Walmart

$WMT (+1,81 %) has announced a partnership with Burger King

$QSR (-0,34 %) to create Walmart+ members a new meal benefit.

Walmart+ members will receive 25 % discount on every digital order at Burger King.

Postes

10Walmart

$WMT (+1,81 %) has announced a partnership with Burger King

$QSR (-0,34 %) to create Walmart+ members a new meal benefit.

Walmart+ members will receive 25 % discount on every digital order at Burger King.

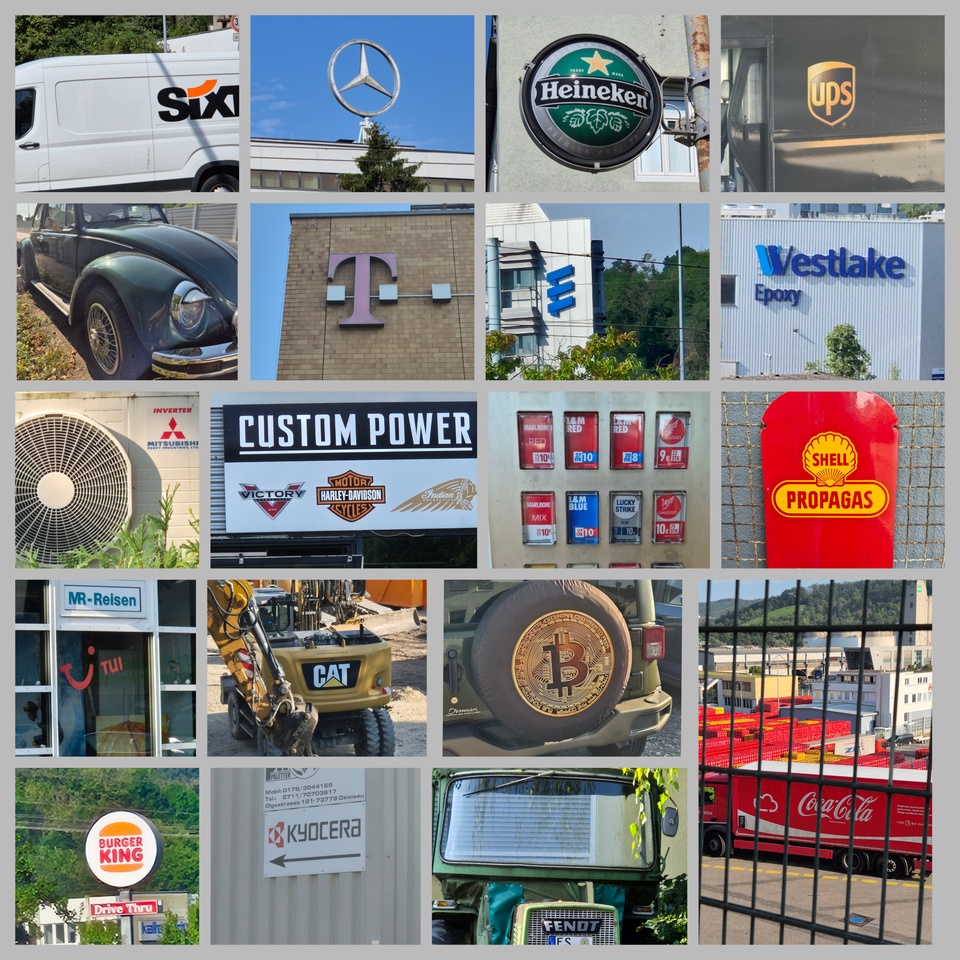

Share march, 30km route with 35 share companies

First day of vacation, 32°C and a 30km walk towards Stuttgart. I was able to find over 35 stock companies along the route.

Highlight, $BTC (+0,21 %) Bitcoin logo on the wheel arch of the Jeep.

In addition to the car brands, $MBG (-3,33 %)

$DTG (-4,27 %)

$VOW (-2,5 %)

$BMW (-3,91 %)

$VOLV B (-3,37 %)

$TSLA (+9,97 %)

$1211 (-3,83 %)

$P911 (-1,22 %)

$F (+0,87 %)

$8058 (-1,27 %) I was able to discover numerous other companies that were new to me.

New for me was $6971 (-0,9 %) Kyocera, a manufacturer of electronic devices from Japan and $WLK (-2,37 %) Westlake Chemical from the USA.

From Germany there were also $SIX2 (+0,13 %) Sixt $DTE (+0,79 %) Telekom $TUI1 (-1,1 %) Tui $AGCO (-1,66 %) (Fendt) $256940 Eberspächer (supplier to the automotive industry) $SIE (-2,51 %) Siemens $EBK ENBW $DHL (+0,1 %) Post and $ALV (-0,71 %) in the process.

Other companies:

$CAT (-2,91 %) Caterpillar $HEIA (-0,59 %) Heineken $HOG (-0,13 %) Harley Davidson $PM (+1,85 %) Philip Morris $NKE (+0,58 %) Nike $AAPL (+0,65 %) Apple $005930 Samsung $UPS (-0,58 %) UPS $SHEL (-1,61 %) Shell $V (+1,22 %) Visa $MA (+0,88 %) Mastercard $KER (-5,61 %) Kering

$KO (+1,1 %) Coca-Cola $QSR (-0,34 %) Restaurant Brands (Burger King)

$O (+2,65 %) Reality Income (leased to Decathlon)

Would you have recognized everything? It's interesting what you discover when you consciously look around.

Out of interest, please link if you post something similar 🫡 or use the #aktienmarsch

I am looking for a fast food stock.

However, I am not quite sure whether it should be quite classic $MCD (+2,19 %) or rather $QSR (-0,34 %) should be.

Do you have any reasons for or against one of these stocks or maybe some alternatives?

Thanks a lot ✌🏼

Hello everyone 🙋♂️. I had you vote on which article should be published today. And very narrowly won the presentation of the purchase of a new company in the restaurant sector.

➡️ 25 shares of Restaurant Brands International (QSR) at 76.21 CAD per share are new in the portfolio since about a week. As usual, I have summarized my thoughts on risks and opportunities in the "Notes" section.

➡️ In contrast to McDonalds, which operates a large number of its own stores and also owns many of the properties, Restaurant Brands International

Restaurant Brands International acts almost exclusively as a franchisor. As such, they assist franchisees with product development, marketing, etc. And the franchisees pay a fee for both the marketing and the franchise licenses, and the franchisor pays a fee for the franchise. $QSR (-0,34 %) .

➡️ Most of the Restaurant Brands International brands are familiar, at least by name. While Burger King is internationally successful, Popeyes and Firehouse Subs are mostly known in the U.S., and Tom Hortons in Canada.

➡️ Restaurant Brands International has faced some challenges. As an investor, the first thing that stands out is the relatively high level of debt (>5 times EBITDA). This is exactly what put me off at the beginning.

However, there is also the other side of the coin, namely financing. And here, there are no major refinancings before 2026, which I consider to be quite positive.

QSR is struggling above all with weakening sales growth in existing space, i.e. in its home markets. One has to mention Burger King U.S. in particular. I am taking a closer look there (keyword 'comparable sales'). If there is a sustained improvement in the next few quarters, the whole model will become more attractive for franchisees and growth can shift into second gear.

➡️ However, the whole thing can of course also work in the other direction should it become apparent that the company is not getting back on track in these relevant areas. The current quarterly figures actually already looked quite promising, even if there is still a lot to do. Therefore I have $QSR (-0,34 %) on the live watchlist and placed a first tranche. In September, more will be announced about the planned changes at Burger King U.S.. We are curious!

Earnings

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗖𝗵𝗶𝗻𝗮𝘀 𝗜𝗺𝗺𝗼𝗯𝗶𝗹𝗶𝗲𝗻𝗸𝗼𝗻𝘇𝗲𝗿𝗻𝗲 / 𝗙𝘂𝗻𝗸𝘁𝘂𝗿𝗺-𝗩𝗲𝗿𝗸𝗮𝘂𝗳 / 𝗪𝗲𝗯 𝟯.𝟬

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, among others, Restaurant Brands ($QSR (-0,34 %)), Medifast Inc. ($MED (-3,18 %)), Amphenol ($APH (+0,97 %)), General Electric ($GE (+4,23 %)) and Nordson corp. ($NDSN (+1,2 %)) traded ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, among others, Nike Inc. ($NKE (+0,58 %)) , Micron Technologies Inc. ($MU (-0,29 %)) and Carnival ($CCL (+2,23 %)) present their quarterly figures.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

Kaisa ($1638 (-5,19 %)) - Chinese real estate group Kaisa hires external advisors to rescue it from a difficult situation. The evaluation of liquidity and the search for possible solutions would be taken over by the company Houlihan Lokey. Kaisa's share price slid 14 percent on Monday after nearly two weeks of trading halt. The stock has fallen 75 percent since the beginning of the year. In addition to Kaisa, rival Evergrande ($3333) was downgraded to "limited credit default" status by ratings agency Fitch.

Deutsche Telekom ($DTE (+0,79 %)) - Shares fell in pre-market trading after the announcement of the possible sale of the radio tower division in the first quarter of 2022. A valuation of up to EUR 20 billion, including debt, is possible given the high demand for investment opportunities in infrastructure. Deutsche Telekom shares came under pressure in a weak market environment in pre-market trading. On Monday, the stock was trading 1.4 percent lower than on Friday.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

Web 3.0 - Reddit co-founder Ohanian and Polygon launch $200 million Web 3.0 social media initiative. On Friday, Polygon venture capital firm Seven Seven Six and Alexis Ohanian announced a $200 million initiative to support projects operating at the intersection of social media and Web 3.0. The initiative will focus on gaming applications and social media platforms built on Polygon's infrastructure.

Follow us for french content on @MarketNewsUpdateFR

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗘𝘃𝗲𝗿𝗴𝗿𝗮𝗻𝗱𝗲 𝗮𝘂𝗳 𝟭𝟭 𝗝𝗮𝗵𝗿𝗲𝘀𝘁𝗶𝗲𝗳 / 𝗬𝗲𝗹𝗹𝗲𝗻 𝘄𝗶𝗹𝗹 𝗦𝗰𝗵𝘂𝗹𝗱𝗲𝗻𝗼𝗯𝗲𝗿𝗴𝗿𝗲𝗻𝘇𝗲 𝗮𝗻𝘇𝗶𝗲𝗵𝗲𝗻 / 𝗘𝗹 𝗦𝗮𝗹𝘃𝗮𝗱𝗼𝗿 𝗯𝘂𝘆𝘀 𝘁𝗵𝗲 𝗗𝗶𝗽

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

Today, Logitech ($LTEC (-1,67 %)) and Restaurant Brands ($0R6 (-0,34 %)) ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, Lennar Corp. ($LENB (+1,67 %)) and Erytech ($2E4A) will present their figures.

𝗜𝗣𝗢𝘀 🔔

𝗩𝗲𝗴𝗮𝗻𝘇 - The full-range vegan food supplier has announced it will complete its planned IPO in the next 12 months. This was confirmed by founder and CEO Jan Bredack this morning. The enterprise sees in the future a very strong growth potential particularly by the customer group of the so-called "Flexitarier". It concerns thereby persons, who do not nourish themselves exclusively vegan, but consume increased climaticneutral and animal-free food. The company's product range currently consists of 120 purely vegan products. Veganz has been able to grow strongly, primarily due to the change in consumer buying behavior in recent years. Most recently, however, the company had to report a balance sheet deficit of 8.73 million euros, which was cured for the time being in June 2021 by an equity financing round of 11 million euros.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

𝗙𝗿𝗲𝗶𝗲𝗿 𝗙𝗮𝗹𝗹 - Evergrande share ($EV1A) at lowest level in 11 years.

The heavily indebted Chinese real estate group now dragged down other real estate and financial stocks, confirming fears that the crisis will spread to other companies.

The mountain of debt has now piled up to over $300 billion. Several interest payments are due this week alone, leading experts to believe that a default is becoming increasingly likely. Others are already talking about Lehman Brothers 2.0.

𝗝𝗮𝗻𝗲𝘁 𝗬𝗲𝗹𝗹𝗲𝗻 - The U.S. Treasury Secretary is pushing to take on more debt.

In an op-ed in the Wall Street Journal, she wrote that a failure by the U.S. to meet its obligations could trigger a historic financial crisis from which the U.S. would emerge as a permanently weakened nation.

If the U.S. defaults, the damage from the Corona pandemic could worsen.

Republicans in Congress have so far refused to raise the debt ceiling.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

𝗘𝗹 𝗦𝗮𝗹𝘃𝗮𝗱𝗼𝗿 - The first country in which bitcoin ($BTC-EUR (+0,21 %)) has been recognized as a legal currency is now going a step further and buying the "dip." The President of the Central American country Nayib Bukele announced via Twitter this Monday morning that the country purchased 150 BTC (~$6.75 million) and now holds a total of 700 BTC (~$31.5 million). Furthermore, Bukele shared of the "presidential notice" that you can't be beaten if you buy the dip. Within the country, there has been increased unrest in recent months due to the recognition of Bitcoin as a currency and the use of government funds to purchase the cryptocurrency. The rating agency Standard & Poor's Global also stated that the purchase of Bitcoin has a direct negative impact on the country's credit rating. Furthermore, S&P states that these actions reduce the country's chances of receiving international funding.

Last week I presented you a small comparison of three well-known fast food stocks ✅

There was already a question in this post why Restaurant Brands International was not included. The reason for this is that I would like to introduce RBI from Canada to you in more detail 🍔🇨🇦

The company was created in 2014 through the merger of Burger King and the Canadian fast-food chain Tim Hortons.

The company also owns the U.S. chain Popeyes Louisiana Kitchen 🍗

RBI currently operates over 24,000 stores worldwide with 6,000 employees (excluding franchise employees) in 100 countries according to the franchise model 🌎

Facts: 🏆

- Sales growth (2012-2020) p.a.: 12,25%

- Profit development (2012-2020) p.a.: 19,36%

- Dividend per share (2020): 3,64%

- Dividend yield (2020): €1.79

- Performance 1 year: +19.93% 📈

- Performance 5 years: +36.75% 📈

I currently do not have RBI in my portfolio as I have McDonalds from the fast food sector in my portfolio and in my opinion they have a deeper moat and are more solid than companies 🏰

Likewise, I see it risky that RBI has had a dividend payout ratio of over 100% for the last four years (2017-2020) 👎🏽

Do you have Restaurant Brands International in your portfolio ? 🍔🍗🍟

Meilleurs créateurs cette semaine