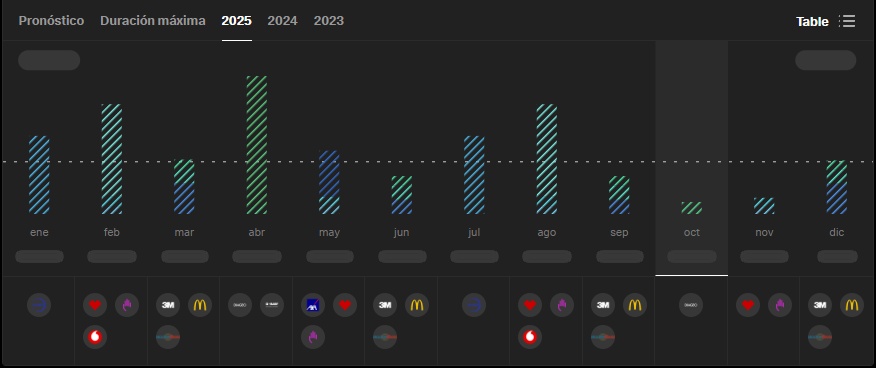

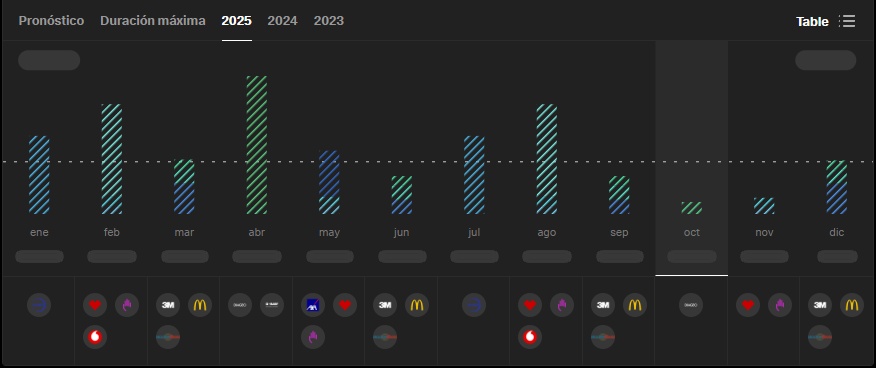

I'm considering buying British American Tobacco and W.P. Carey to boost my #dividends for October and November.

What are your thoughts on $BATS (-0,41 %) and $WPC (-1,36 %) ? Is now a good time to buy, or are there better options available?

I'm considering buying British American Tobacco and W.P. Carey to boost my #dividends for October and November.

What are your thoughts on $BATS (-0,41 %) and $WPC (-1,36 %) ? Is now a good time to buy, or are there better options available?