Hello :)

I can't say yet if there will be a comeback here - but now I have some time to briefly introduce a trade I'm in or in which I'm increasingly going into should I get more bullish signals.

Currently I am still holding a $TSLA (+2,96 %) long from May $INTC (+1,05 %) from September (even if we are still a bit away from my entry here). $NTR (+0 %) Long from July (it should move!) and since October a $BA (+1,19 %) long - which I am now presenting!

Why is that $BA (+1,19 %) ? Well, a colleague at work has told me several times how bad the company is doing and that (to exaggerate) he expects it to go bankrupt next year. So I thought I'd take a look at the chart and lo and behold I found it quite attractive for a long ;).

As you know, I don't pay much attention to fundamental news, so I'm not interested in the bad news. With a few exceptions, everything is priced in before we hear about it and then I can see it in the chart anyway.

Briefly on the basic situation:

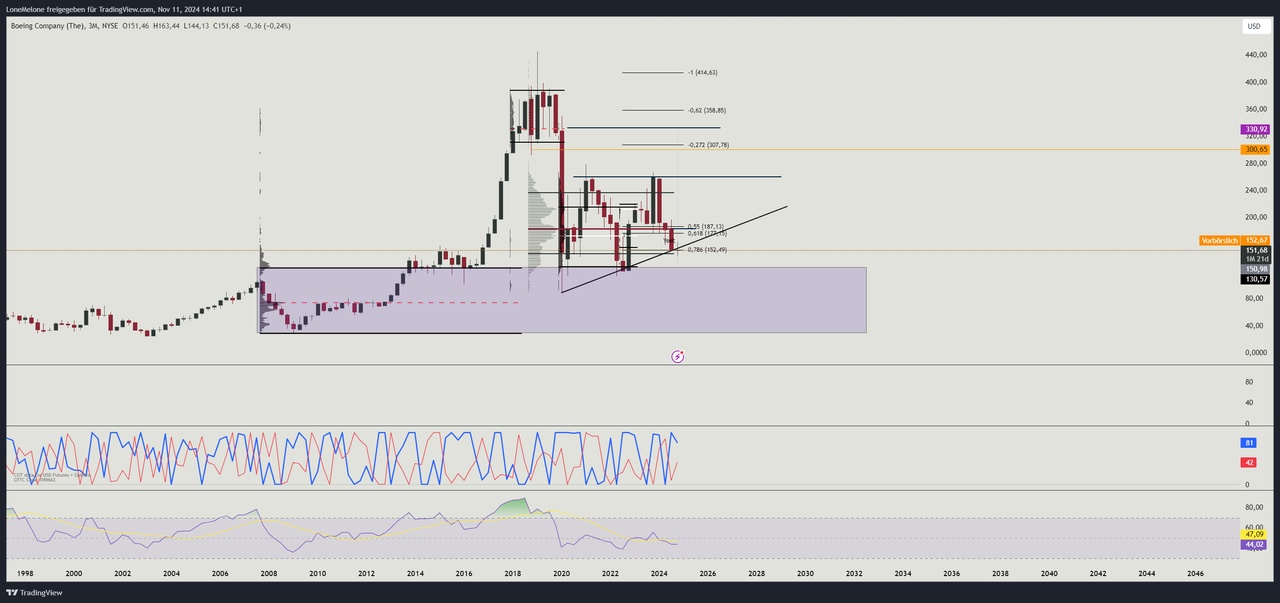

Corona crashed to 88$ then a nice rebound to 280$. That would give us our range for the last 3-4 years. Even due to Corona and the latest NASA news etc., we have never broken our breakout zone from the all-time high. We never broke our breakout zone from the all-time high. This means that we have always remained bullish in the monthly structure and higher.

What is my basic target for this trade? Breakout zone from Pre Corona. So 300-400$.

Why now ?

We are basically at the lower end of the range. That means basically in the discount zone. - Anyone who knows me knows that I only take trades from a discount zone - in other words, I always trade anti-cyclically and on trend changes after a clear confirmation. In other words, I don't buy into a bearish candle at random, but after we have already seen a structural change in the order flow.

In addition, we have reached a POC, i.e. a point of control (point of highest volume in a range). We still have a nice POC a little further down at around 133$ but that would break the order flow which would be so bearish that the trade is irrelevant for me anyway. (There is no perfect setup anyway).

We are currently accumulating nicely at the trendline and have obtained a bullish structure on the daily chart. At the beginning I said that I am not yet completely convinced - this is because we are currently still at the breakdown point - so we could expand downwards at any time with a strong downward impulse. However, if we now break the 160 mark again impulsively, this is a clear signal for me that the share wants more and I would then buy even more into my position on a correction.

The first and most difficult target is the 180$ mark. Here we have the point of control of the downward movement that came about after the last test of the range highs at 260$. Above 200 at the latest is practically no man's land and price discovery up to 260$.

So I set my stop loss at 180$ to +-0 (breakeven). If we break and close the range highs at 260$ impulsively with a weekly candle, the path to the target at 300$+ is clear.

Why do I think the trade is good at the moment and I am already in it without having broken the 165$ .... well, I just think the chart is good and wanted to open halfway. A lot comes with time simply by feeling and I have the chance here to set a tight stop loss and thus get a comparatively high R/R with high leverage. So I have a tight invalidation level. Earnings are now over and the news is therefore limited.

It is important to mention that my entry is a RISK ENTRY and a confirmation for me is actually only given from the break of 160$. Before that, anything can happen and it is normally just a watchlist position for me. (So exception)

Enclosed you will find my monthly, weekly and daily charts. Questions as always in the comments. I have probably written complete gibberish again.

PS. $DIS (+0,13 %) is currently on my watchlist.

If you have any great stocks on your watchlist - check them out. Due to $TSLA (+2,96 %) has freed up some liquidity, so I can enter into a few new swing trades.

Greetings Melon!