Generali: Start-to-finish pension policy (since 01.12.2004)

Hello everyone and good morning,

I would like your opinion on a pension policy that my parents took out on 01.12.2004 (luckily in good time!) - why is this important? Because the pension policy remains tax-free if it was regularly saved before 01.12.2004!

As of 01.01.2005, the greedy and insatiable state has made a change to the law in which pension policies are taxed (we all agree anyway that this is absolute crap and that it will come back like a boomerang, because pensions aren't enough...oh well).

I digress.

Well, I ONLY have this pension policy because it's tax-free in the event of retirement or a lump-sum settlement, which is why I hold it. Otherwise, of course, I would have thrown it in the garbage can long ago. I generally consider funds to be junk from times gone by anyway, when ETFs were not yet so well known for everyday use by the average Joe. I would of course switch to well-known ETFs, but of course Generali also has to take money out of my pockets with DWS, what else?

Sorry, I'm rambling again, I'm getting too excited now though.

I can switch funds free of charge and there are no tax-damaging changes due to a fund switch.

To my question:

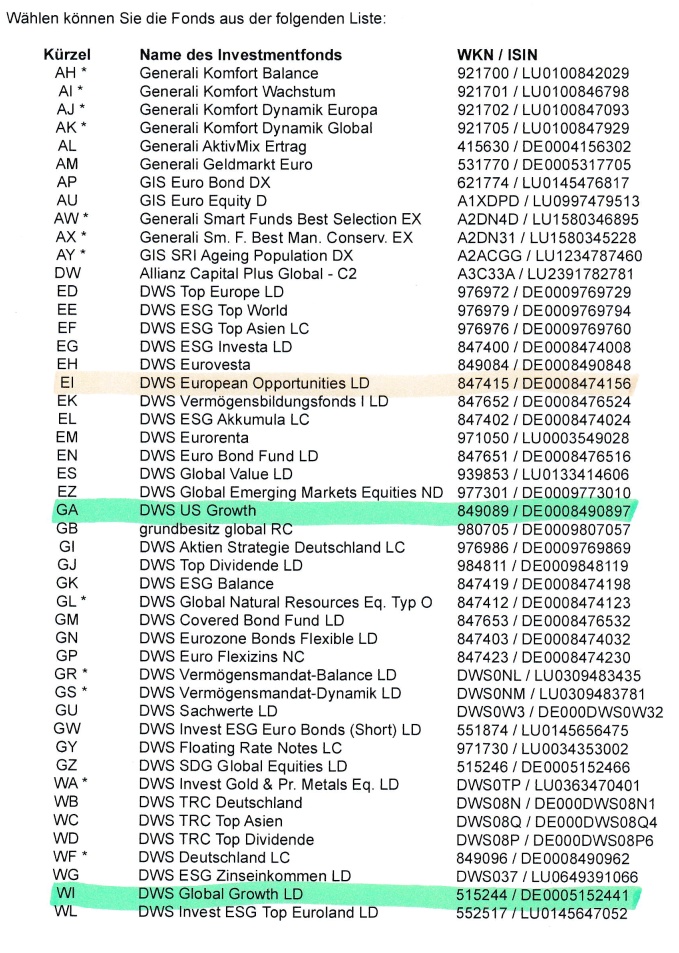

- I currently have the "DWS European Opportunities LD" (847415/ DE0008474156) $DE0008474156 (+0 %) currently at €38/month, started 20 years ago at €20/month. I cannot change the dynamic increase of 5% p.a.. However, I would like to change the current fund because it has been underperforming the MSCI World for so long.

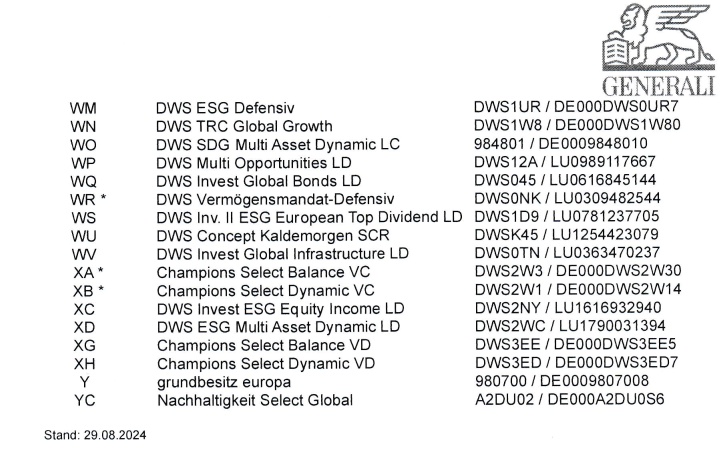

- Here is an overview of the funds I can switch to, most of them are absolutely garbage, they really make my hair stand on end:

Which ones would you switch to, I've already compared a few with extraETF, and then used the iShares Core MSCI World as a benchmark:

- My favorite would be the "DWS US Growth LD" $DE0008490897 (-0,97 %) simply because the figures speak for themselves and I believe in the US economic market. Or do you see a better fund?

I would appreciate any constructive tips, thank you! :)

(P.S.: have a look at the $DE0008474198 (-0,03 %) ....such a piece of junk... and many more in the listing look so crappy :D)