Hello everyone 🙋♂️. Today let's take a look at my REITs in the portfolio.

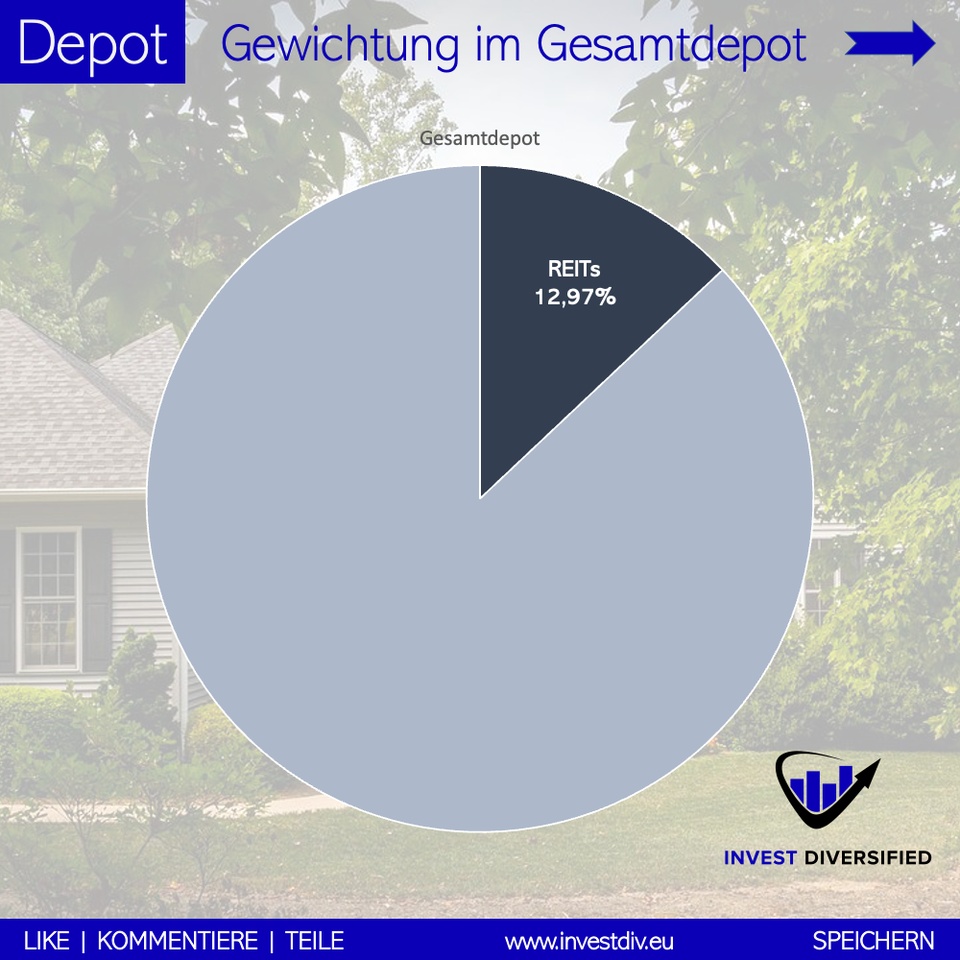

➡️ The REITs have a total value of ~45,179 EUR and thus a weighting of 12.97% in the overall portfolio 👍.

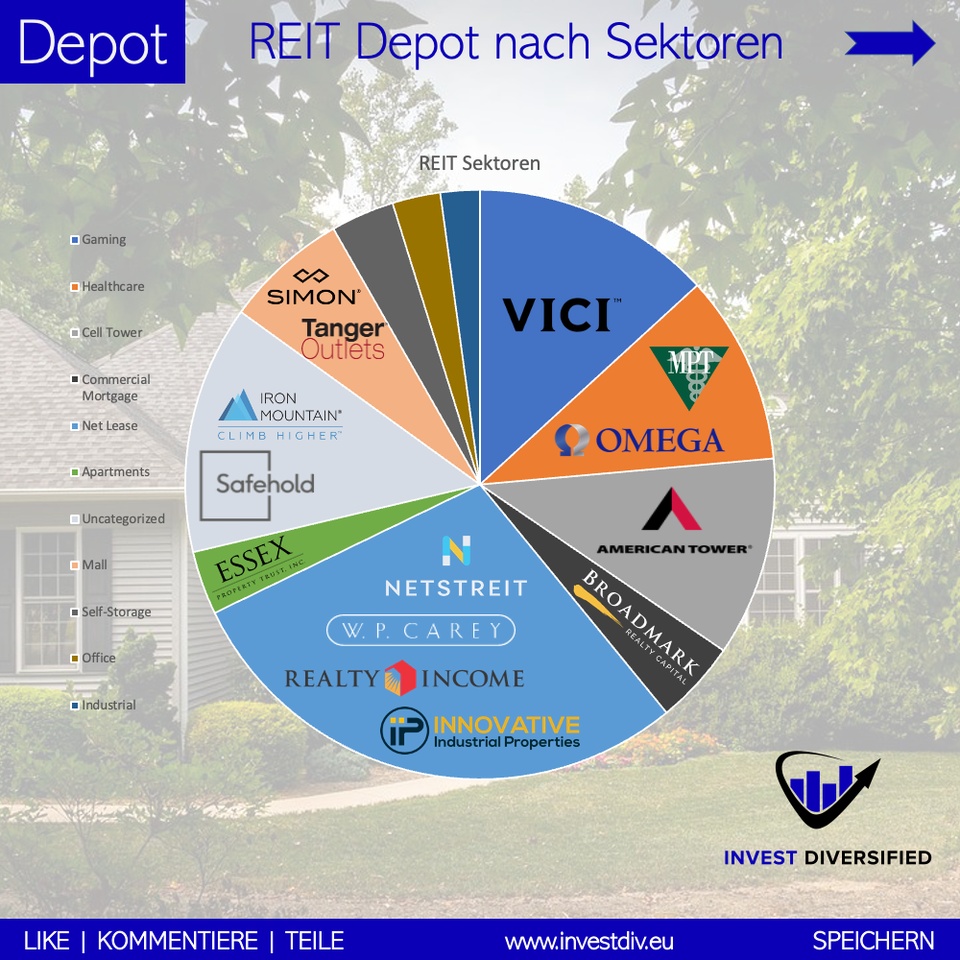

➡️ The largest value is $O (+0,05 %) with ~7,456 EUR, smallest the $HABA (+0 %) with ~982 EUR.

➡️ You can find a (sub)sector overview on the screenshots.

➡️ As a cashflow fan I am a big friend of Real Estate Investment Trusts (REITs). I maintain these REITS as a portfolio in the (total) portfolio, so to speak.

➡️ The Net Lease subsector is the largest in terms of weighting, and that's the way I want it. I will gradually expand this sector.

➡️ The Commercial Mortgage sub-sector is also deliberately underweighted.

➡️ I am not represented in some sectors, for example Timber REITs. In others (e.g. Data Center) indirectly (via Iron Mountain).

➡️ Overall, REITs account for just under 13% of the total portfolio, with a target weighting of up to 25%.