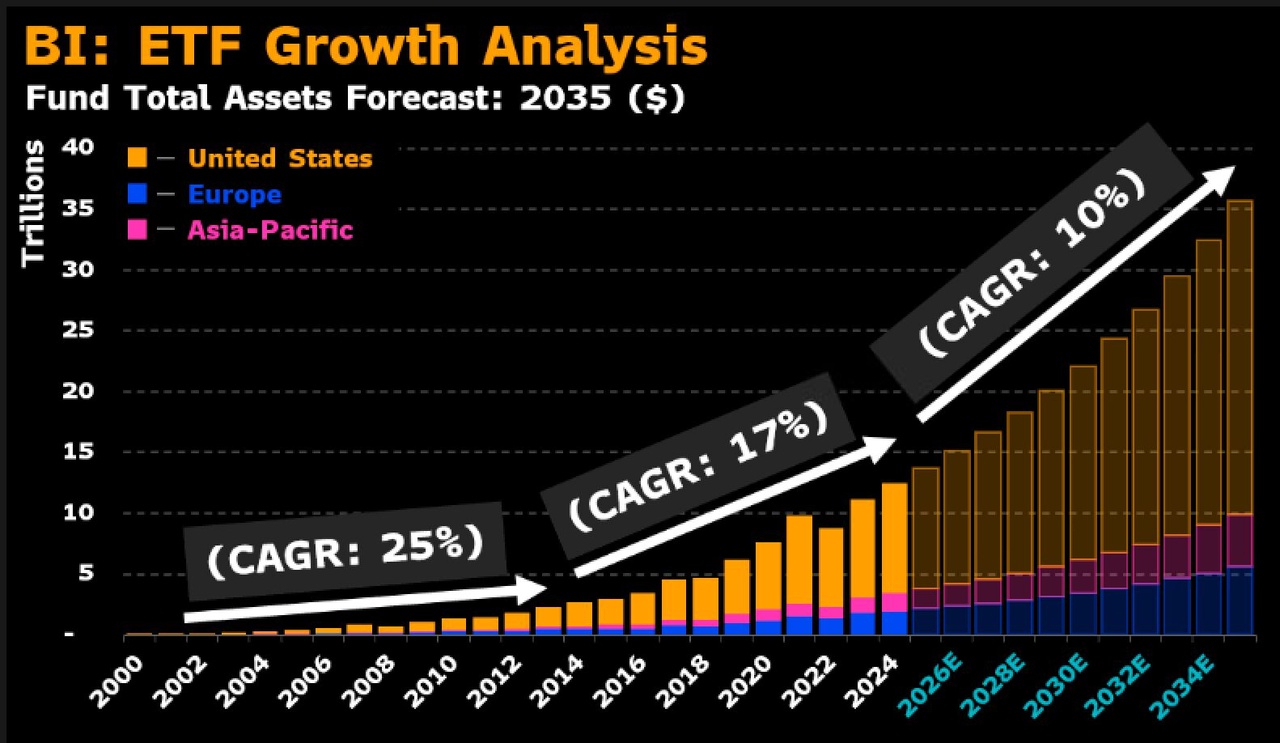

Forecast: ETFs are expected to reach USD 35 trillion in assets worldwide by 2035

Hi folks.

ETFs, which currently manage USD 13 trillion in assets, are expected to grow to USD 35 trillion by 2035, a three-fold increase. This forecast is based on a compound annual growth rate (CAGR) of 10%, which seems quite modest compared to the last decade's 17% and the previous decade's 25%. Nevertheless, the more moderate growth is considered likely as market returns may be less impressive in the future.

The advantages of ETFs, such as low costs, liquidity during the trading day, tax efficiency and flexibility, will continue to attract investors and traders. This will lead to an increase in new products, innovative designs and more sales strategies. Long-term structural changes overseas also favor ETFs, while various mutual fund share classes in the US will encourage further inflows of capital.

Direct indexing, which has been seen as a threat by some, appears to be less of an issue, while tokenization may have a future role to play, but not in the foreseeable future. In fact, tokenization could even benefit ETFs.

These developments suggest that ETFs will continue to play a dominant role in global financial markets and grow significantly. Companies such as $BLK Vanguard, $IVZ (+0,65 %) or $AMUN (+0,71 %) will benefit significantly from this trend. The question here will be which company can take the biggest slice of the pie. My secret tip here would be $BLK 😉.

Chart via: @thetrinianalyst (X)

Post idea: Eric Balchunas (LinkedIn)