A tale from our youth 👨🏻🔧🏭

Since I had some time today and took the opportunity to stow away my relics of days gone by, I found the mementos of when I started my career. Both the badge and the IGBCE membership card.

For those who are not familiar with it: The Industriegewerkschaft - Bergbau, Chemie, Energie is the second largest industrial union in Germany after IG Metall. It represents the interests of the 580,000 members in the mining, chemical and energy sectors in Germany.

Some readers may be interested to know what impact the current wage negotiations in the chemical industry may have on German shares in this sector.

The chemical industry currently employs around 585,000 people. Of these, around 464,000 are considered "employees".

The largest employer in the industry in Germany is BASF $BAS (+0,37 %) with just under 51,000 employees. It is followed by Merck $MRK (+0,87 %) (approx. 28,000) and Bayer $BAYN (+0,27 %) (approx. 22,000), but also Henkel $HEN (-0,23 %) Lanxess $LXS (+0,28 %) and Covestro $1COV (-0,05 %) are also major listed employers in the industry in Germany.

What can be recognized?

Across the industry, all companies have been deeply affected by past price shocks and the resulting economic weakness. This can be clearly seen in the share prices due to the price jumps in electricity and gas. Although the prices for electricity and gas have fallen back to an acceptable level, the order situation is rather miserable. The 3rd quarter of 2024 promises an improvement.

But could an economic upturn also boost profits again?

In the industry, long-term supply contracts are concluded. Supply contracts with reliable partners are rarely terminated. Instead, higher prices are passed on to the end customer. In many places, however, customers are no longer prepared to dig deeper into their pockets, which is why it is expensive to retain customers or acquire new ones. And if they do? Then new customers are lured in by low-cost offers, even though producers have to pay extra for years. The important thing here is that the production plant costs remain lower than the loss due to new contracts. Depending on the size of an idle production plant, the costs per hour can be in the four to five-digit euro range. So: the main thing is to produce, regardless of whether you have to pay hundreds of euros for months for a supply contract. The losses can be offset in the balance sheet with more profitable business or, under certain conditions, written off and thus save taxes. (Please note that this depends on the individual company and its business strategy. This cannot be generalized under any circumstances).

Back to the topic. What is the union demanding for the employees?

It is explicitly about

- a wage increase of 7%

- Better conditions for union members compared to non-members

- Revision of the federal collective wage agreement (this is explicitly about the integration of certain activities into the wage groups of the collective agreement)

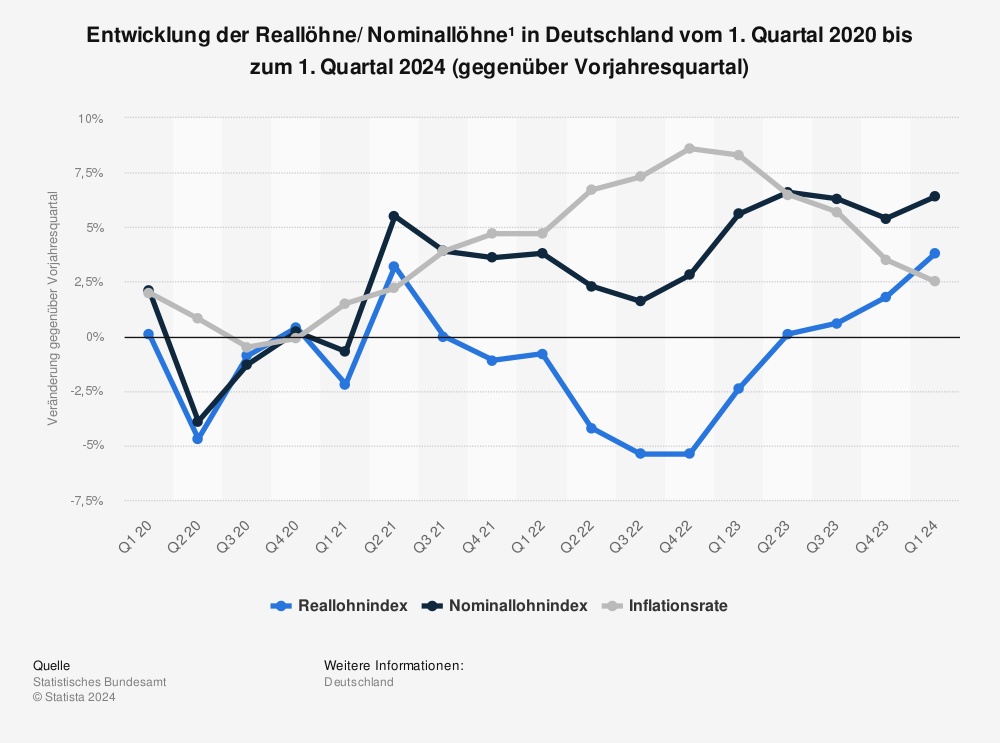

In view of the fact that the union argues that employees' real wages have fallen back to the level of the 2010s due to inflation and that neither side is willing to compromise on this, the risk of strike action in the sector appears to be realistic for the first time since the 1970s.

But why?

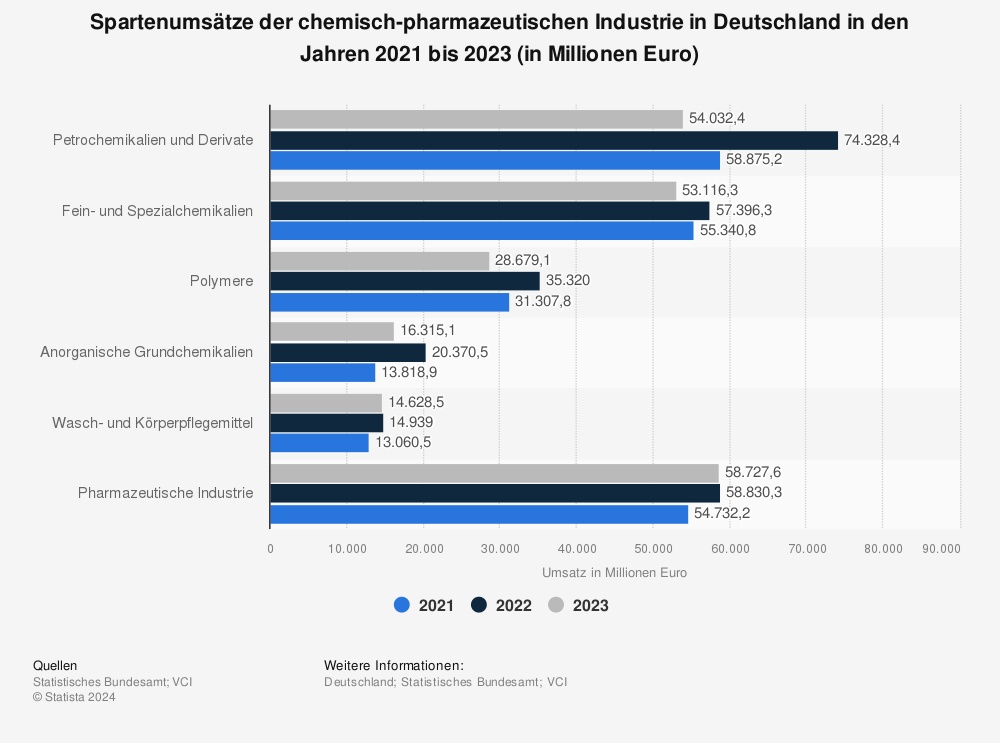

- Sales in the chemical-pharmaceutical industry are weakening. There was no significant increase in turnover from 2022 to 2023.

- The profits of some companies have almost completely collapsed.

- They would not have survived these years without state aid. The reports of some German stocks show record sales due to the government price brakes on electricity and gas. The management also communicated this to investors, causing share prices to collapse accordingly.

- The sales markets are weakening. High inflation in the euro and dollar zones has left its mark. Real wages only climbed back to the 2021 level towards the end of 2023. People had to pay the difference in 2022 out of their own pockets, even though the state also subsidized the inflation compensation premium. Of course, many small and medium-sized companies in particular were not in a position to bear these employee costs.

What could happen next? (3 scenarios)

- Employers and trade unions negotiate a wage increase that is acceptable to both sides. Collective bargaining peace is maintained. Companies can calculate the economic upswing without further cost pressure. (This would also be a bullish signal for share prices in the chemical industry).

- Employers are uncompromising in their response to the union's demands. Cost pressure is increasing, which is likely to further dampen the chemical industry's business index, but the risk of strikes can be eradicated. (This would lead to further capital outflows from company stocks. However, investors can speculate on sales/integrations. The scenario is conceivable, as Covestro shows).

- The employers and trade union cannot reach an agreement. Strikes take place in the chemical industry in Germany for the first time since the 1970s. This could strengthen the employees and their influence. At the same time, however, it could give employers another reason to focus on their investments abroad. (This would be fatal for German manufacturers, their share prices and at the same time a downward impulse for a key industry in the German economy.

All in all, the German industrial landscape remains exciting and at the same time offers opportunities for investors. However, if you are invested in this sector, it is highly recommended that you follow the wage negotiations. On June 30, the current collective wage agreement for the chemical industry ends and with it the obligation to maintain peace. It remains exciting.

What do you think? Is it really conceivable that there will be strikes in a key German industry? Would politicians actively intervene and disrupt the autonomy of collective bargaining?