Depot update April/May

Target 2023 💸 🟩🟩🟩🟩🟩🟩🟩🟩>⬜⬜

🥁🥁🥁🥁🥁🥁 -> 🎆🎇✨🎉🎊

Target 2023 💸 🟩🟩🟩🟩🟩🟩🟩🟩>🟩⬜

Gross. I get to add another green box to my self-made deposit scale. The last time was not so long ago and also the attached screenshot of my comment at the low point in mid-March, in the middle of the banking quake, makes you look at the last two months somehow surreal.

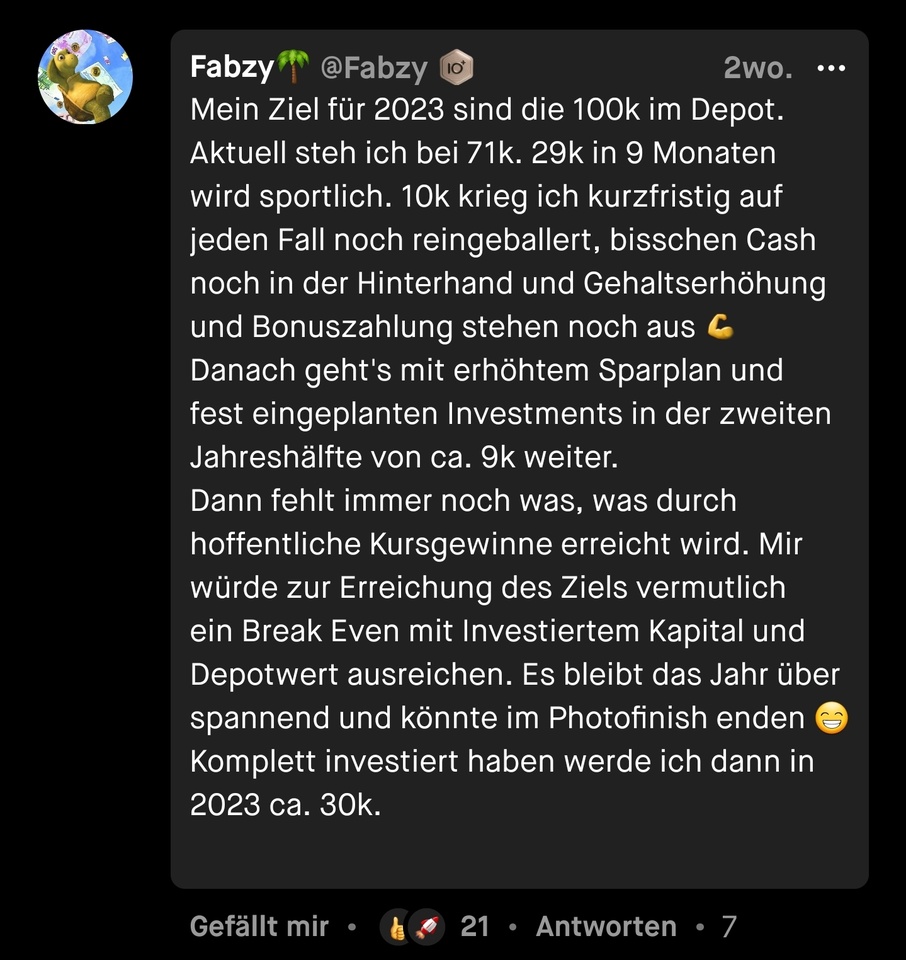

My goal for the year is the 100k in the portfolio. A green box represents a tenth of that. So in the last two months since the commentary on March 13, the portfolio value has moved up +19k. I think of how forever I have oscillated between 55k and 65k .... What a difference a few percentage points suddenly makes at higher deposit values. The good thing is that you grow with your portfolio and get used to it.

At the beginning of the year, I took the euphoria of the exciting world of individual stocks from the end of last year with me and put a few, as I find very nice, satellites in the portfolio, behind which I continue to stand fully and with which I see myself very well prepared for the next half of the year and beyond.

The cash has been used up so far, the individual positions are full. The main focus now is to strengthen the core again, because I expect my satellites to grow stronger than my World+EM combination. In order to keep the balance, the next savings rates will be applied to the core of the portfolio. Back to the roots.

Moreover, I almost fell off my chair when I saw that my MSCI World alltime is only -0.44%. The last time I saw this value in the plus was in April 2022. Overall, the depot is still 2.5% in the minus. I get all bouncy when I think about seeing alltime in green in the foreseeable future.

But we are not there yet and the roller coaster ride is certainly not over yet, but since at the close of the market yesterday the portfolio value was now above the 90k, I think I have earned the green box.

What happened in my portfolio the last weeks?

$NET (+1 %) - I put in some play money and bet on a rebound after the -25% crash. This also occurred, with a purchase at ~40€ and a sale at ~44€, so just under 10% jumped out. Since it was not intended to hold the value longer, I have not participated in the rest of the increase until today.

$AUTO (+3,44 %) - Meanwhile also play money. Two times I could now buy cheap and sell again. Have somehow developed an understanding of the course, drive the little game until I fly on the nose ;)

$TMO (-0,59 %) - Last re-buy at ~481€. EK thus lowered to ~505€. The only single share that has not yet delivered as desired. But that will come, I am sure.

Perhaps at this point an anecdote, which I have not yet told 🙈. At $TMO (-0,59 %) I had made the mistake of buying with the increase directly after quarterly figures. At that time it went from 515 € to 540 € high or something like that. Spread of course huge, with displayed 525 € course, the purchase price but at 533 €. No matter, it is just going steeply upwards.

...

Yes, I will never do again and also advise everyone else against it. Either buy before or at least sleep over it and watch the development of the price. In the end, I messed up the EC and am more in the red with the value than one should be. What else can I say, except: I learned something again.

$FTNT (+0,42 %) - Before the quarterly figures at a favorable 55 € again added. Largest single position in the portfolio. In retrospect, the right decision, given the development since then.

$PYPL (+0,25 %) - After the quarterly figures and the further plunge to 58€, I had $NET (+1 %) - sale, for the money $PYPL (+0,25 %) in the depot. Hope was a similar bounce as $NET (+1 %) to join. But from this attempt, I have then but quite quickly separated again. The starting position of both companies is different. I have noticed myself with my online purchases that GooglePay/ApplePay is actually the more convenient way to pay. Chart-wise, you can't say that $PYPL (+0,25 %) big on underpinnings, which makes the short-term chance of a rebound too uncertain for me, undervalued or not. So this is just pure gambling, but you don't have to get involved in every play either.

On the crypto side, nothing new has happened. The two altcoins are downright forgotten and left lying around. The $BTC (+0,7 %)-I follow the course, but I do not have the need in the current environment to add here again.

Now it is first strengthen World + EM by savings plan, the remaining money instead of in the depot for the vacation raushauen and also treat yourself again. There are still a few exciting topics that influence the market in the next few weeks, so look at me as planned rather from the sidelines.

What about those who held a lot of cash at the beginning of the year? Are you completely back in the market or are you still holding on?