Nemetschek Group Stock Analysis

Hello everybody,

Nemetschek has clearly won in my last survey on the desired company presentation, which is why I will give you a short overview of the Nemetschek Group ($NEM (+1,42 %)).

Have fun reading!

Note: This is my second slightly larger post, I would still appreciate feedback and thank you for the positive response to my last post.

Overview:

Company Presentation

Moat and company management

Quality - Scoring

Growth - Scoring

Valuation

1. company presentation Nemetschek Group

The Nemetschek Group is a German-based provider of software solutions for the construction industry and describes itself as a pioneer for digital transformation in the AEC/O industry and the media sector. Founded in 1963 by Prof. Georg Nemetschek, the Nemetschek Group today employs around 3,600 experts worldwide. 🇩🇪

The more than 7 million users (customers) of this software are architects, civil engineers, planners, landscape architects and many more. .

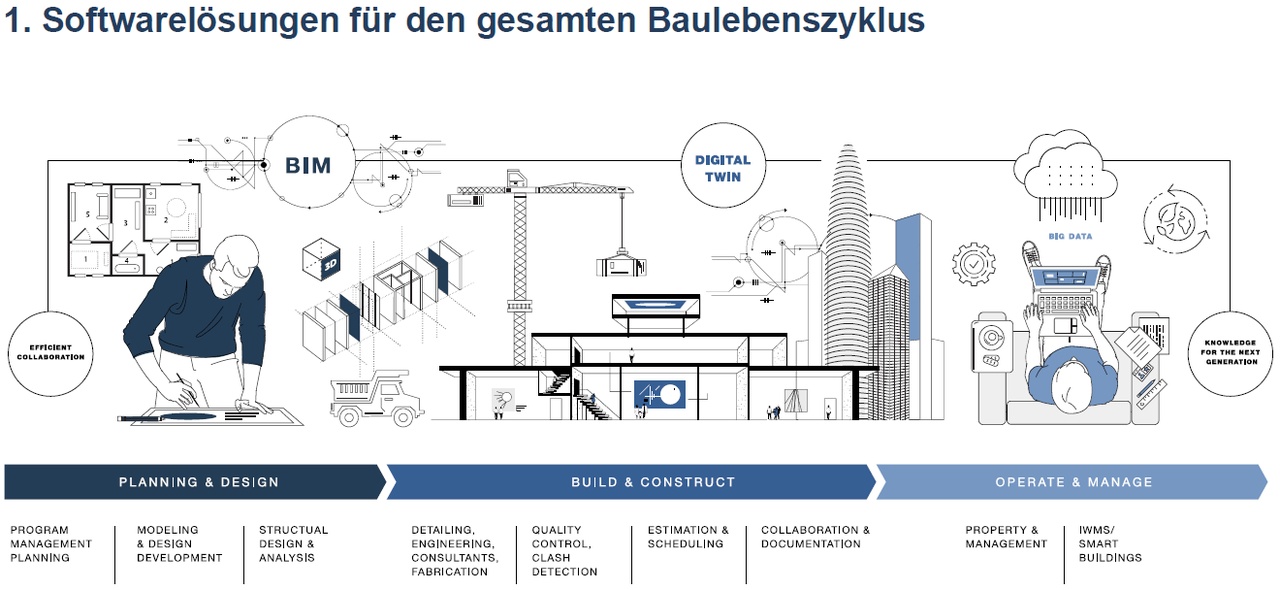

The intelligent software solutions cover the entire life cycle of construction and infrastructure projects and lead their customers into the future of digitalization. 🏗

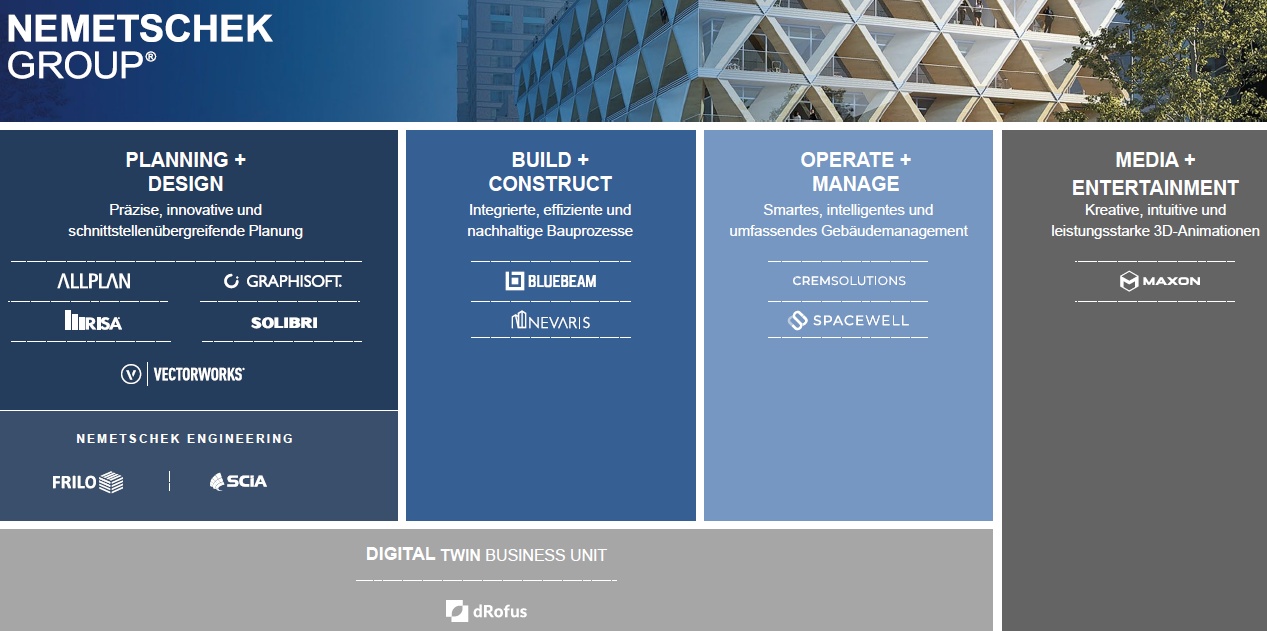

Here, the solution is divided into 4 customer-oriented segments (Planning+Design, Build+Construct, Operate+Margin, Media+Entertainment) with 13 strong brands, with the Planning+Design segment comprising 7 brands. (s. Figure 1 in the appendix)

As an inconspicuous "small" German company, Nemetschek is a leading global player in an inconspicuous industry. With more than 80 locations and users in 142 countries, broad diversification is ensured (21% Germany, 30% Europe ex. DE, 39% America, 10% Asia/Pacific).🌍

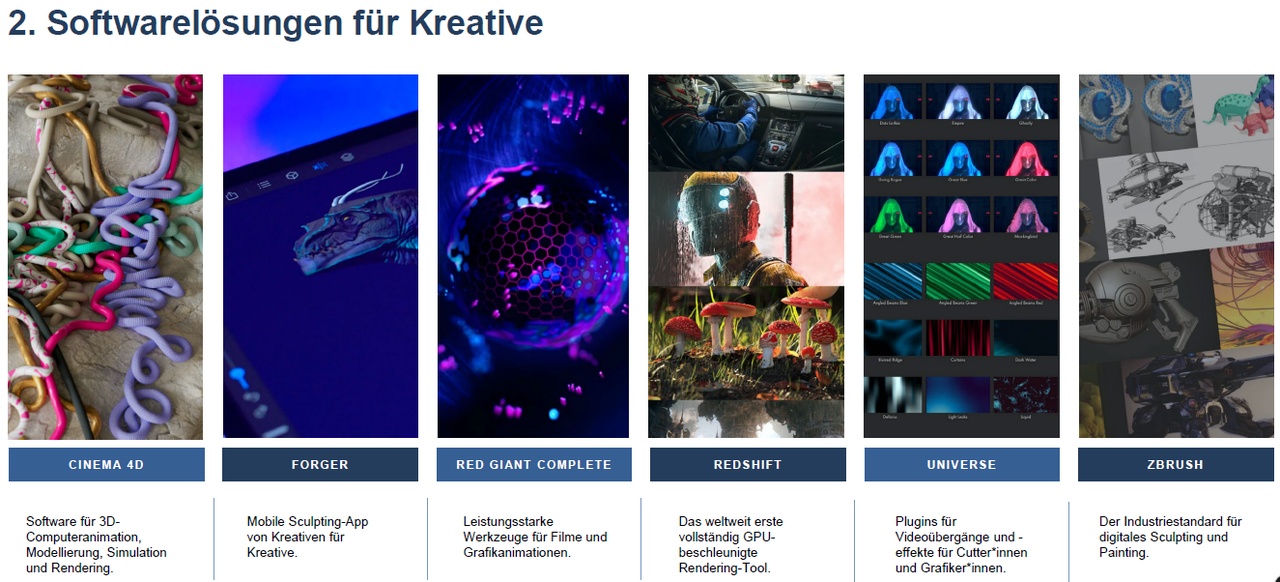

Nemetschek is the market leader and offers software for the entire construction life cycle and has pursued this holistic approach from the very beginning. And they also have a wide range of products for creative minds.

(s. Appendix Figure 2&3).

2.moat and corporate governance

Nemetschek has been led (CEO) by Frenchman Yves Padrines since March 01, 2022. His strategic focus is on the further conversion to subscription and SaaS, the strengthening of the go-to-market approach, the introduction of innovations, the expansion of M&A and venture activities, and the optimization of operational processes within the group.

The following strengths can be identified:

- Attractive end markets

- Growth potential through structural growth drivers such as the low level of digitalization in the construction industry

- Structural megatrends (urbanization, infrastructure, sustainable construction, smart/green buildings)

- High barriers to market entry

- Unique market position

- Leading product portfolio, close proximity to customers, pioneer in Open BIM (in a data exchange strategy according toOpen BIM, data is exchanged using open information models)

- Attractive business model

- High percentage of recurring revenue, high profitability and return on investment (more later)

- Solid financial position

- Healthy balance sheet, high equity ratio, long-term oriented anchor shareholder

- Value-creating acquisitions

- Focus on long-term value creation, track record of value-enhancing acquisitions

Morningstar's economic moat rating (Wide) coincides with my impression that Nemetschek has a large and stable moat.

In the following scoring points, I will only briefly present the key figures and evaluation of these that are important to me personally.

3.Quality Scoring

ROIC 5Y AVG: 16.34% ✅

ROCE 5Y AVG: 26.6% ✅

FCF Margin: 30% ✅

Gross Margin: 54.21%🔰(I prefer >60%)

GuruFocus Profitability Rank: 10/10 ✅

Debt/EBITDA: 0.51 ✅

4.Growth Scoring

Nemetschek drives innovation, open standards and sustainability in the industry and continuously expands its portfolio by investing in start-ups. In addition, 24% of revenue is invested in research and development.

Revenue 10Y CAGR: 16.42%✅

FCF 5Y CAGR: 17.05%✅

EPS 5Y CAGR: 1.36%📛

5.rating

In the Morningstar Valuation Rating, Nemetschek is currently trading at a fairly valued price.

In my personal valuation scheme, Nemetschek is unfortunately not a buy for me at the moment.

The FCF Yield of 2.25% is below the 5Y Average of 2.93% and also far below the S&P 500 Earnings Yield and the US 10Y Treasury Yield.

The Market implied FCF Growth Rate for the next 5 years is 12.64% and thus below the past 5Y FCF CAGR of 17.05% --> positive!

I do not want to go further into the valuation here :-).

Thanks for your feedback. What are you missing in this (short) performance? What is your opinion about the Nemetschek Group?

Feel free to share the article if you like it!

Sources:

Key figures sources vary, ask if interested :-)

Nemetschek Group Annual Report

Nemetschek Group company presentation

https://ir.nemetschek.com/websites/nemetschek/German/100/equity-story.html

https://ir.nemetschek.com/websites/nemetschek/German/0/investor-relations.html

https://investor.morningstar.com/quotes/0P0001LSPH

-Tom