S&P 500 recovers after two consecutive weekly losses, 2024 still up 25%

The Standard & Poor's 500 avoided a third consecutive weekly loss, rising 0.7% and extending its year-to-date gains to 25% with two trading days left in 2024.

The benchmark index closed Friday's session at 5,970.84 points, up from the previous week's close of 5,930.85 points. The S&P 500 reached its all-time high of 6,090.3 points on December 6. The last trading day of the year is Tuesday.

"Investor sentiment is high entering 2025 as several positive trends from 2024, which are still in place, have been reinforced by the results of the US presidential election in November. These have raised expectations of pro-growth policies," D.A. Davidson explained in a note to clients on Friday. "This creates conditions for equity prices to continue to rise if US economic growth remains above 2% and corporate earnings grow by more than 10%."

The effect of a so-called "Santa Claus rally" in the US stock market could be reversed early next year by the prospect of new trade policies or tariffs under the new Trump administration, Saxo Bank said in a report published this week. The Santa Claus rally describes the tendency of stock markets to rise in the last week of December and the first two trading days of January.

US markets were closed on Wednesday for Christmas. According to preliminary data from a Mastercard report, retail sales rose more than expected during the holidays, outpacing last year's growth.

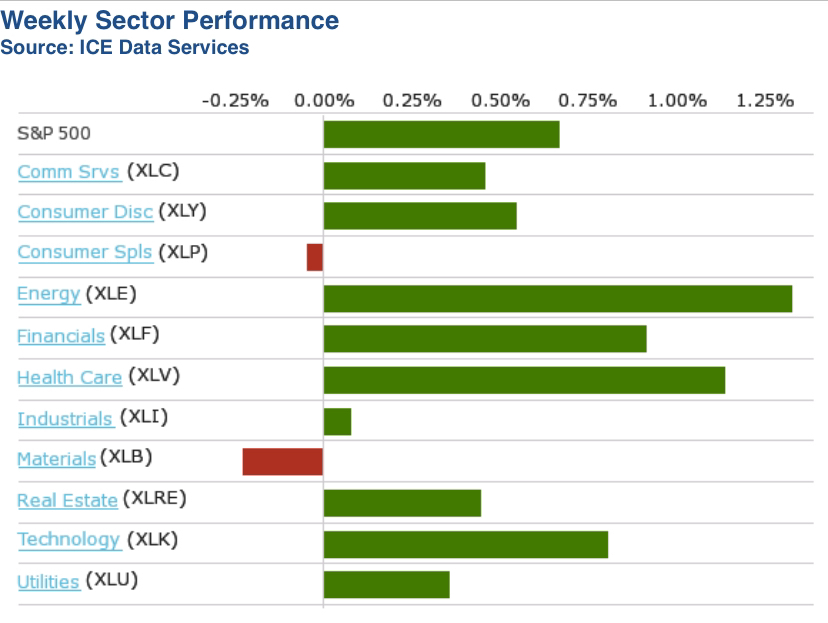

Among sectors, energy and healthcare were the week's best performers, each rising more than 1%. Only consumer discretionary and materials posted losses.

In healthcare, the US Food and Drug Administration (FDA) announced that it is proposing a rule that would introduce and require standardized testing methods to detect asbestos in cosmetic products containing talc.

The technology sector posted a weekly gain of 0.9%, helped by some key semiconductor stocks, including Broadcom (AVGO), which jumped 9.5%, and AI chip favorite Nvidia (NVDA), which rose 1.7%.

The financial sector also posted a weekly gain of 0.9%. Some US banks and business associations filed a lawsuit against the Federal Reserve, criticizing a "flawed" stress test procedure.

The consumer sector rose 0.5%, driven by a 4.9% jump in coffee chain Starbucks (SBUX), whose employees returned to work on Wednesday after a five-day strike. Electric vehicle maker Tesla (TSLA) posted a weekly gain of 2.5%.

In the area of everyday consumer goods, the US Consumer Financial Protection Bureau (CFPB) filed a lawsuit against retail giant Walmart (WMT) and fintech company Branch Messenger. It accused them of forcing delivery drivers to use expensive deposit accounts in order to get paid. Walmart recorded a weekly decline of 0.6 %.

Next week's economic calendar includes December US manufacturing data from the Institute for Supply Management and S&P Global. Reports on pending home sales for November and home price data for October are also expected. The markets will be closed on Wednesday for the New Year.