Active ETFs - really outstanding, but what are the risks?

Hello everyone -

I added the active ETF to my portfolio last year $216361 (-0,08 %) last year and am continuing to build up the position.

Who of you has experience with such active ETFs. In my view, these track an index but aim to outperform it by having fund managers develop specific strategies for targeted deviation in order to regularly adjust the fund composition.

One advantage for investors is that active ETFs are cheaper than traditional actively managed funds that are not traded on an exchange.

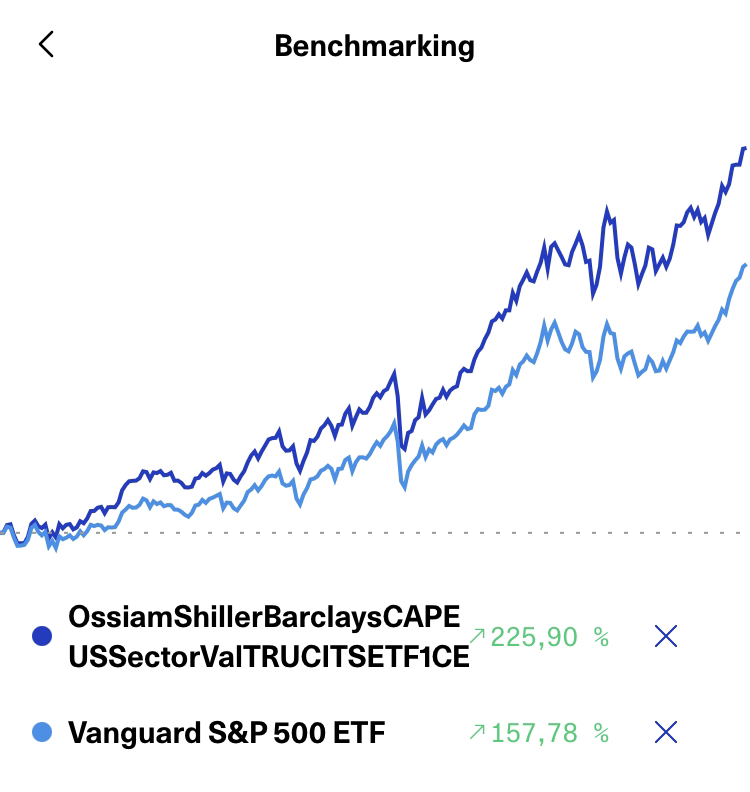

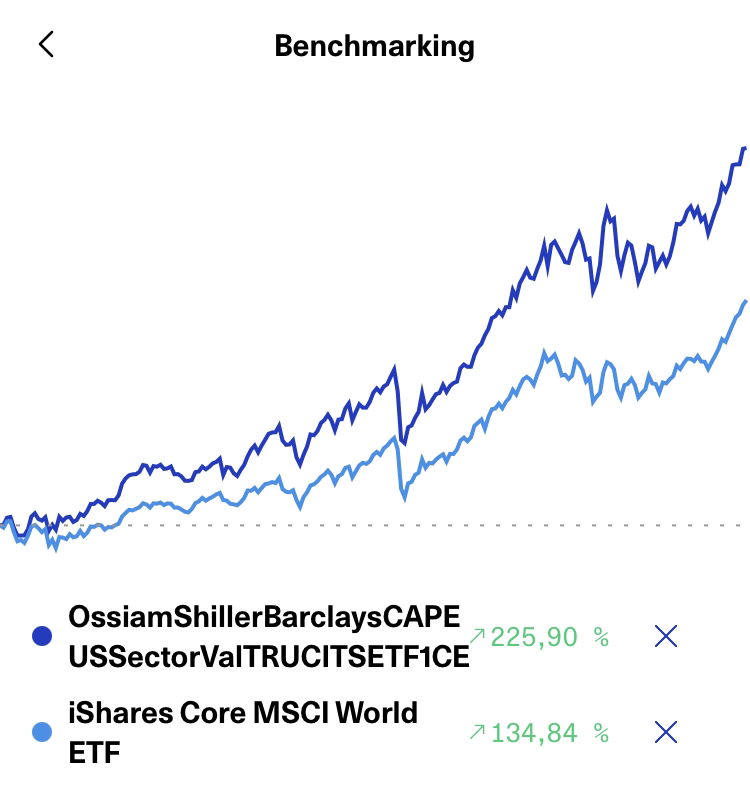

When I look at this comparatively, active ETFs do surprisingly well and deliver really good annual returns. In addition to Ossian, active ETFs are also available from Fidelity International, Invesco and JP Morgan Assets.

The benchmark with the MSCI $IWDA (+0,23 %) is also impressive.

Addition: Thanks for the first comments; therefore also getquin benchmark to $VUSA (+0,32 %) ...

What risks do you see with active ETFs compared to passive ones?