Simplify your portfolio?

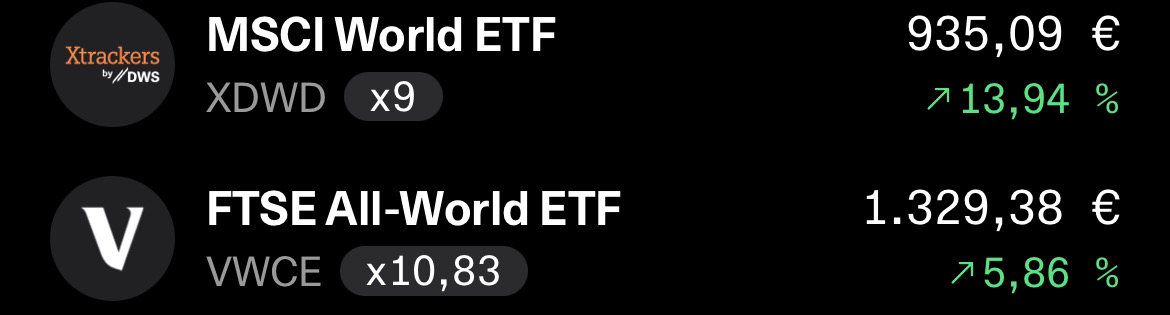

Hi, I have been moving my main ETF from the $XDWD (+1,02 %) to the $VWCE (+0,98 %) MSCI.

As the market wasn't doing so well at the time, I decided to hold the MSCI for the time being until I get a bit more return.

Do you think I should let both run or should I switch the $XDWD (+1,02 %) into the $VWCE (+0,98 %) put it in the

Greetings and have a nice WE ❄️