Novo Nordisk share - start of a correction at the all-time high. Increasing competitive pressure from Eli Lilly and Viking Therapeutics. Product pipeline and takeovers.

As always in web article format with pictures and an interactive live chart: Novo Nordisk Aktie

Hello everyone,

Novo Nordisk is the winner of the Aktienanalyse im März 2024. With over 21 percent of the votes you Novo Nordisk was chosen. The suggestion for this share came from the community in February.

Novo Nordisk share (ISIN: DK0062498333 / WKN: A3EU6F)

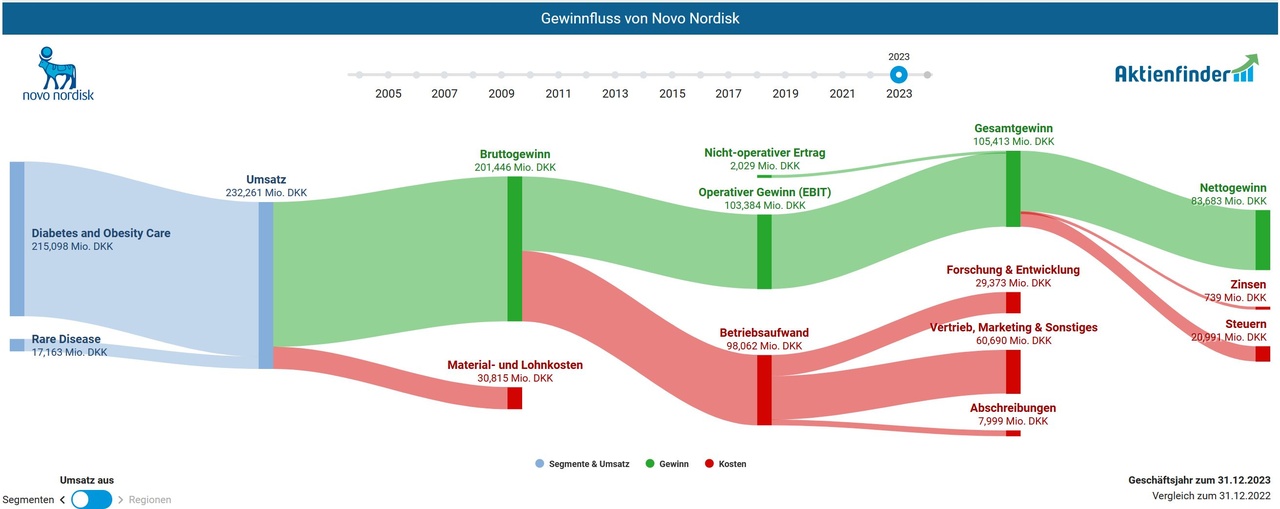

Novo Nordisk (WKN: A3EU6F / ISIN: DK0062498333) is a global leader in the healthcare sector specializing in diabetes care and Obesity Care. Diabetes and Obesity Care are responsible for 92.6% of Novo Nordisk's sales in 2023. Novo Nordisk is active in the research, development and manufacture of pharmaceutical products worldwide.

With the fight against chronic diseases such as diabetes, obesity and rare diseasesNovo Nordisk has established itself as a market leader in these areas. At the same time Novo Nordisk is Europe's largest and most valuable pharmaceutical group in terms of market capitalization.

The pharmaceutical group was founded in 1923 and is headquartered near Copenhagen in Bagsværd (Denmark).

CEO of Novo Nordisk is Lars Fruergaard Jørgensen. He took over the company in January 2017, utilizing his many years of experience in the pharmaceutical industry. Jørgensento further establish Novo Nordisk as a leading company in the healthcare industry.

Novo Nordisk share real time price chart

Novo Nordisk is close to its all-time high and continues the strong growth since 7 years.

Novo Nordisk latest news and announcements

The hype surrounding the weight loss injection Wegovy with the active ingredient semaglutide began in Hollywood, with Kim Kardashian and Elon Musk using the product to lose weight. Sales led to ever higher all-time highs. Ozempic for type 2 diabetics also contains the active ingredient semuglutide. Driven by the two weight loss drugs Ozempic and Wegovy, operating profit rose by over 44 percent in 2023, making Novo Nordisk the most valuable company in Europe.

Awiqli shortly before EU approval

The Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) has issued a positive opinion on the approval of Awiqli for the treatment of adults with diabetes, referring to the results of the ONWARDS clinical trial program (Phase 3a study). With Awiqli, it is possible to reduce the number of injections required from 7 to just 1 per week and thus significantly improve the treatment methodology. The drug has not yet received final approval, as the European Commission has not yet given its consent, although it generally follows the EMA's recommendation, which is already available.

Zepbound from Eli Lilly

The competition between Novo Nordisk and Eli Lilly is currently at its peak. For the first time since the launch of Zepbound in December 2023, Eli Lilly has recorded more prescriptions in the USA than Novo Nordisk, which has been on the market for two years.

VK2735 from Viking Therapeutics

The Californian biotech company Viking Therapeutics is currently testing its new drug VK2735 in a phase 2 trial, which is designed to burn body fat five times faster than Wegovy. Depending on the dose, 140 test subjects were able to lose between 9 and 15 percent of their body weight in 13 weeks. Wegovy promises a weight loss of 15 percent in 18 months.

New miracle drug Amycretin

Amycretin is the new hope from Novo Nordisk. The bestseller Wegovy (semaglutide), which has been approved since 2022, Zepbound from Eli Lilly and VK2735 from Viking Therapeutics are drugs that have to be injected. Amycretin is a pill that is convincing in the Phase I trial. After 12 weeks, the study participants were able to lose 13.2 percent of their body weight, compared to 6 percent for Wegovy over the same period.

A pill with twice the effectiveness, without the disadvantages of the previous obesity drug Wegovy, could revolutionize the weight loss industry and would be the drug of choice. A pill would be more acceptable than weekly injections over a period of many months. It will still take some time before approval is granted.

A few hours ago Reuters the success of a Viking Therapeutics study on the new weight loss pill. The Viking Therapeutics share price rose by 10 percent following the announcement. Here, too, it is clear that the market is highly competitive and that the competition is not sleeping.

In 2023, Novo Nordisk generated sales equivalent to around 28.8 billion euros in the diabetes and obesity care segment. Analysts from JPMorgan estimate the GLP-1 market (diabetes and obesity) for weight loss products at 100 billion dollars by 2030 and thus expect strong growth in the industry.

Cardior Pharmaceuticals acquisition

The biotech start-up Cardior Pharmaceuticals Ltd.announced on Monday in einer gemeinsamen Meldung the takeover by Novo Nordisk for 1.025 billion euros.

Cardior is a spin-off of the Hannover Medical School (MHH). The therapy for heart disease and heart failure developed by the start-up is currently in a Phase II study. Novo Nordisk is to accelerate development, is the ideal partner for Cardior and at the same time strengthens its own cardiovascular pipeline.

With the development new products and the expansion of its own portfolio through acquisitionsNovo Nordisk confirms its growth growth plans.

Facts, figures and data

Annual report 2023 and outlook 2024

On 31.01.2024 Novo Nordisk publishes the Annual Report 2023. In the annual review, Novo Nordisk confirms its growth trajectory and provides an outlook for 2024.

The most important figures summarized:

- Sales grows by 31 percent to 232.3 billion Danish kroner in 2023

- Operating profit increases by 37 percent to 102.6 billion kroner

- Net profit increases by 51 percent to 83.7 billion kroner

- The dividend increases to 9.40 Danish kroner per share. Dividends are paid out in March and August.

The outlook remains strongthe growth rates are estimated to be more moderate due to increasing competition from Eli Lilly. Sales are expected to increase by 18 to 26 percent and operating profit by 21 to 29 percent.

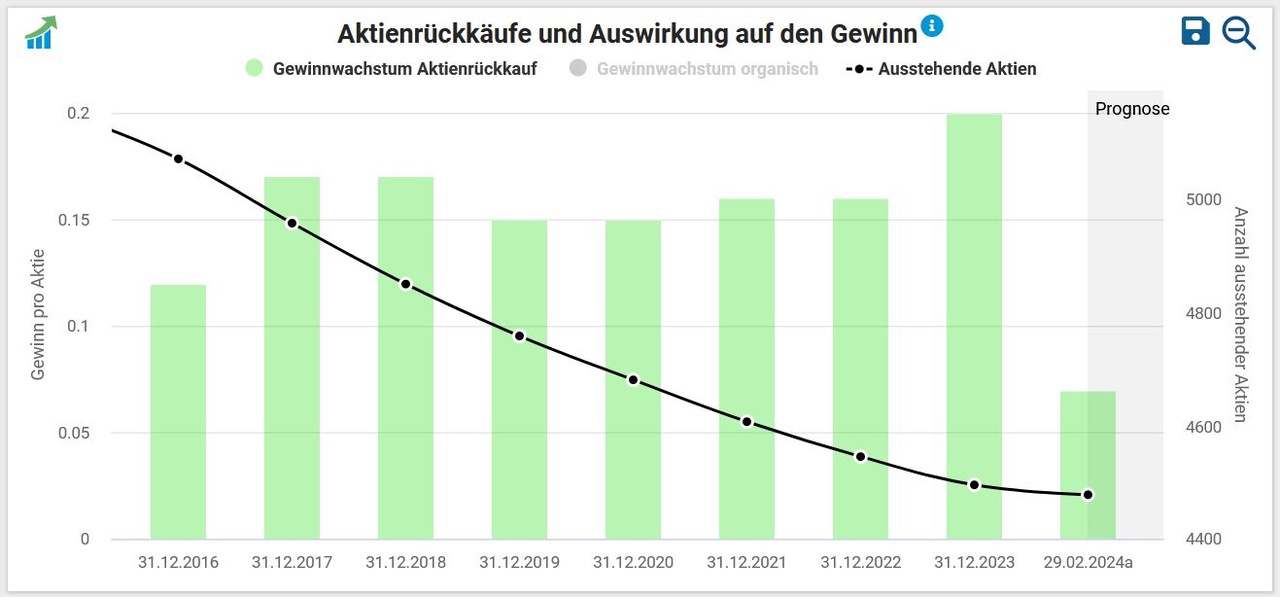

Share buyback

Novo Nordisk has been for over 20 years regularly share buybacks for 20 years. This strengthens the share price on the one hand and increases profit growth on the other.

A share buyback program is also planned for 2024. share buyback program in the amount of 20 billion euros has been announced.

Novo Nordisk's profit flow

The Profit flow 2023 presents the quarterly figures and illustrates the company's specialization in the Diabetes and Obesity Care segment with over 92 percent of sales.

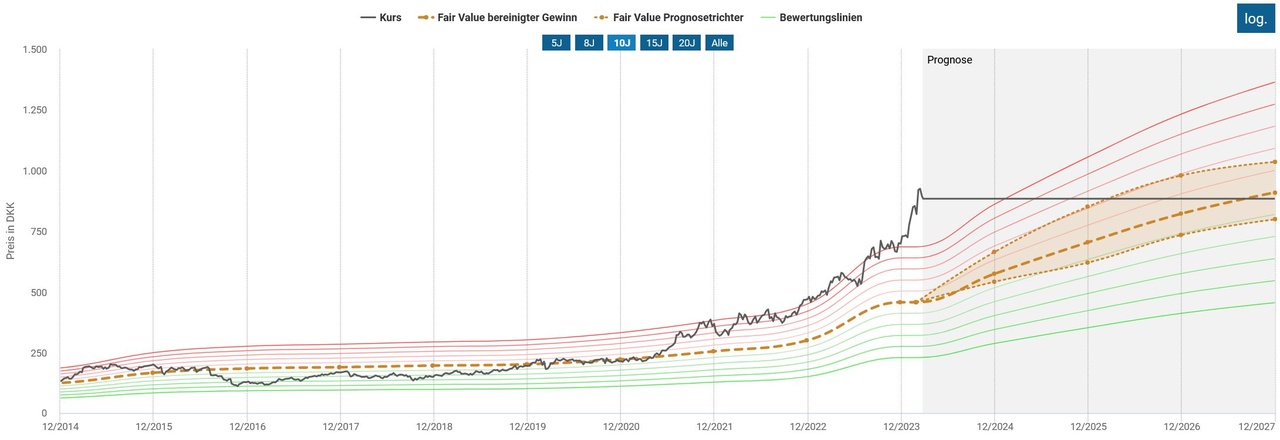

Fair value

Based on the reported business figures for 2023, the Aktienfinder.net analysis tool gives a calculated fair share price of DKK 456. The share price therefore appears to have already priced in many positive developments and would therefore be overvalued. This is also confirmed by the current P/E ratio of just over 49.

31 analyst opinions on the Novo Nordisk share

The current sentiment of the analysts as of 22.03.2024 on Consorsbank / FactSets is as follows. Out of a total of 31 analysts:

- 17 buy

- 3 overweight

- 8 hold

- 0 underweight

- 3 sell

The price potential for the year is currently estimated at DKK 955 at 7,01 % seen. The average analyst opinion is hold to buy.

Novo Nordisk is at an all-time high and has already risen 28% YTD since January 2024.

Novo Nordisk share chart analysis

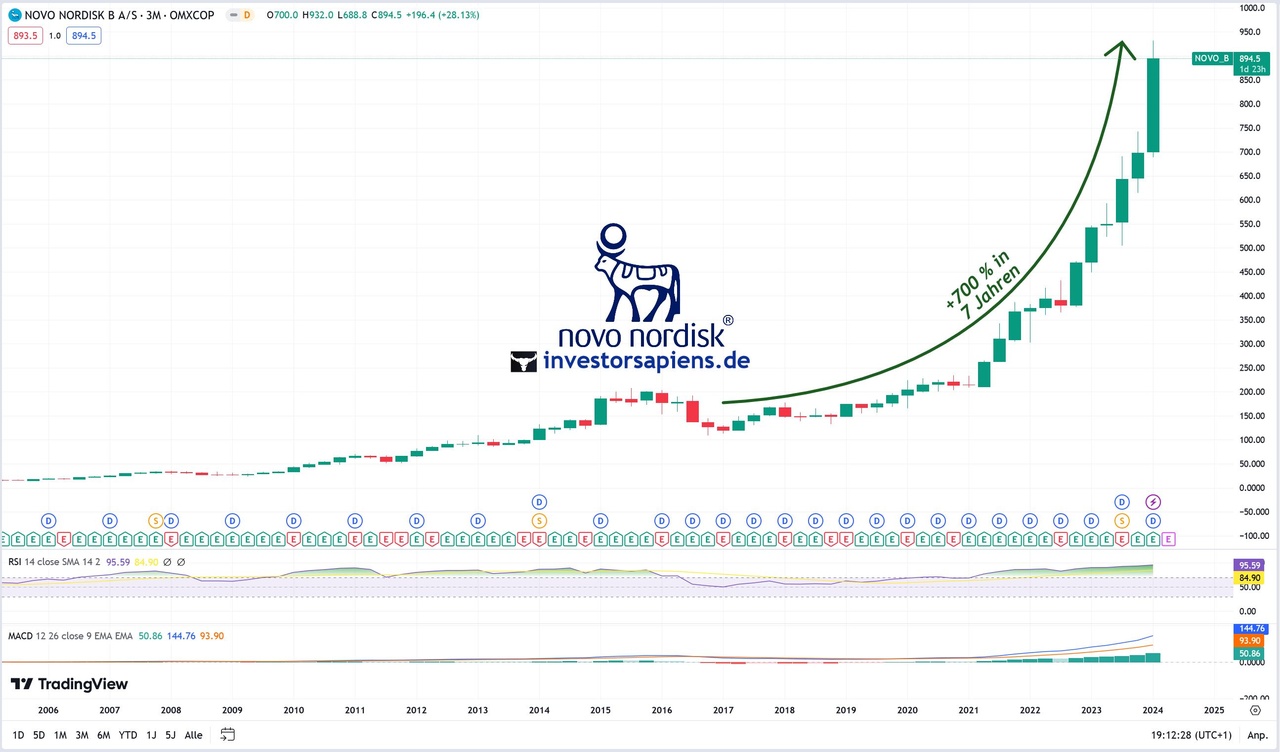

Big Picture (20 years)

In the Big Picture (20-year view, 1 candle = 3 months) Novo Nordisk is in a 20-year upward trend. upward trend. The last real correction was in year 2016. At that time, the share price fell by 50 percent within one year. The reason was strong competitive pressure from Eli Lilly and Sanofi for insulin-products, as well as price pressure from health insurers in the USA.

Growth forecasts, sales growth, operating profit and the outlook were lowered by management at the time.

With trial successes and the approval of Ozempic (Semaglutide), Novo Nordisk made a comeback one year later. comeback. With Ozempic and Wegovy Novo Nordisk was able to increase its sales by 700 percent within 7 years.

The big picture shows the upward trend remains activealthough the indicators are strongly overboughtbut so far signaling no trend reversal.

200% Wegovy uptrend

The 2-year upward trend in the medium-term chart with one candle = 1 week shows the first signs of overheating and stagnating momentum. The trend is still active, the price is even breaking out of the trend channel to the upside, but is beginning to weaken and falls back into the trend channel. Like the big picture, the RSI index shows clear signs of overheating and overbought situation and is starting to correct slightly. correction to fall with the correction. The MACD is stagnating at a very high level and indicates an imminent trend reversal.

If the correction in the medium-term chart is confirmed by mid-April, an extension of the correction must be expected. extension of the correction within the upward trend must be expected. Possible targets:

- Correction target 1 at DKK 808 (approx. EUR 108) at the February low

- Correction target 2 at DKK 740 (approx. EUR 100) at the October high and approx. Fibonacci retracement 61.8 percent

Indicators (RSI, MACD)

The indicators MACD and RSI are already in correction mode on the daily chart. They point to an overbought situation situation. The daily chart shows a double top which also points to a correction. If the correction does not end within a few days, the indicators in the weekly chart will also switch to correction mode.

Overarching the upward upward trend. As long as no negative news fundamentally changes the valuation of the share, the correction targets are possible entry and subsequent purchase prices, provided that one is convinced of the company.

Conclusion Novo Nordisk share analysis 2024

Environment and news

With increasing competitive pressure from Eli Lilly, the diabetes and obesity market no longer belongs to Novo Nordisk alone. This will change the environment for Novo Nordisk more demanding. In the long term, things continue to look good. There are enough products in the pipeline. Novo Nordisk is strengthening its product portfolio with takeovers and acquisitions. Overall, things are looking good for the industry. The market is expected to grow and reach a value of 100 billion dollars by 2030. However, the share currently appears to be highly valued and to have priced in many positive scenarios.

Analysts' sentiment

In view of the strong rise in the share price of 700% in the last 7 years and an increase of almost 30% in the first 3 months of the year, the analysts' forecast target is more cautious. more cautious more cautious. With an average price target of DKK 955, the price potential for the year is currently 7.01 percent. The average analyst opinion is hold to buy.

Novo Nordisk share chart analysis

The chart analysis signals the first signs of weakness in the short-term chart and indicates the beginning of a correction correction within the upward trend trend. In the medium-term chart, the price is at the upper limit of the upward trend and the indicators are overbought.

Overarching the upward trend remains activecorrections represent an entry opportunity.

Outlook

In the long term the diabetes and obesity market looks good. According to JPMorgan, the GLP-1 market is expected to grow to over 100 billion dollars. Novo Nordisk has a good pipeline with promising products and is continuing to grow.

In the short term the share is overbought and is in a correction at its all-time high. The competition is reporting its own successes with comparable products. It is becoming increasingly difficult for Novo Nordisk to maintain its exponential growth, so a correction within the positive long-term trend must be expected. With the information available today, corrections offer an attractive opportunity to enter the share.

As always: No investment advice and no recommendation to act. Purely an informative article.

I appreciate every follow ❤️

$NOVO B

$VKTX (+1,85 %)

$SAN (-0,6 %)

$LLY (+1,78 %)

$NOVO B (-17,74 %)

$NOVO B