Since March $AMD (+4,65 %) fallen from 227 $ to 118 $.

That is a fall of 49 % in less than 8 months.

Continued sales growth of 17% year-on-year, EPS growth and free cash flow of 67% year-on-year.

I think any price below $120 with a 49% decline (even now at $126 ) is a great long term opportunity.

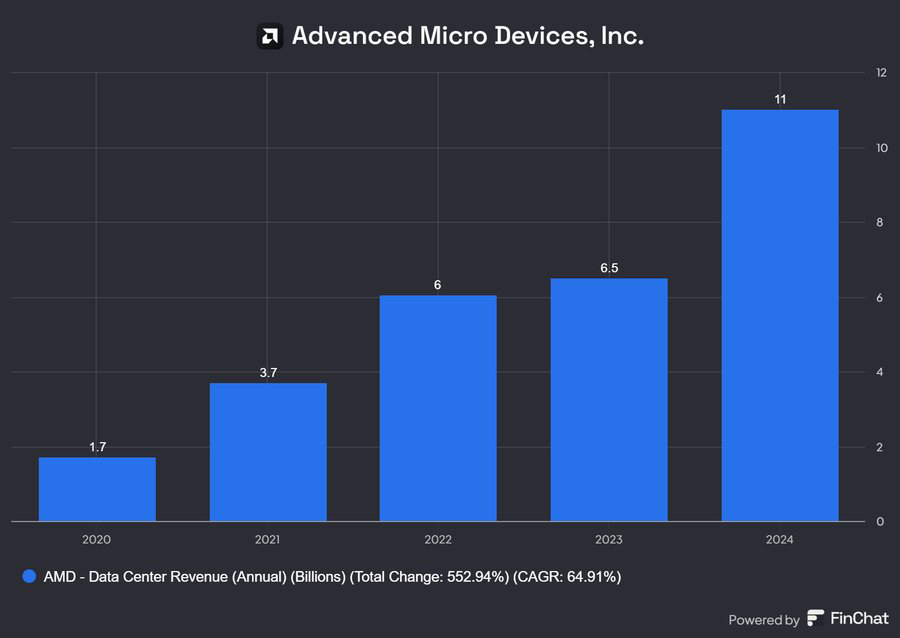

The revenue of $AMD (+4,65 %) in the data center space has grown at an impressive CAGR of 64.9% since 2020. 🚀

$AMD (+4,65 %) ubd $NVDA (+3,72 %) now also own a stake in Elon Musk's xAI -- capitalizing on the scaling of xAI and the accompanying demand for advanced GPUs to work with $MSFT (-0,33 %) GPT, $GOOGL (+1,66 %) Gemini and Claude from Anthropic (backed by $AMZN (+0,06 %) ) to compete with

AMD Instinct™ MI300X GPU accelerator :

are designed for superior performance in generative AI workloads and HPC applications. AMD's CDNA3 architecture is specifically optimized for high performance computing (HPC) and data centers, differentiating it from the RDNA architecture, which is more focused on gaming and consumer graphics. The MI300X offers 19456 cores (stream processors) and 192GB ECC memory and therefore has a significantly better price-performance ratio than the competition.

$AMD (+4,65 %) CFO : "Last year when I was here, our MI300X revenue was 0. And so it's amazing what we've done as a company in these 2 years from 0 to about 5 billion dollars in 2024. That's a great achievement."

Rajat Monga from Microsoft talks about the partnership between $MSFT (-0,33 %) with $AMD (+4,65 %) :

"The hardware is great. The chips are very competitive and usable and with the ever-growing software stack, it's great."

"I've seen the ROCm stack grow from nothing to where it is today and it's amazing how far it has come. We went from a model running on a different architecture to this one (AMD) with really good performance in a matter of months."

Rajat Monga from Microsoft explains the pros and cons of the MI300 from $AMD (+4,65 %)

- Advantages

Great support

Fast improvement

Lots of memory

Higher memory bandwidth

Helps with additional KV caches

- Disadvantages

Newer software stack

Software has rough edges

$MSFT (-0,33 %) - President Brad Smith says data centers will be responsible for 10% of the global increase in power consumption over the next decade.

Jensen Huan ($NVDA (+3,72 %) ) said new data centers will require up to 1 million GPUs.

$AMD (+4,65 %) and $NVDA (+3,72 %) will deliver; $MSFT (-0,33 %)

$AMZN (+0,06 %) , $GOOGL (+1,66 %) , $META (+2,35 %) will buy.

I think you just have to be patient with $AMD (+4,65 %) just have patience, 2025 will surprise positively and the share price will follow. ✌️🚀