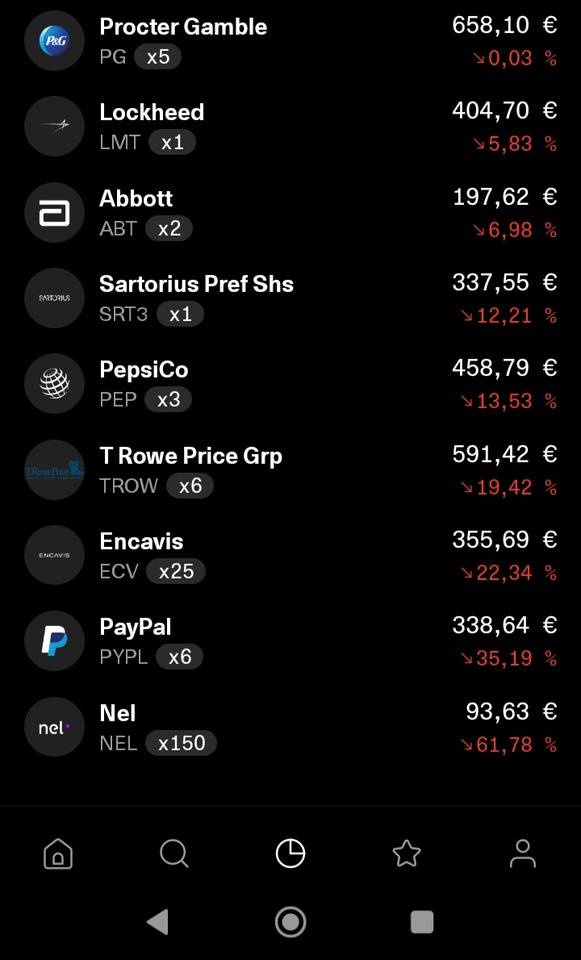

To make the distorted picture caused by all the +100% rewinds a little more realistic, I would like to share with you the biggest current flops in my portfolio. Don't let me dissuade you from saving.

My portfolio (approx. 32k) comprises 60% MSCI World and 40% individual stocks (17 positions). In the future I would like to increase the ETF share to about 75% and reduce the number of individual positions somewhat. Overall, I am relatively lucky that the larger individual positions are now all in the black and my flops are therefore not quite as significant. Nevertheless, it is of course not a nice feeling to lose your money.

Flop 3:

$NEL (-0,08 %) I opened this position as a punter hoping for the next Tenbagger. Beginner's mistake. I learned from it.

The probability that this stock will turn green again is of course low, but as I only went in with relatively little capital in the first place, the loss is bearable. I will stay invested until the bitter end. Whatever that may look like.

$PYPL (-0,25 %) I think enough has been said about PayPal here on the platform in recent weeks. It's probably a bit like crypto at the moment: you either believe in it or you don't. I'm with the former. The competition from Apple PayPal, Amazon Pay and the like is there, of course. However, little has changed in my investment thesis since I started. Sales and profit growth are still intact. The company is in a solid financial position and I am also hoping for positive impetus from the new CEO. I am currently considering buying a few more shares at the favorable price.

$ECV (+0 %) The desire to participate in the German energy transition was behind this. Due to the fall in energy prices, the stock has been hit hard, but I'm still going to stay in it.

I also like investing in German stocks, even if feelings such as a little bit of patriotism have no place in investing.