0.5% to €200,000 & approx. 35% more dividend - 1Q review and 2Q outlook

1Q Review:

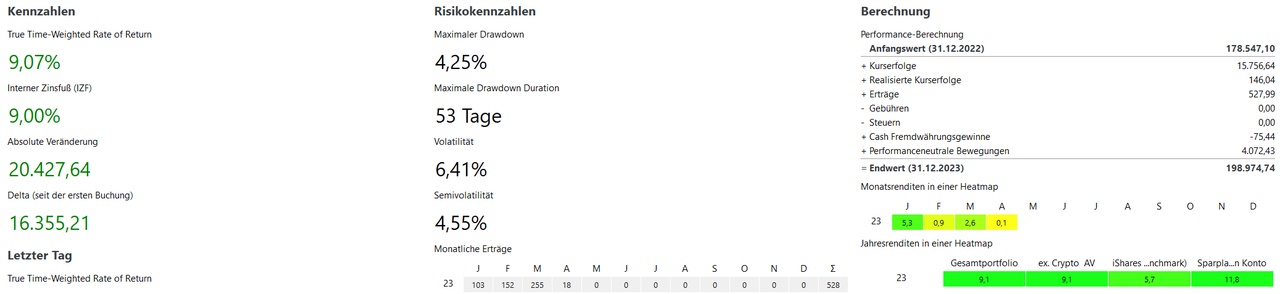

- 25% of the year is already over again and only about 0.5% is missing to reach 200,000€

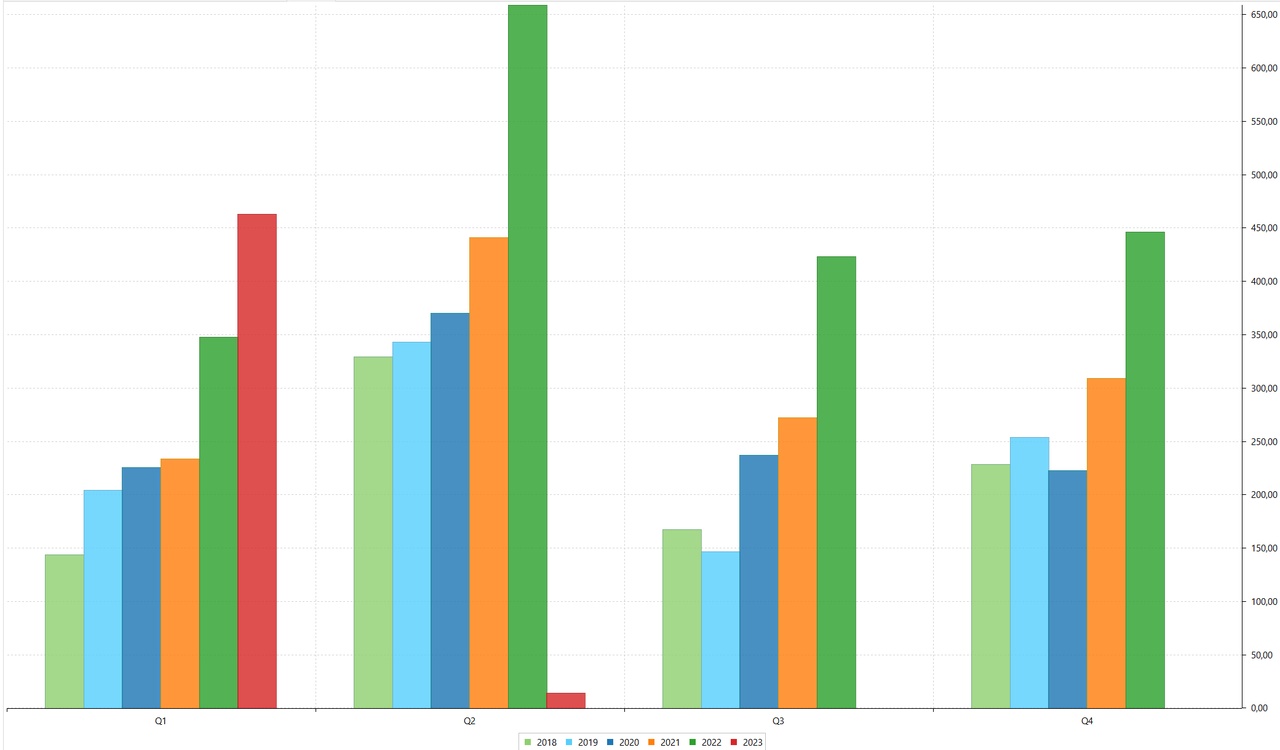

- My dividends were approx. 460€ ($NVDA (-2,33 %) and $DLR (+1,48 %) with approx. 20€ still outstanding). So I could increase my dividends by about 35% compared to the previous year.

- My performance was about 9%, which in absolute terms equals almost 16.000€ price gains

- My best stocks were more or less the worst investments from 2022. NVIDIA $NVDA (-2,33 %) with +85%, Meta $META (+0,15 %) with +76% and Sea $SE (-2,34 %) with +66%

- My worst stocks on the other hand were the top performers from 2022: Pfizer $PFE (+2,63 %) with -22%, Encavis $ECV (+1,89 %) with -14% and Johnson & Johnson $JNJ (+0,25 %) with also -14%

2Q Outlook:

- The €200,000 should definitely be reached in the next quarter

- May will probably see a dividend of over €400 and thus the best month ever

- For the market, I expect more of a sideways trend in the next quarter. The money market interest rate in the USA is at 5%, which corresponds to a PE ratio of 20. The S&P 500 is also at around 20. I therefore do not see too much upside for the time being, as bonds and cash could be seen as more interesting under these circumstances.

#dividends

#dividende

#aktie

#performance