My forecast for Zinssenkung🇺🇸:

🟢Current forecast: September 24

🔴Previous forecast (October 23): July 2024

Rationale:

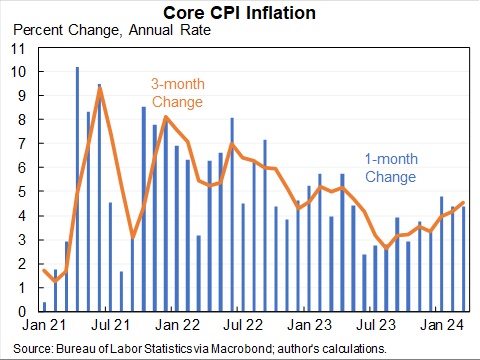

The inflation indicates that the FED will refrain from cutting interest rates for the time being. The estimates for an interest rate cut in June have fallen significantly and I expect that the FED at the earliest in September could take action.

The core inflationfor the March amounted to around 3,8% and is clearly above the estimates. In general, current inflation leaves no scope for interest rate cuts, as a normalization of the CPI data are low, which of course makes an interest rate hike unlikely in the foreseeable future.

Especially the sectors healthcare and transportation are contributing to inflation remaining at a high level overall. High petrol prices, which are driven by high oil prices ($IOIL00 (+0,37 %) ), the FED is basically only able to maintain the current interest rate. The oil prices have been driven up by EIA reports and geopolitical tensions, such as the Ukraine conflict and of course the Houthi rebels have added significantly to this.

Given these circumstances, a rate cut in June is unlikely. In my opinion, July is also unlikely to see no interest rate cut either. September is therefore the most likely time for a relaxed easing.

What is important to consider now? I would focus strongly on commodities and US elections.