Every success has its learning phases. In 2018, 80% of my portfolio was in the red and I thought to myself: "My goodness, have you burned through your money?" I had existential fears and feared that I'd blown my wife's and my own money. For two years, I researched and read intensively every day about what Bitcoin and cryptocurrencies actually are. I continued to invest and understood the future potential of Bitcoin & Co.

I am still convinced that we are only at the beginning. Even if the current phase is no longer a pre-sale market, it is still a "young" market that will develop into an established market in the coming years.

I can only recommend it to everyone: Read what Bitcoin is, understand what cryptocurrencies are, and recognize the differences! Start with small savings rates and don't stand on the sidelines and just watch. A portfolio that includes a portion of cryptocurrencies is certainly a good thing.

Unfortunately, I listened to my brother-in-law in 2010 and didn't get into Bitcoin.

Of course, I can't say whether I would have sold prematurely or lost everything due to a hack, but I would have liked to have taken the learning effect with me at the time. I would certainly have understood the Bitcoin Cycle better and managed it better from 2017 onwards.

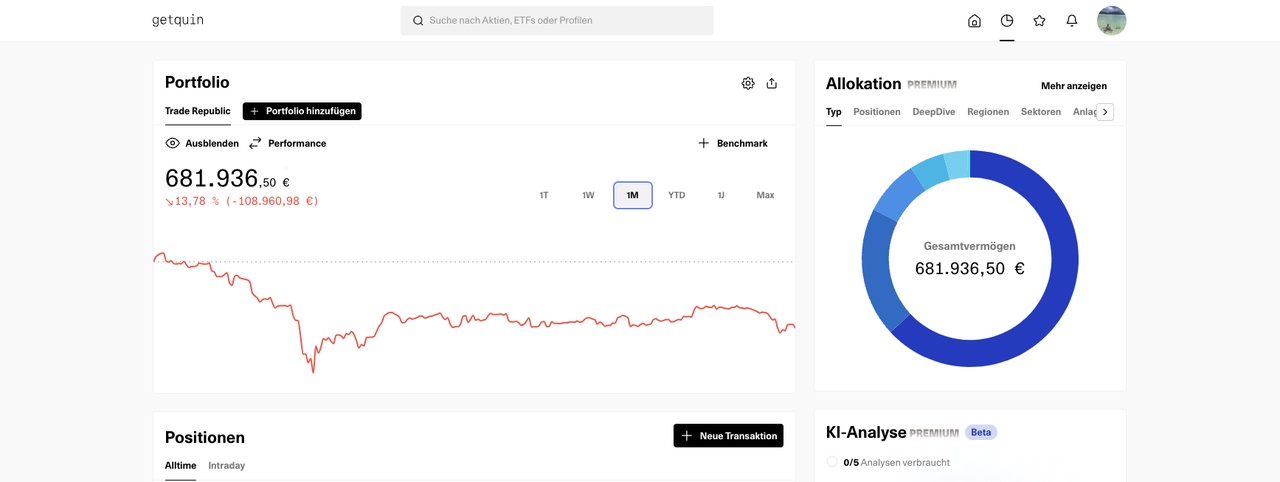

P.S.: Yes, I love cryptocurrencies, and the monthly downward trend is quite severe, but you learn immensely when you recognize the potential. This is the only way to act according to the motto "Never Sell in Red" with Bitcoin.

With this in mind, I wish you a good rest of the week.

Your Banani

$BTC (-0,37 %)

$ETH (-0,84 %)

$ADA (-2,75 %)

This is not investment advice!