Can anyone tell me what am I missing with $IAG (+0,11 %) ?

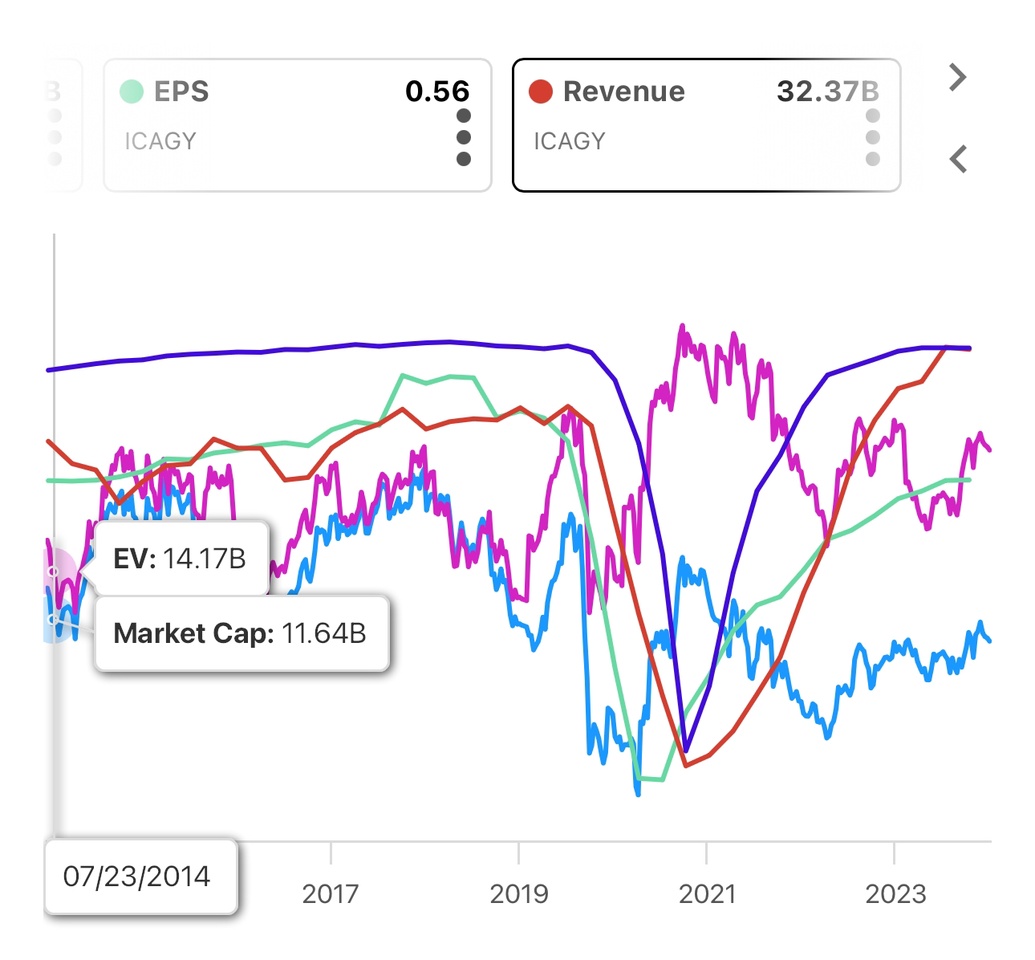

The gap between Enterprise Value and Maket Cap is huge, before Covid it used to be near zero. EPS sre back on track, Revenue is higher than ever, EBIT margin is on the top line of what it used to be, financial position is healthy (fast debt repayment, high cash)…

Why is the stock not going up like crazy? It is at the same price when Covid was here and no one knew how the future would be. Ok debt is higher than then but is that enough for this valuation?