Is AI now making financial institutions better and causing a mega-revolution? $GFT (+0,11 %)

Artificial intelligence has only been a topic on the markets for just under two years, since ChatGPT celebrated its launch. But it is already clear that the technology will disrupt the economy like perhaps no other before it. The financial sector, where personnel costs play a decisive role, could be particularly affected by this.

Is AI now making financial institutions better and causing a mega revolution? Is there a threat of significant job cuts at the same time? And how can investors best benefit from this development?

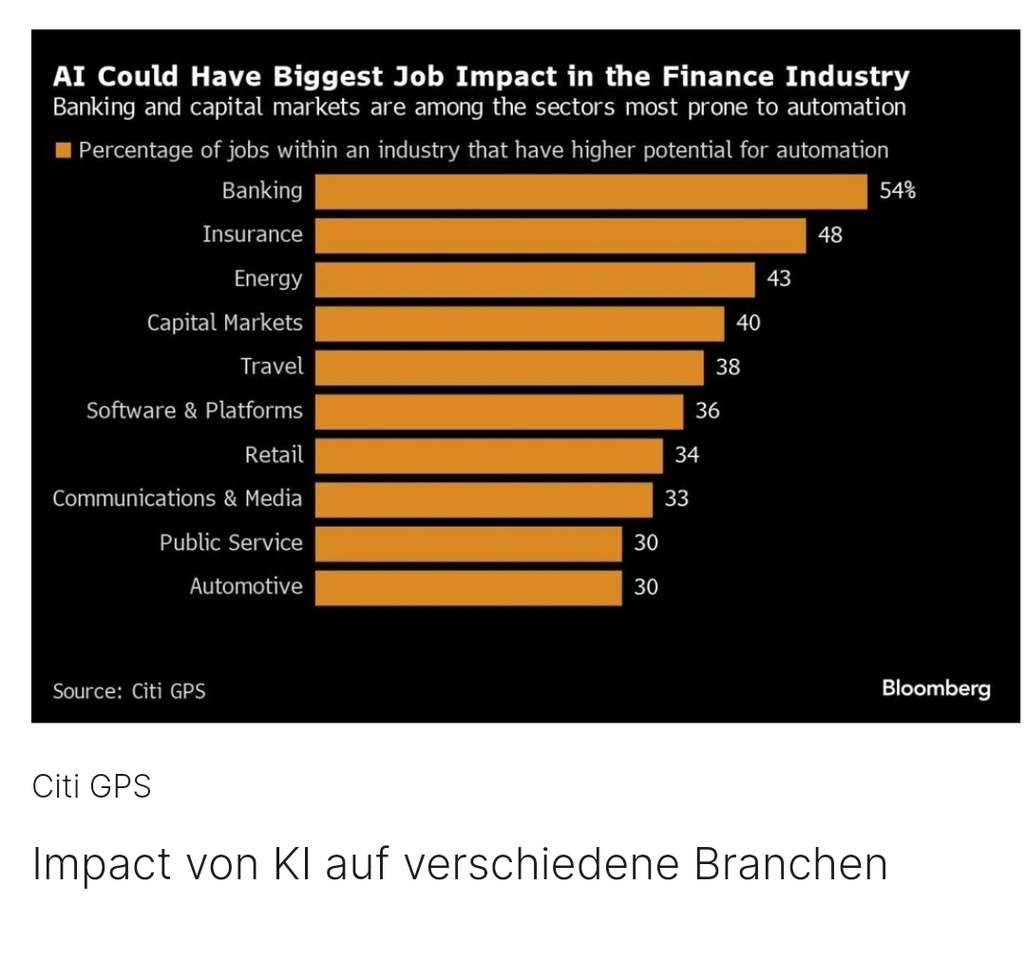

At least if you listen to the experts, the banking sector is facing a major transformation. After all, of all industries, the financial sector appears to have the greatest need for automation (see chart below). In fact, the first effects of this are already becoming apparent, as BPER Banca, an Italian banking group, has already announced its intention to save ten percent of its workforce by 2027 through technology-driven productivity improvements. A corresponding analysis by Citigroup suggested that the transformation thanks to artificial intelligence is likely to claim the most jobs in the banking sector.

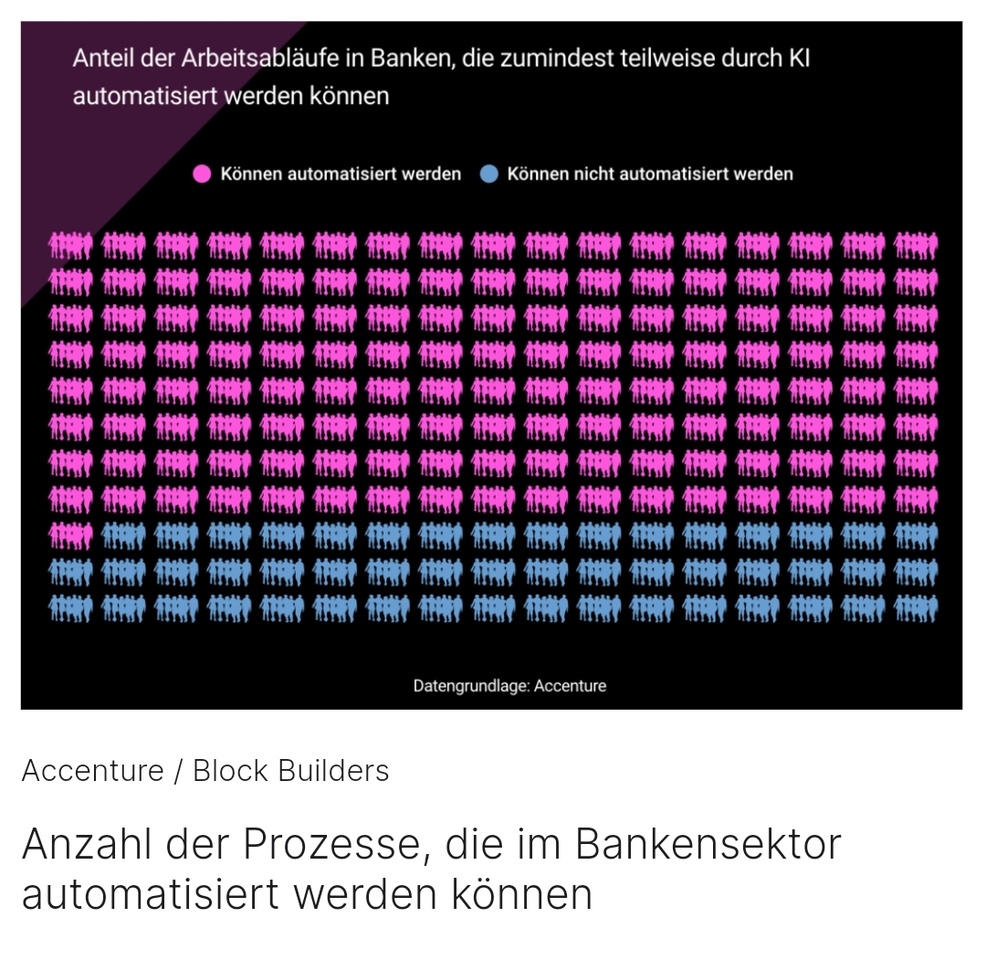

The reason for this is that the majority of tasks in the financial system can be automated (see chart below).

Background: Many processes such as lending, audit processes etc. are extremely time-consuming due to the amount of data that is processed, as well as the government regulations and internal company rules that must be adhered to. It is also hoped that there will be less need for monitoring due to the lower error rate of AI compared to human decisions. AI systems will also take over the work of fraud detection in the future. The bottom line is that this will lead to significantly lower staffing requirements.

Massive efficiency gains are to be expected

However, while this is negative news for the workforce, for banks and their shareholders it means the prospect of a leap in profits. After all, German financial institutions alone spent 48.4 billion euros on their employees in 2024. In Europe, each employee costs a financial institution an average of 84,000 euros (data from 2022).

Companies have therefore already recognized their opportunity, not least due to the massive increase in demand for experts in the field of artificial intelligence.

By the way: This article appeared a few weeks ago in Euro am Sonntag. It contains weekly analyses on current topics