🏪 Alimentation Couche-Tard Inc. $ATD (+0,37 %) : Advantages, opportunities and risks 🚀

Overview: Alimentation Couche-Tard Inc (Ticker: ATD) is a leading convenience store and mobility company operating in approximately 29 countries and territories. With more than 16,700 stores, nearly 13,100 of which offer road transportation fuels, the company is a major player in the retail industry.

Corporate structure and market presence:

Alimentation Couche-Tard operates under the well-known brands Circle K, Couche-Tard and Ingo. The company is represented in the USA and Canada, Scandinavia, the Baltic States, Ireland, Poland, Hong Kong, Belgium, Germany, Luxembourg and the Netherlands. In North America, the network consists of approximately 17 business units, including 14 in the US covering 47 states and three in Canada covering all 10 provinces. In Europe, the company operates a broad retail network across seven business units.

Financial data and growth:

- Market capitalizationCAD 73 billion

- Dividend yield: 0,91%

- Price/earnings ratio (P/E ratio): 20,38

- Basic EPS (TTM)3.81 CAD

- Enterprise Value: 91 billion CAD

- Price to Earnings Ratio: 20

- Price to Sales Ratio: 0.8

- Price to Cash Flow Ratio: 11

- Price to Book Ratio: 4.1

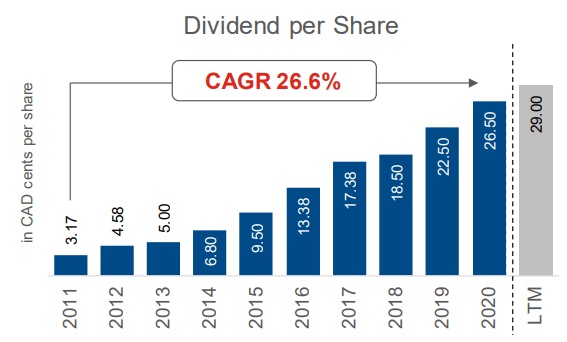

Dividend history:

Alimentation Couche-Tard has an impressive dividend history with continuous growth:

- 2023: 4,628 CAD (+4.62%)

- 2022: 4,424 CAD (+24.06%)

- 2021: 3.566 CAD (+9.14%)

- 2020: 3,267 CAD (+13.78%)

- 2019: 2,872 CAD (+27.88%)

- Forecast 2024: CAD 4.786 (+3.41%)

Analyst ratings: The price target for Alimentation Couche-Tard is CAD 87.16, which represents an increase of 13.54%. The stock is rated by 16 analysts, 14 of which have a Buy recommendation.

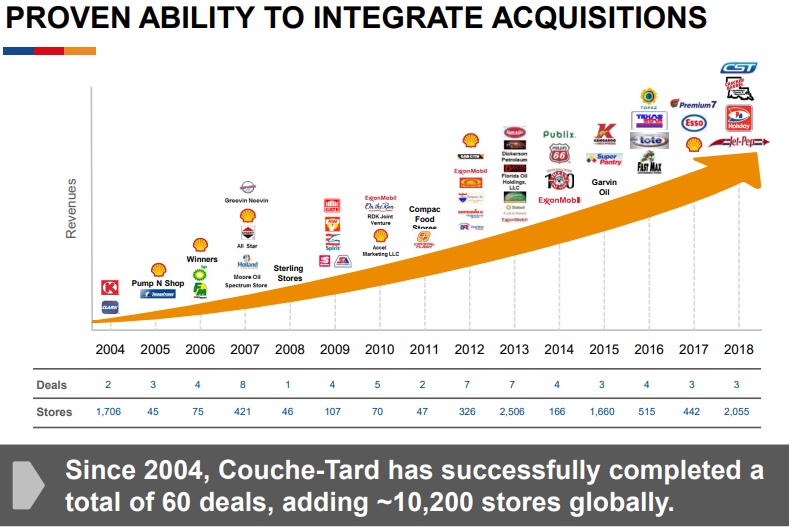

Strategy and expansion:

The company focuses on the continuous expansion and diversification of its portfolio. It invests in new technologies and continuously improves the customer experience in its convenience stores. Alimentation Couche-Tard also plans to increase its presence in electromobility through state-of-the-art charging stations.

Financial strengthAlimentation Couche-Tard shows continuous growth with a solid financial position. The company offers stable dividends and has a long history of dividend increases, making it an attractive option for income investors.

Future prospectsThe company remains committed to strengthening its market position through innovation and expansion into emerging markets. Sustainability and technology leadership are key components of the future business strategy.

RisksDespite its many strengths, there are some risks that investors should be aware of:

- Competitive marketThe retail industry is highly competitive and Alimentation Couche-Tard must continually invest in innovation and customer experience to remain competitive.

- Regulatory risksChanges in trade and customs rates as well as regulatory requirements may affect business operations.

- Macroeconomic factorsEconomic downturns and exchange rate fluctuations can affect sales and profit development.

- ConclusionAlimentation Couche-Tard is a leading player in the convenience store sector with a strong brand portfolio and solid financial fundamentals. The company remains a reliable choice for investors looking for long-term growth and stable earnings. 📈🏪💡

DisclaimerThe information provided is for general information purposes only and does not constitute professional financial or investment advice. All content is provided without guarantee of completeness, accuracy and timeliness. Any liability for actions based on the information on this site is expressly excluded. In accordance with § 309 No. 7 BGB, exclusions of liability for gross negligence and willful misconduct cannot be effectively excluded. Please consult a licensed financial advisor for individual advice. Use of this site is at your own risk.