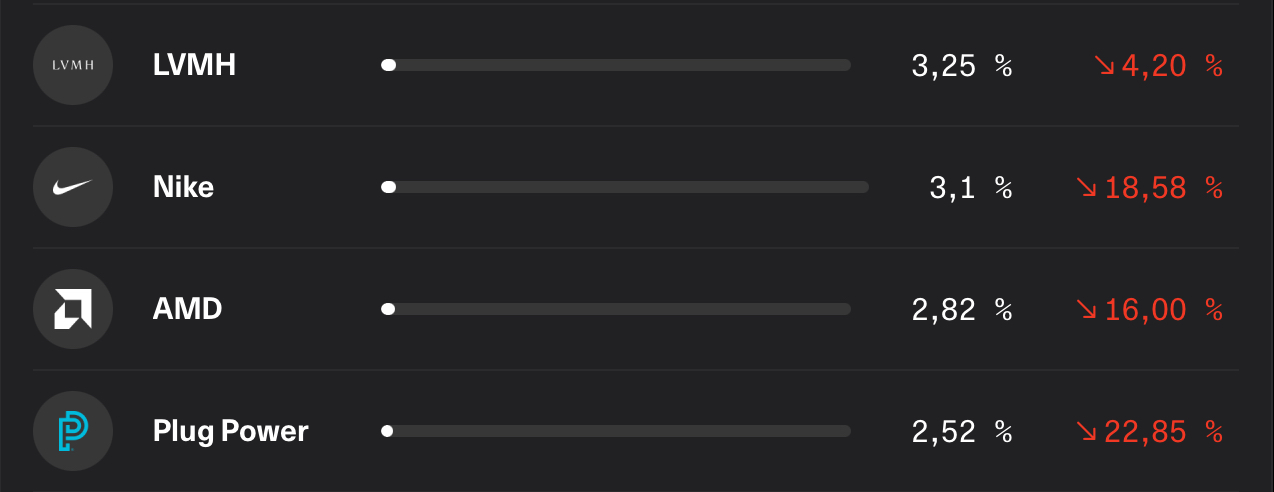

My current low performers

These shares are currently in the red for me. I'm wondering whether I should sell these shares or buy more. With $NKE (-6,85 %) and $PLUG (+9,5 %) I am pretty sure that I will sell these shares as soon as they recover somewhat. With $AMD (-0,35 %) as a semiconductor company, I can imagine that it will play a major role in the future and I am therefore toying with the idea of increasing my position in $AMD (-0,35 %) to increase my position. With $MC (-0,25 %) however, I am absolutely unsure whether I should increase or sell my position. I would therefore like your opinion on this. What would you do if you were in my position?