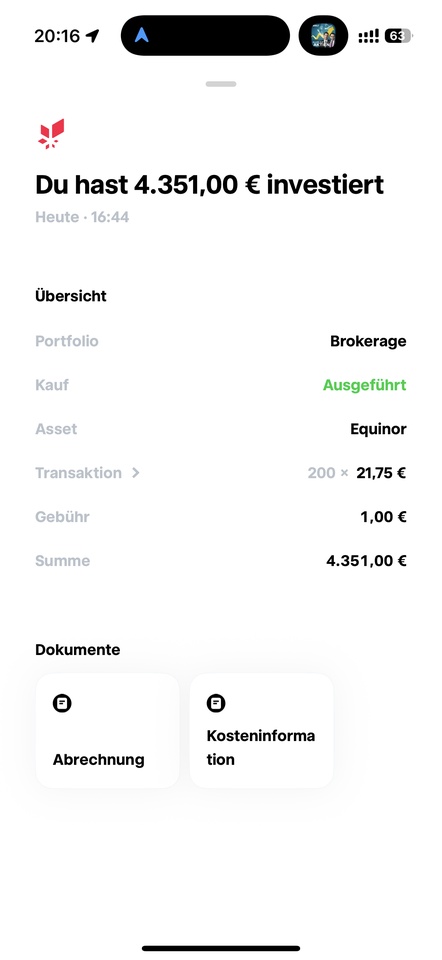

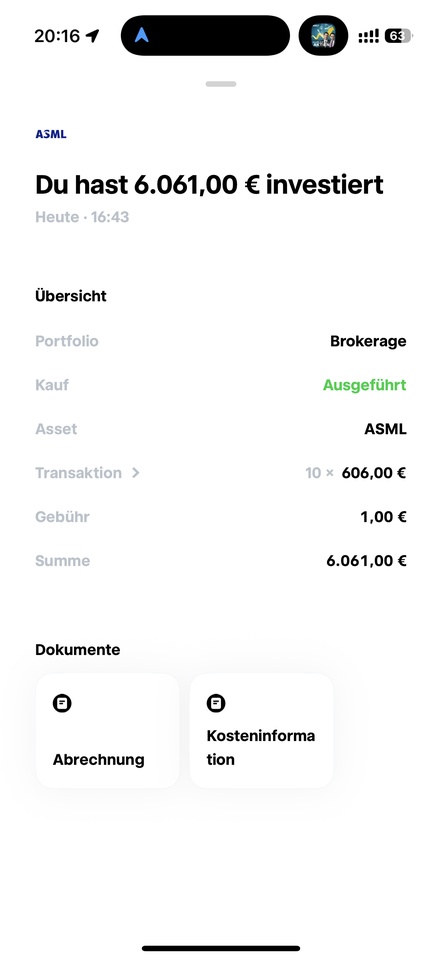

As of today, I am invested in the energy sector with 8.2% of my portfolio.

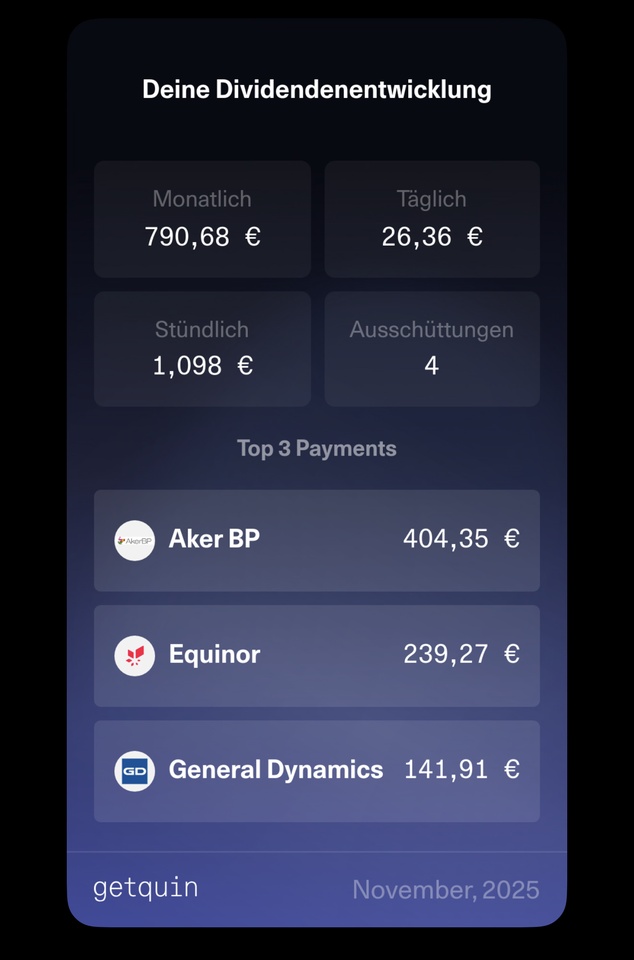

In addition to the stocks presented, I am also invested in $CVX (+0,26 %) , $EQNR (-0,97 %) , $OXY (+0,3 %) , $TTE (+0 %)

Do you have an "insider tip" from the energy sector that you would like to share? 🤔