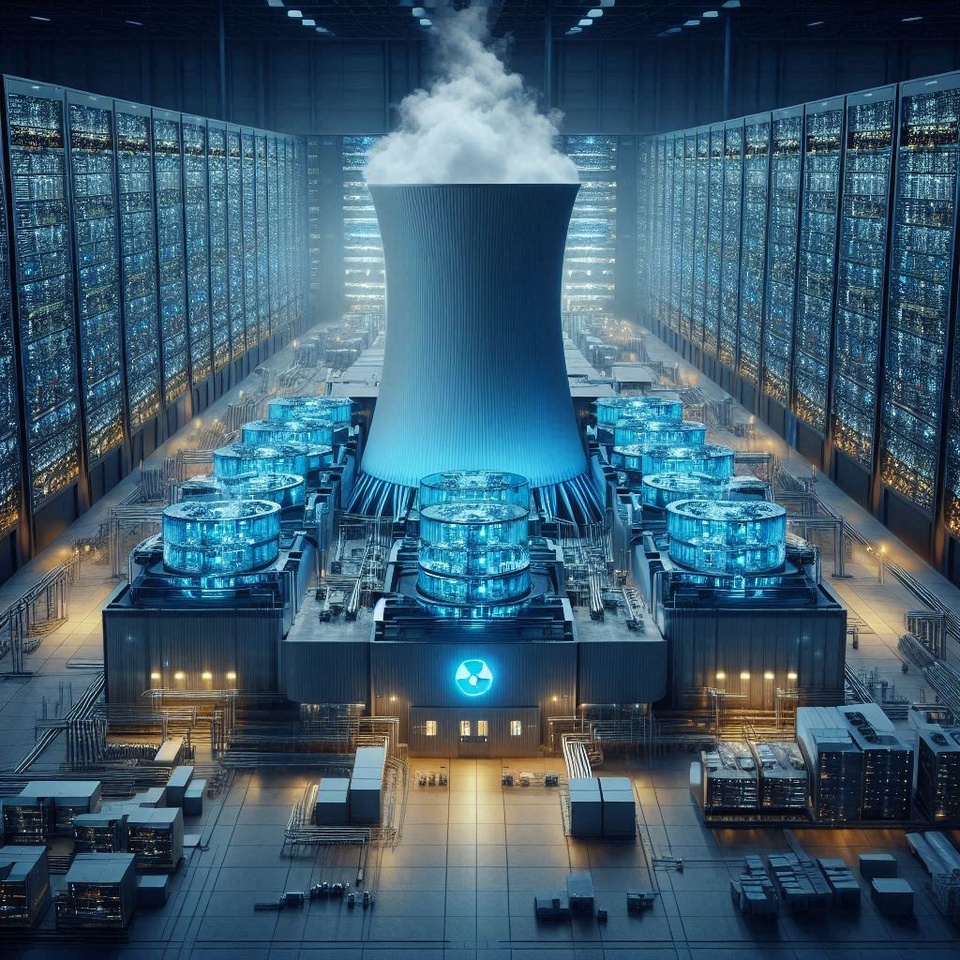

Due to the expansion of data centers, shares in the energy sector such as $CEG (-0,06 %)

$VST (+1,56 %)

$ETN (-0,22 %) and $BWXT (-0,16 %) (nuclear) are soaring, especially after the announcement by $MSFT (-1,05 %) regarding nuclear energy.

After looking into your private crystal ball, do you think that a longer-term trend has begun in terms of share price development? Or do you think that everything is already priced in and that the rise will soon flatten out again, so that all that's left now is to chase the "runaway train"? (I think this will happen much faster than the "normal" investor thinks - after all, "smart money" is a bit smarter than we are).

Personally, I think that the most likely candidates here are the established $SU (-0,75 %) and $ETN (-0,22 %) will prevail in the long term, even if they have already done very well. Another permanent 'player' for me would be $RR. (-0,37 %) (SMRs - although the question is when they will actually be built and profitable).

What do you think? Are you looking at other companies in this field?