The US dollar is the last remaining final opponent.

After another rally of +7.4%, the US dollar $BTC (-0,55 %) reached a new all-time high yesterday, both in terms of the euro exchange rate and its market capitalization in USD.

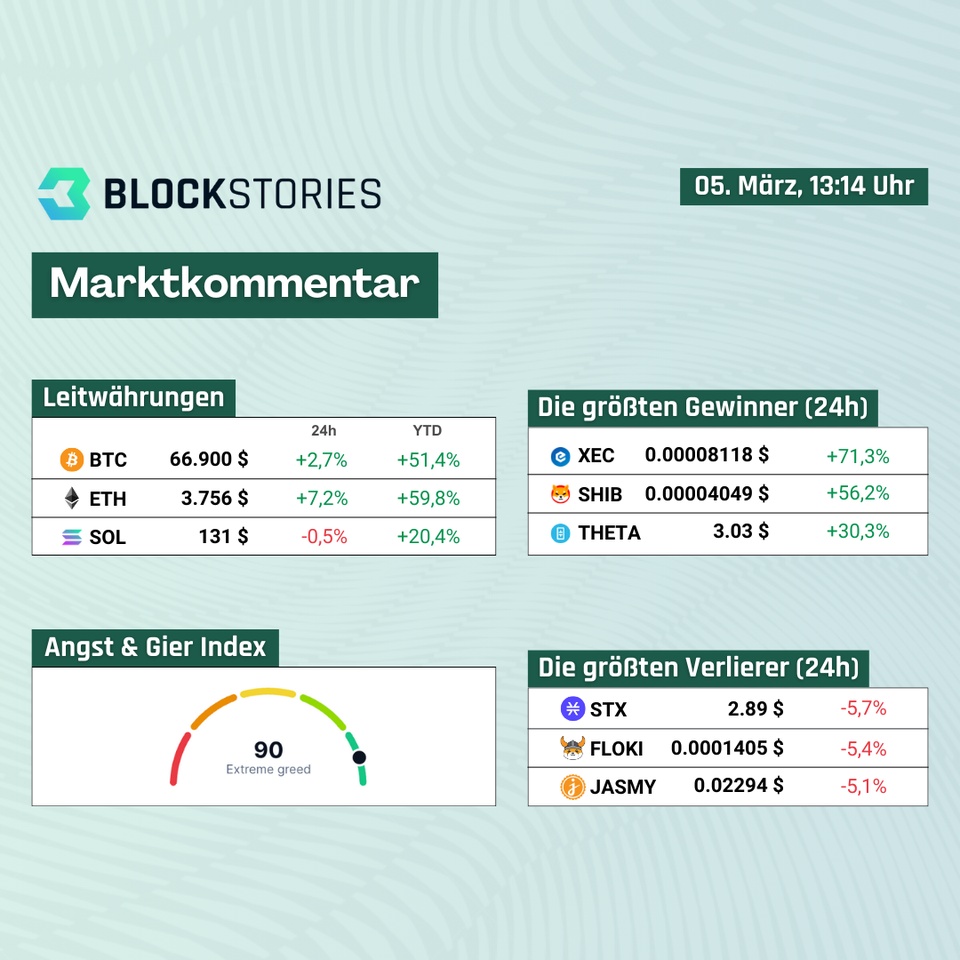

According to the current status (05.03. 13:14) just under +3% and the high from November 2021 would be set.

The market is maximally long and seems not to be overheating precisely because the demand for Bitcoin spot ETFs is virtually absorbing the volatility.

With a trading volume of USD 5.5 billion), the ten spot #etfs marked their second strongest day since launch yesterday.

This brings Bitcoin's dominance of the crypto market back up to 53%.

However, it has become abundantly clear in recent days that some traders are no longer willing to wait until this dominance is broken and some of the capital finds its way to more remote areas of the risk curve.

Memecoin mania reigns.

The menu includes all coins with frogs or dogs on them. Here is a performance overview of selected memecoins in the last seven days:

- $DOGE (-0,45 %) +93%

- $BONK +183%

- $WIF+226%

- $SHIB (+0,28 %) +291%

- $PEPE +247%

After a short breather tonight, the memecoin rally now seems to be continuing.

This is mainly due to the fact that Robinhood is now letting its users trade $BONK and Binance has announced the listing of $WIF at the same time.

------

What else has happened these days?

- Ordinals record record volumes

- Michael Saylor wants even more Bitcoin

- BlackRock to invest in BTC ETFs with Strategic Income Opportunities Fund

- SEC postpones decision on BlackRock's Ether spot ETF

- Coinbase introduces smart wallets

You can find all the background information in today's newsletter: https://blockstories.beehiiv.com/p/coinbase-stellt-smart-wallets-vor

------

Sources:

Funding Rate Heatmap: https://www.coinglass.com/FundingRateHeatMap

BTC-ETF Volume: https://twitter.com/EricBalchunas/status/1764763178368463267

BTC dominance: https://de.tradingview.com/symbols/BTC.D